Abstract

Abstract

- The paper elaborates the notion of innovation as an emerging property of complex system dynamics and presents an agent-based simulation model (ABM) of an economy where systemic knowledge interactions among heterogeneous agents are crucial for the recombinant generation of new technological knowledge and the introduction of innovations. In this approach the organization of the system plays a crucial role in assessing the chances of individual firms to actually introduce innovations because it qualifies the access to external knowledge, an indispensable input, together with internal learning and research activities, into the recombinant generation of new knowledge. The introduction of innovations is analyzed as the result of systemic knowledge interactions among myopic agents that are credited with an extended procedural rationality that includes forms of creative reaction. The creative reaction of agents may lead to the introduction of productivity enhancing innovations. This takes place only when the structural, organizational and institutional characteristics of the system are such that agents, reacting to out-of-equilibrium conditions, can actually take advantage of external knowledge available within the innovation system into which they are embedded to generate new technological knowledge. The ABM enables one to explore effects of alternative organizational features of the systems, namely different configurations of the intellectual property right regimes and different architectural configurations of the regional structure into which knowledge interactions take place, on the rates of introduction of technological innovations. The results of the ABM suggest that the dissemination of knowledge favors the emergence of creative reactions and hence faster rates of introduction of technological innovations.

- Keywords:

- Complex System Dynamics, Innovation, Emergent Property, Technological Knowledge, Intellectual Property Rights, Knowledge Dissemination

Introduction

Introduction

- 1.1

- The article develops an agent based simulation model (ABM) of innovation considered as an emerging property of a complex system. It explores how architectural, organizational and institutional variables, such as the spatial distribution of firms and the intellectual property right regime, have an impact on innovative behaviours. Firms are considered as myopic agents that may react creatively to un-expected events. Their reaction may be adaptive or creative, according to the localized context of action. The reaction of agents may lead to the introduction of productivity enhancing innovations if and when the organization of the system is such that the reactive agents can actually take advantage of external knowledge available within the innovation system into which they are embedded. In this approach external knowledge is an indispensable input, together with internal research activities, into the generation of new knowledge.

- 1.2

- Our approach contributes a line enquiry of evolutionary economics that emphasizes the role of interactions among agents within the organized complexity of economic systems. This approach differs from evolutionary analyses of a darwinistic ascent where innovation is spontaneous and occurs randomly, in house capacities are considered as the unique source of novelty creating activities and market are credited with the role to select alternative novelties (Penrose 1959; Nelson and Winter 1982).

- 1.3

- In our approach innovation is an emerging property at the system level that takes place when the action of individuals and the organization of the system match. Knowledge interactions among heterogeneous agents and the organization of the knowledge flows within the system play a crucial role in assessing the chances of individual firms to actually introduce innovations. The access to external knowledge is viewed as an indispensable input, together with internal learning and research activities, into the generation of new knowledge. The introduction of innovations is analyzed as the result of systemic knowledge interactions among myopic agents that are credited with an extended procedural rationality that includes forms of reaction. Such reactivity can be either adaptive or creative. The reaction of agents can be creative so as engender the introduction of productivity enhancing innovations when a number of contextual conditions that enable the access to external knowledge are fulfilled (Anderson Arrow Pines 1988; Lane 2009; Zhang 2003; Antonelli 2011).

- 1.4

- The aim of the paper is to show that, because of the relevance of external knowledge for the generation of new knowledge, the organization of the system articulated in the different institutional and architectural settings of the structure into which knowledge interactions take place, affects the rates of generation of new knowledge and the pace of introduction of technological innovations (Bischi Dawid Kopel 2003).

- 1.5

- Using ABM methodology, the paper shows that innovation is likely to emerge faster and better in organized complex systems characterized by high levels of dissemination and accessibility to knowledge externalities.

- 1.6

- The rest of the paper is structured as it follows. Section 2 elaborates the theoretical framework and presents the building blocks of an approach that integrates the economics of innovation and the economics of complexity. Section 3 presents the agent-based model of the innovation system. Section 4 exhibits the results of the simulation focusing upon the alternative hypothesis about the institutional and architectural features of the innovation system. Section 5 elaborates the policy implications of the results. The conclusions summarize the main results and put them in perspective.

The theoretical frame

The theoretical frame

- 2.1

- This section presents the basic assumptions and hypotheses about the working of an economic system where innovation is characterized as the emergent property of the system dynamics of knowledge interactions. The introduction of innovations is analyzed as the possible result of systemic interactions among heterogeneous and myopic, yet learning and reactive, agents when and if they can take advantage of external knowledge so as to make their reaction, creative, as opposed to adaptive.

A behavioral approach enriched by creativity

- 2.2

- There are direct links between the Schumpeterian legacy and the behavioral theory of the firm that have been poorly appreciated so far. Schumpeter (1947) in a landmark contribution introduces the notion of creative reaction as a conclusive point of his theoretical elaboration. Schumpeterian firms are portrayed explicitly as myopic agents that are not able to foresee all the possible events and are occasionally surprised by un-expected events. Schumpeterian firms are myopic but endowed with the capability to react and to rely upon external resources in their reaction. Their reaction to the changing condition of their economic environment can be either adaptive or creative. If their reaction is adaptive, equilibrium conditions prevail and lead to traditional price/quantity adjustments with no innovation. Their reaction becomes creative, as opposed to adaptive, when knowledge interactions supported by a viable organization of the system makes possible to access external knowledge at favorable conditions[2]. Creative reaction engenders out-of-equilibrium conditions and with appropriate external conditions feeds a virtuous cycle of growth and change (Antonelli 2011).

- 2.3

- This Schumpeterian legacy is fully consistent and actually complementary with the basic assumptions of the beahavioral theory of the firm elaborated by Herbert Simon and Jamie March. In the classic behavioral theory firms are myopic: their rationality is bounded, as opposed to Olympian, because of the wide array of unexpected events, surprises and mistakes that characterize their decision making and the conduct of their business in a ever changing environment (March and Simon 1958). Firms, however, are endowed with an extended procedural rationality that includes the capability to learn. Agents are intrinsically heterogeneous. They are characterized by distinctive and specific characteristics that qualify their competence, the endowment of tangible and intangible inputs and their location in the space of interactions (Cyert and March 1963; March 1988; March 1991).

- 2.4

- In our approach agents can do more than adjusting prices to quantities and vice versa: they can try and react to the changing conditions of their economic environment by means of the generation of technological knowledge and its exploitation by means of the introduction of technological innovations. To innovate firms mobilize their slack resources consisting in tacit knowledge and competence accumulated by means of internal learning processes (Leibenstein 1976). Internal slack resources, however, are a necessary but not sufficient condition to innovate. The reaction becomes creative only with the support of an organized complexity of the system where firms are embedded

- 2.5

- A behavioral theory of a myopic but learning firm enriched by the Schumpeterian creativity provides the basis to implement a model of the economic complexity of technological change. In our approach firms try and innovate when their performances differ sharply from the average. A clear causality between performances, both negative and positive is established. When performances are below the average firms are dissatisfied and try to change their routines. When performances are above the average, firms have more opportunities to fund risky activities. This out-of-equilibrium causal link, in a typical satisfying approach, between performances and attempts to innovate marks a clear difference with the post Nelson and Winter approach where no causality is introduced and innovation is viewed as the spontaneous result of the behavior of firms considered as single agents.

Innovation and knowledge

- 2.6

- The introduction of technological and organizational innovations requires the generation of new knowledge. The generation of knowledge is characterized by specific attributes: knowledge is at the same time the output of a specific activity and an essential input into the generation of new knowledge. Because of knowledge indivisibility, the access to existing knowledge, at each point in time, is a condition necessary for the generation of new knowledge. Yet no firm can command all the available knowledge, hence no firm can generate new technological knowledge alone. The twin character of knowledge as an output of a research process and the input into the generation of further knowledge stresses the basic complementarity and interdependence of agents in the innovation process: innovation is inherently the collective result of the interdependent and interactive intentional action of economic agents (Blume and Durlauf 2001 and 2005).

- 2.7

- The structure of the system and its continual change, following the tradition of analysis of Simon Kuznetz, play a crucial role. The organization and the structure of the system affects the architecture of knowledge externalities, interactions and transactions and plays a crucial role in the access to external knowledge and hence in the definition of the actual chances of agents to implement their reactions and make it creative, as opposed to adaptive (Silva and Teixeira 2009).

- 2.8

- Technological knowledge is viewed as the product of recombination of existing ideas, both diachronically and synchronically. The generation of new knowledge stems from the search and identification of elements of knowledge that had not been previously considered and their subsequent active inclusion and integration with the preexisting components of the knowledge base of each firm (Weitzman 1996 and 1998; Fleming and Sorenson 2001).

- 2.9

- Marshallian externalities as implemented by the notion of generative interactions play a central role in this approach (Lane and Maxfield 1997). The amount of knowledge externalities and interactions available to each firm influences their capability to generate new technological knowledge, hence the actual possibility to make their reaction adaptive as opposed to creative and able to introduce localized technological changes. Each myopic agent has access only to local knowledge interactions and externalities, i.e. no agent knows what every other agent in the system at large knows. Because of the localized character of knowledge externalities and interaction, location in a multidimensional space, in terms of distance among agents and their density, matters. Interactions in fact are localized, as opposed to global. At each point in time agents are rooted within networks of transactions and interactions that are specific subsets of the broader array of knowledge externalities, interactions and transactions that take place in the system. In the long term, however, they can move in space and change their location in the networks. In so doing they change the organization of the system.

Contingent factors influencing innovative vs. adaptive behaviors

- 2.10

- Appropriate structural and institutional characteristics of the system upgrade the reaction of firms and help to make it actually creative and hence engender the introduction of productivity enhancing innovations. Only when the role of such external and complementary systemic conditions is taken into account the role of innovation as the productivity enhancing result of an intentional action can be articulated. The organization of the system plays a key role as it shapes the access to external knowledge. When the role of the external context is properly appreciated, it becomes clear that innovation is not only the result of the intentional action of each individual agent, but it is also the endogenous product of dynamics of the system. The individual action and the organization of the system conditions are the crucial and complementary ingredients to explain the emergence of innovations (Lane et al. 2009).

- 2.11

- Positive feedbacks take place when the external conditions into which each firm is localized qualify the access to external knowledge so as to make the reaction of firms creative, as opposed to adaptive. When the access conditions to the local pools of knowledge enable the actual generation of new technological knowledge and feed the introduction of innovations, actual gales of technological change may emerge. The wider is the access to the local pools of knowledge and the larger is the likelihood that firms are induced to react. The larger the number of firms that react and the better the access conditions to external knowledge and the stronger are the chances that their reaction are creative: technological change becomes a generalized and collective process (Arthur 1990, 1994, 2009).

- 2.12

- In such a context innovation is an emergent property that takes place when complexity is 'organized', i.e. when a number of complementary conditions enable the creative reaction of agents and makes it possible to introduce innovations that actually increase their efficiency. The dynamics of complex systems is based upon the combination of the reactivity of agents, caught in out-of-equilibrium conditions, with the features of the system into which each agent is embedded in terms of externalities, interactions, positive feedbacks that enable the generation of localized technological change and lead to endogenous structural change (Anderson, Arrow, Pines 1988; Arthur, Durlauf, Lane 1997; Lane et al. 2009).

- 2.13

- Innovation is the endogenous result of the system dynamics: it does not fall from heaven, as standard economics suggests. Neither is it the result of random variation as some evolutionary approaches, consistently with their with strong darwinistic traits, where mutation take place randomly, contend. Agents react and succeed in their creative reactions when a number of contingent external conditions apply at the system level. Innovation is the result of the collective economic action of agents: "innovation is a path dependent, collective process that takes place in a localized context, if, when and where a sufficient number of creative reactions are made in a coherent, complementary and consistent way. As such innovation is one of the key emergent properties of an economic system viewed as a dynamic complex system" (Antonelli 2008:I).

- 2.14

- The appreciation of the systemic conditions that shape and make innovations possible, together with their individual causes leads to the identification of innovation as an emergent property of a system. Our approach provides a solution to the conundrum of an intentional economic action whose rewards are larger than its costs. This can happen only if the complexity of the system is appreciated. The introduction of innovations that make it possible to enhance the productivity and efficiency of the system can in fact take place only as the emergent property of an organized system complexity and in turn organized complexity is explained as an endogenous and dynamic process engendered by the interactions of rent-seeking agents, that try and cope with the ever changing conditions of their product and factor markets (Antonelli 2009 and 2011).

Architectural and institutional trade-offs

- 2.15

- In this context, because of the twin character of knowledge as the output of a research process and the input into the generation of further knowledge, two knowledge dissemination trade-offs take place. The first relates to the structure of intellectual property right regimes; the second to the distribution in economic, regional and knowledge space of knowledge generation activities. Let us analyze them in turn:

- 2.16

- A) The intellectual property right trade-off. The structure of the intellectual property right regimes, the scope of patents, their duration, the assignment procedures and their exclusivity play a crucial role. Strong intellectual property right regimes increase the appropriability of technological knowledge for they limit the leakage of information and delay uncontrolled knowledge dissipation. Innovators can secure for a longer period of time the benefits stemming from the generation of new technological knowledge and the introduction of new technologies. Strong intellectual property regimes increase the chances of innovators to exploit technological knowledge. Consequently strong intellectual property right regimes enhance the incentives to the generation of new knowledge and hence help increasing the amount of resources that would be committed to the generation of new knowledge. Strong intellectual property right regimes, however, reduce both the static and the dynamic efficiency of economic and innovation systems. Strong property right regimes increase the duration of monopolistic power in the product markets and the appropriation of consumers' surplus by innovative suppliers. Strong property right regimes, however, reduce the dynamic efficiency of innovation systems because they prevent and delay the access to existing knowledge as an input into the generation of new knowledge and hence reduce the efficiency of the recombination process that leads to the generation of new technological knowledge. The combined effect of strong property right regimes in fact is to increase the incentives to generate research ad hence the amount of resources but the reduction of their efficiency because at each point in time available knowledge cannot be used to recombine and generate new knowledge and must be invented again. Strong intellectual property right regimes risk to increasing the replication of research efforts and the reduction of the pace of recombinant generation of technological knowledge. This knowledge trade-off requires the fine-tuning of intellectual property rights with the identification of the proper mix of the protection of appropriability on the one hand and the dissemination of available knowledge.

- 2.17

- B) The architectural trade-off. The architectural characteristics of the network of interactions that qualify each economic system have powerful consequences on the actual capability of each economic agent to generate new technological knowledge. The distribution in regional and knowledge space of knowledge generation activities has important effects. Because of the pervasive role of external knowledge as an input into the recombinant generation of new technological knowledge the regional concentration of knowledge generating activities may increase the pace of technological advance. Proximity, in fact, helps the identification of useful external knowledge hence reduces search and exploration costs. Proximity in regional space helps reducing the risks of opportunistic behaviors because of increased interactions, hence helps limiting transaction costs and finally proximity increases the homogeneity of codes and favors the absorption of external knowledge. Excess concentration may favor the forging ahead of small but effective clusters of highly innovative groups of firms strongly interconnected and able to interact at a fast pace. At the same time, however, excess concentration might be identified where the rest of the system is cut of the flows of creative interactions and the dissemination of new knowledge is delayed. Excess concentration risks to reduce knowledge variety and the related opportunities for knowledge recombination. The dissemination of knowledge generating activities may help the stimulus to the recombinant generation of new knowledge because of the wider participation of a larger number of heterogeneous agents in the collective endeavor that leads to the generation of new knowledge. Once more it is clear that a knowledge trade-off between concentration and dissemination of knowledge generating activities takes place with important policy implications about the best allocation of additional research resources and activities through regional space (Page 2011).

- 2.18

- Agent based models can help structuring in a rigorous frame of analysis the dynamic properties of the system so as to provide a context into which the implementation of simulation techniques can exhibit the different results of alternative structures of knowledge interaction mechanisms and intellectual property rights regimes[3]. This exercise can contribute the implementation of an approach that adapts complex system dynamics to economics where technological change is the central engine of the evolving dynamics of the system and it is the result of the creative response of intentional agents, embedded in an evolving architecture of market, social and knowledge interactions (Aghion, David, Foray 2009; Terna 2009).

- 2.19

- The simulation of the working of an economic system where technological change can take place implements the basic intuitions of complexity theory and of economics of innovation. The simulation will enable to identify the proper solutions to the two knowledge trade-off that have been identified with respect to the structure of intellectual property right regimes and the regional distribution of knowledge generation activities.

- 2.20

- Let us now turn our attention to analyze the building blocks of our agent-based simulation model. The following section shows how the use of the basic tools of agent-based simulation can implement a rigorous representation of the dynamics of a full-fledged economic system where agents are credited with the capability of generating technological knowledge and generating technological innovations provided a conducive architecture of network interactions and an effective intellectual property right regime is implemented.

The simulation model

The simulation model

- 3.1

- The working of the system of interactions and transactions that qualify the simple but articulated economic system outlined in the previous section can be explored by means of an ABM in order to investigate the dynamics of the innovation process at the system level[4]. ABM provides with the opportunity to explore the full range of implications of a multilevel structure of interactions and transactions as framed in the previous section and to take into account the variety of outcomes of the decisions taken by each heterogeneous agent (Pyka Werker 2009; Terna 2009).

- 3.2

- The ABM implemented in this section operationalizes, through the interactions among a large number of objects representing the agents of our system, the working of a typical complex process characterized by the key role of Marshallian externalities and augmented by the Schumpeterian assumption that firms are credited with the capability to try and innovate according to the levels of their performances and the context into which they are localized (Dawid 2006).

- 3.3

- The model assumes that firms are boundedly rational but endowed with procedural rationality enriched by the capability to react and to innovate when and if a number of external circumstances are provided. The rationality of their behaviour is objective, as opposed to subjective. Firms in fact do react to the dynamics of both product and factor markets but never maximize. Their reaction includes the possibility to innovate, instead of sheer adjustments of quantities to prices.

- 3.4

- In the ABM demand and supply meet in the market place; production is decided ex ante; firms try and sell their output in the product market, where customers spend their revenue. The matching between demand and supply sets temporary prices that define the performances of firms. According to the levels of their performances and the availability of external knowledge firms can fund dedicated research activities to try and innovate (Lane 2009).

- 3.5

- In the simulation, heterogeneous firms produce homogeneous products sold into a single market. In the product markets the households expend the revenues stemming from wages (including research fees) and the net profits of shareholders. In the input markets the derived demand of the firms meets the supply of labor provided by workers, including researchers. For the sake of simplicity, no financial institutions have been activated, nor payments can be postponed. Shareholders supply the whole capital of the firms and all the commercial transactions are immediately cleared.

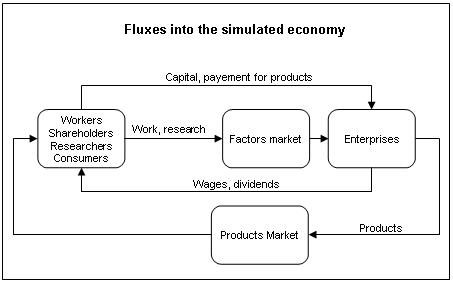

Figure 1. Fluxes into the simulated economy - 3.6

- Market clearing mechanisms based exclusively upon prices maintain a perfect equilibrium between demand and supply. Such equilibrium is ensured for both the product and the factor markets: the quantities determine the correct price that ensure the whole production be sold. No friction neither waiting times are simulated, factors are assumed to be immediately available. Here the joint reference to the Marshallian and Schumpeterian legacies play a key role to understanding the working of such markets. At each point in time the market equilibrium is typically Marshallian, as opposed to Walrasian. Here exchanges occur after production. Production has been taking place according to the plans based upon the expectations, beliefs and technological competence of each agent. For each transient market price, because agents are heterogeneous, some make profits and other incur losses. Following the Schumpeterian traits of our model, however, no convergence can take place as long firms introduce innovations and hence keep changing the attractors.

- 3.7

- The production function is very simple, in order to avoid matters related to different kinds of production processes, inputs availability, warehouses cycles and so on, outputs depend exclusively from the amount of employed work and its productivity. Both labour and productivity vary among firms: labour depends on the entrepreneur's decision about the growth of the production. Productivity is a function of the technological level the firm achieved through innovation.

- 3.8

- The whole output is sold on the single product market, where the revenue equals the sum of wages, dividends and research expenses and the price depends on the liquidity. According to the temporary price levels, profits are computed as difference between income and costs, no taxes are paid, neither part of the profit can be retained into the enterprise. Shareholders either will receive the profits or reintegrate the losses.

- 3.9

- Heterogeneous firms are localized into an economic structure represented as a regional and technological space. Both spaces are managed as grids divided into cells each of which can host an unlimited number of firms. The position into the regional grid determines the neighbourhood into which firms can observe their competitors, comparing results. The position of each firm in the technological grid measures its productivity and defines the possibility to access quasi-public knowledge. The distribution in the two space dimensions is not consistent: firms technologically very close could be positioned in far distant cells of the regional space and vice versa. In this way the absorption of technological knowledge spilling from firms based in regional and technological proximity may enable the introduction of an innovation with positive effects in terms of productivity growth.

- 3.10

- The localization of agents in both space dimensions is the result of their past activities and yet it can be changed at each point in time. The results obtained during a production and consumption cycle influence the strategies the agents will take during the next cycle. Hence the dynamics of the model is typically characterized by path dependence: the dynamics in fact is non-ergodic because history matters and irreversibility limits and qualifies the alternative options at each point in time. At each point in time, however, the effects of the initial conditions may be balanced by occasional events that may alter the 'path' i.e. the direction and the pace of the dynamics (David 2007).

- 3.11

- The firms into the model, in fact, are always comparing their performances in terms of profits, to the neighbours average results, the difference between own figures and neighbours average ones increases the motivation to innovate. Transparency is clearly local: the ray within each firms can observe the conduct of other firms is limited accordingly with a parameter value. Beyond that ray information is scarce and costly.

- 3.12

- The farther is profitability from the average and the deeper the out-of-equilibrium conditions. Firms can innovate if the results are under the average level, to improve their performances, as well as when the results are above the average level, to take advantage of abundant liquidity and reduced opportunity costs for risky undertakings. Innovation is viewed as the possible result of intentional decision-making that takes place in out-of-equilibrium conditions. The farther away is the firm from equilibrium and the stronger the likelihood for innovation to take place. Hence we assume a U-relationship between levels of profitability and innovative activity, as measured by the rates of increase of total factor productivity (Antonelli and Scellato 2011).

- 3.13

- Summarizing, firm increases its motivation to innovate each time its performance is found to be far enough from the average. Such a motivation become stronger and stronger if the enterprise's relative position remains outside a band for several and consecutive production cycles: after a parametrically set number of consecutive cycles the enterprise performs an innovation trial.

The simulation of the innovation process

- 3.14

- ABM enables to explore in detail the innovation process and the role within it of the external factors that shape the recombinant generation of technological knowledge. At each point in time firms can react so as to try and increase their productivity. Hence they can move and change their regional and technological localization by means of research costs. The research costs are directly related to the actions performed by each firm to innovate, either:

- mobilize internal slack competence,

- absorb external knowledge spilling from neighbours,

- move to other location in order to exploit more developed neighbours.

- 3.15

- We assume a sequence of innovative steps. At first firms try and mobilize their own internal slack competence. The firms that have not sufficient potential try and absorb the external technological knowledge spilling from a neighbour and, if knowledge absorption is not possible, they can move randomly to another location into the physical space. Let us consider them in turn:

- firms can mobilize their internal slack competence accumulated by means of learning processes. The firms of the model are endowed with the ability to learn better ways to perform their production cycles. Each time a production cycle is done, firms acquire and cumulate some technological potential. Such a potential can be transformed in actual innovation only by means of appropriate research activities and access to external knowledge. Firms are able to build up competence by means of learning processes. The accumulation of experience proceeds at a specific internal "learning rate" that is biased by the impact of external "learning factor" that reflects the competence level of the enterprises' neighbourhoods, measured as the average productivity of the neighbours enterprises. The competence can be transformed in real innovation when a parametrical threshold is reached, at a cost. Because the internal slack competence is seldom sufficient to support the recombinant generation of new technological knowledge and hence the actual introduction of a productivity enhancing innovation, firms explore the technological and regional space into which they are localized and try to access and absorb the knowledge of their neighbours (March 1991).

- absorption enables to take advantage of the technology introduced by other firms: because of absorbing costs however it is not free. The effective access to external technological knowledge requires substantial resources in exploration, identification, decodification and integration into the internal knowledge base (Cohen and Levinthal 1989 and 1990). Moreover, because of bounded rationality, firms can observe only the other ones that lay in a certain neighbourhood whose extension depends on a "view" parameter: his value limits the number of positions all around the agent it can explore. Due to the fact the simulated world is managed as a grid the position of the agent limits this view: agents in a corner have less possibility to observe than other located in the middle of the grid, as well as agents in a very crowded neighbours have more information than isolated firms. Note that a single position into the grid could pile several agents, so simply exploring its cell an agent may found other firms to observe.

The view parameter determines only the number of cells the agent can access, the real number of other firms it can observe depend upon the evolution of the agents' distribution and constitutes an emerging phenomenon that continuously evolves during the execution of the simulation. When the agent is located near the end of the grid its capability falls dramatically.

A major constraint to the possibility to take advantage and absorb others' technologies is represented by intellectual property rights (IPR). In order to model a credible IPR regime we allow enterprises to patent their technology and hence to retain exclusive exploitation rights for a certain number of cycles (Reichman 2000).

By observing other firms each firm knows the latest technological level they apply that is not covered by a patent licence. The key parameter "patent expiration" is used to experiment different scenarios, its value determines the number of production cycles each innovation remains hidden to the competitors. It is plausible to expect that the longer is the patent period, value of the patent expiration parameter (pe), the higher will be the research effort: unless enterprises were given the exclusive possibility to exploit the research results, no private firms would be interested in investing money, because their discovery would be immediately available for competitors. In the model, even with patent expiration equal to zero, the new technology is exploited exclusively by the innovating enterprise for almost one cycle.

Observed technologies can be absorbed only if the distance between them and the own ones is less than a parametrical value, so called "knowledge absorption threshold". This limitation has been introduced to avoid dramatic jumps in the productivity of firms that would be not plausible. Knowledge absorption has a cost equal to the named distance. Because the possibility to observe neighbours depends on the position of each enterprise into the physical space, when knowledge absorption gives poor or null results enterprises could decide to move into another location in order to meet better technological conditions. - relocalization. The third way to improving productivity levels consists in moving around the physical space in order to reach more interesting neighbours. When the mobilization of competence and knowledge absorption are not viable solutions, firms can try and move randomly to another location in the hope to found better developed zones. Movement is limited by a parameter called "jump", its value determines the maximum amount of cells the firms can go through vertically and horizontally back or forward; the effective number of cells the enterprise will move is determined randomly into this range, that constitutes a Von Neumann's neighbour. Moving costs are directly related to the distance between the original and the new location.

- 3.20

- Here we see how the structure of the system influences in several ways the innovation chances of the enterprises: learning is faster for firms that operate in a well developed neighbour, and imitators have higher possibilities to observe and copy if they operate into a crowded and technologically advanced environments (Ozman 2009).

- 3.21

- Firms are endowed, at the start of the simulation, with a competence and a technological level, randomly tossed for each into the lowest quarter of the possible values, following a uniform probability distribution. The simulations started with low skilled firms, with a uniform distribution among them, both to give each firm:

- the possibility to express its own development path,

- a similar starting situation to analyze the different development paths.

- 3.22

- In the real world, knowledge centres, like universities, technical and management schools and so on, are located unevenly in the geographical territory with clear effects: a large evidence confirms that firms operating in geographical regions whit an high density of such organisations have higher chances to access higher level of knowledge. To introduce these aspects in the simulation model we have represented geographical regions by means of physical spaces where competence is distributed following different configurations: from a full concentration in a limited space to a well disseminated distribution. Knowledge centres are represented by firms with very high technological level (so called 'genius'), whose initial knowledge endowment is randomly tossed within the highest quarter of the possible values, whereas normal agents are given values in the lowest one.

- 3.23

- Neighbours can take advantage of the external knowledge spilling from the 'genius' within the boundaries of the knowledge absorption threshold value set up for the simulation. Hence the higher the knowledge absorption possibility is and the stronger is the influence of the genius to their neighbours. The patent duration does not slow the effect because the initial knowledge is pretended to be an old and public one.

- 3.24

- In order to experiment different scenarios the number of genius is parametrically managed and could be set to zero to exclude this effects. The distribution in space of agents is tossed randomly at the beginning of the process but it becomes fully endogenous as agents are credited with the capability to move in regional space searching for the access to external knowledge spilling in the proximity of 'genius'. Hence the dynamics of the regional distribution of agents exhibits the typical traits of path dependence.

- 3.25

- The process is non-ergodic but not past-dependent: small variations can exert important effects in terms of emergence of strong clusters or, on the opposite, progressive dissemination in space (D'Ignazio and Giovannetti 2006; Antonelli 2008).

Results of the simulations

Results of the simulations

- 4.1

- The strength of the ABM consists in the possibility to assess in a coherent and structured frame the systemic consequences of alternative structural configurations of the properties of the system. Simulation techniques allow to exploring the outcomes of different hypotheses concerning key issues of the model within a structured and consistent frame that takes into account the full set of direct and indirect effects of the interactions of agents (Pyka Werker 2009).

- 4.2

- The results of the simulation confirm that the model is consistent and able to mimic the working of a complex system where rent-seeking agents react to the changing conditions of the product and factor markets. Hence the results confirm that the set of equations is able to portray the working of a complex system based upon a large number of heterogeneous agents on both the demand and the supply side that are price taker in product markets. Markets clear with temporary equilibrium price. The replication of the temporary equilibrium price in the long term confirms that the model is appropriate to explore the general features of the system when the reaction of firms is adaptive and consists in price to quantity adjustments. In the extreme case where firms cannot innovate for the lack of internal competence to be mobilized and external knowledge to be absorbed, the system mimics effectively the working of static general equilibrium in conditions of allocative and productive efficiency but with no dynamic efficiency. The markets sort out the least performing firms and drive the prices to the minimum production costs. This result is important because it confirms that static general equilibrium is the simple and elementary form of complexity that takes place when agents cannot innovate. As soon as agents try and succeed in their reaction to changing market conditions with the introduction of innovations, the equilibrium conditions become dynamic and all the key features, such as the prices, the quantities, the efficiency and the structure, of the system keep changing (Antonelli 2011).

- 4.3

- Innovation is effectively an emerging property of the system because it takes place when the external conditions and the structure of the system provide access to the external knowledge that is crucial to feed the effective recombinant generation of new technological knowledge and hence the actual introduction of productivity enhancing innovations by firms that try and cope with the changing conditions of the system doing more than sheer adjustments of prices to quantities.

- 4.4

- The access to external knowledge is necessary to achieve the effective recombinant generation of new technological knowledge and to eventually introduce new technologies. The structural characteristics of the system into which firms are embedded are crucial to enable the reaction to become creative and hence to introduce innovations that increase their productivity.

- 4.5

- The simulations provide key information about the two knowledge trade-offs and enable to assess the systemic effects in terms of dynamic efficiency of alternative configurations of the intellectual property right regimes and architectures of the network interactions We have explored the consequences of two sets of hypotheses: 1) the effects of different durations patents and 2) the effects of different architectural properties of the system in terms of distribution of firms with high levels of technological competence.

- 4.6

- The effective recombinant generation of technological knowledge and the consequent introduction of technological innovations is tracked and quantified in terms of productivity growth, measured as the ratio of input - output. Firms that are able to take advantage of knowledge externalities, to generate successfully new technological change and hence to introduce better technologies, will experience an increase in the general levels of efficiency of their production process and will experience higher mark-ups with evident positive consequences on productivity levels.

- 4.7

- The changes in productivity levels affect the dynamics of the system not only in terms of average rates of growth but also in terms of variance. Growth cum technological change is far from a steady increase. On the opposite it exhibits fluctuations that are typical of long term Schumpeterian process of creative destruction. Occasionally the majority of firms incur major losses due to the mismatch between their current cost conditions and the performances of a few radical innovators able to introduce breakthrough innovations. In a typical Schumpeterian process we see that the introduction of radical innovations engenders occasional phases of decline in output. It is interesting to note that the fluctuations are sharper when the pace of technological change is higher and more specifically in the configurations of spatial distribution and appropriability regimes that make faster the rates of introduction of technological innovation and hence of productivity growth.

- 4.8

- Let us now consider in turn the alternative results that are obtained with different structural configurations of both the intellectual property right regimes and the spatial distribution of firms[5].

The first knowledge trade-off: Intellectual property right regimes

- 4.9

- The first question the simulation has been employed to investigate refers to the role of patent protection in promoting and sustaining the innovation. The well-known IPR trade-off can now be investigated (Harison 2008;Vandekerckhove and De Bond 2008).

- 4.10

- Intellectual property rights enable firms to secure exclusive rights on the technological knowledge they have generated. By means of IPR enterprises can exclude competitors from the exploitation of such new technologies and consolidate an effective competitive advantage. At the micro level patent protection reinforces the motivation to innovate giving the enterprise the possibility to exploit its own innovation in an exclusive way (hereafter "reinforcing effect").

- 4.11

- Moving from our basic assumption that the introduction of innovations builds upon in the recombination of existing knowledge it is clear that the patent protection has a negative effect: the longer the protection lasts the slower the new technologies can spread among firms (hereafter "slowing effect") (Gay, Latham, Le Bas 2008).

- 4.12

- This research investigates both the effects focusing on the influence they have on the innovation process. The simulations has been run using the following model set up:

- all the firms (agents) operated into a common market and district,

- all the firms started from a similar level of technologies, randomly tossed into the first quarter of the achievable technologies following a uniform distribution,

- each firm was given high capability to observe the neighbours and to absorb external knowledge,

- the unique parameter that varied among the simulations was the "patent expiration", i. e. the time, in production cycles, a new technology was owned by the innovator and not available to the other agents in the system.

- The probability firms try to innovate even if their results are similar to their neighbours ones is positively correlated to the patent expiration since it is less than one hundred; for values greater than one hundred no innovation at all are pursued by the firms unless their results were far from the neighbours ones.

- 4.13

- Two sets of experiments have been executed both based upon the observation of the average productivity level the agents achieved after a determined number of production cycles. In the model productivity is positively correlated to the technology, so the more a firm innovates the higher is its productivity: by observing the dynamics of the productivity it is possible to study the effects of the institutional and regional context upon the innovation strategy of the firms.

- 4.14

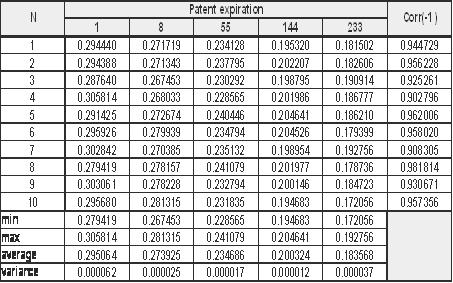

- The first set of experiments consisted in benchmarking the innovation to explore the difference among the results in terms of productivity levels obtained with several different duration times of the patent protection and a benchmark figure, represented by the productivity level the agents achieved with patent expiration set to one. To ensure the results were robust and systematic, each simulation was run ten times by varying, for each run, the seed employed to generate pseudo random numbers; the result of each experiment was computed as the average of the ten runs results.

- 4.15

- The second set of experiments consisted in correlating innovation and patent expiration: fifty simulations was run varying, each time, both the random seed and the value of the patent expiration parameter; the value was randomly tossed following a uniform distribution into the interval: ]1,255[. The described approach ensured both the robustness of the results and the independence of the parameters set up from any researcher's mental schemata.

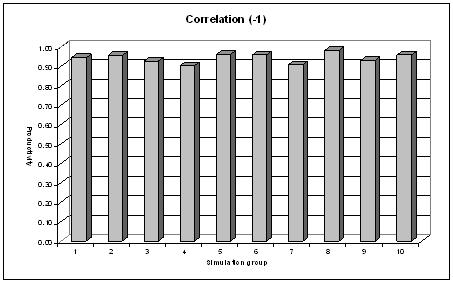

Benchmarking the productivity

- 4.16

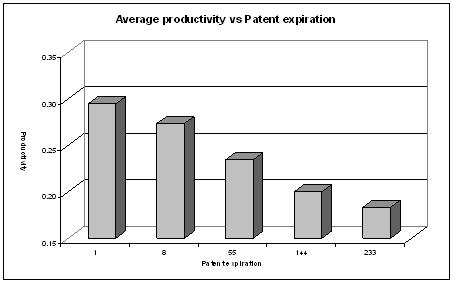

- The following figure 2 shows the average results obtained in five different experiments based upon diverse values for the patent expiration parameters.

- 4.17

- The results of the first one (patent expiration set to one) constitute our benchmark. Each experiment consisted in running for several times (ten in this case) a simulation five hundred whole production-consumption cycles long, with a determined value for the patent expiration parameter and different random seed; the results of each simulation have been summarized by means of the average productivity value computed tacking the reached values of each firm into the population of the model.

- 4.18

- The distribution of those average values exhibited a very low variance allowing its usage as the representative value and suggesting that the results were robust and fully independent from the different random numbers distributions generated for each simulation starting from a diverse seed.

- 4.19

- The graph shows that the four different scenarios (8, 55,144, 233) were not able to achieve the benchmark (scenario 1), because the productivity level directly depended on the achieved technological level, it would mean that the reinforcing effect has been systematically weaker than the slowing one.

- 4.20

- In sum the results confirm that the stronger the IPR protection was (the more extended in time the patent protection was) the slower the innovation process proceeded.

Figure 2. Histogram representing the results of the simulations. - 4.21

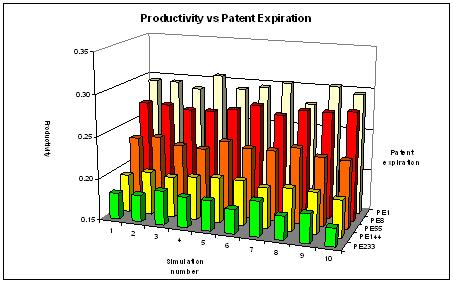

- More in details the following figure 3 shows that in all the simulations, the results were systematically higher the lower was the patent expiration.

Figure 3. Results reached in each of the ten simulations. - 4.22

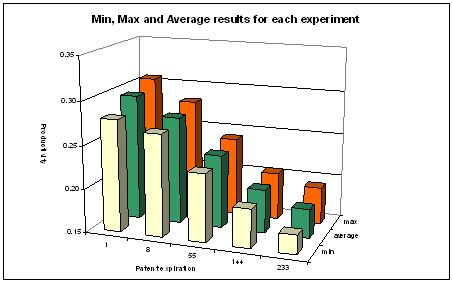

- The figure 4 better shows the trend of the phenomena by drawing minimum and maximum results obtained in each experiment.

Figure 4. Results of the experiments related to the value of the patent expiration parameter. Correlating innovation and patent expiration

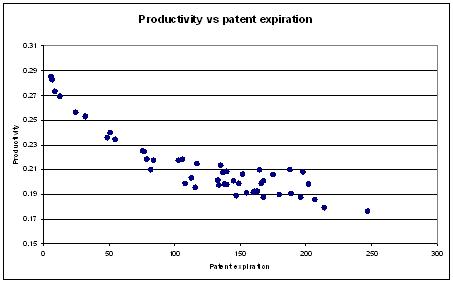

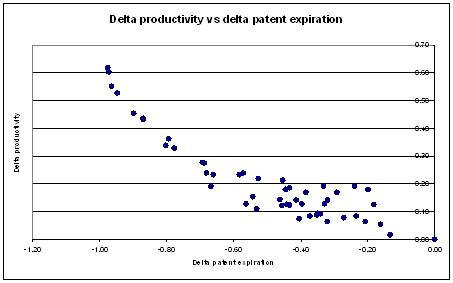

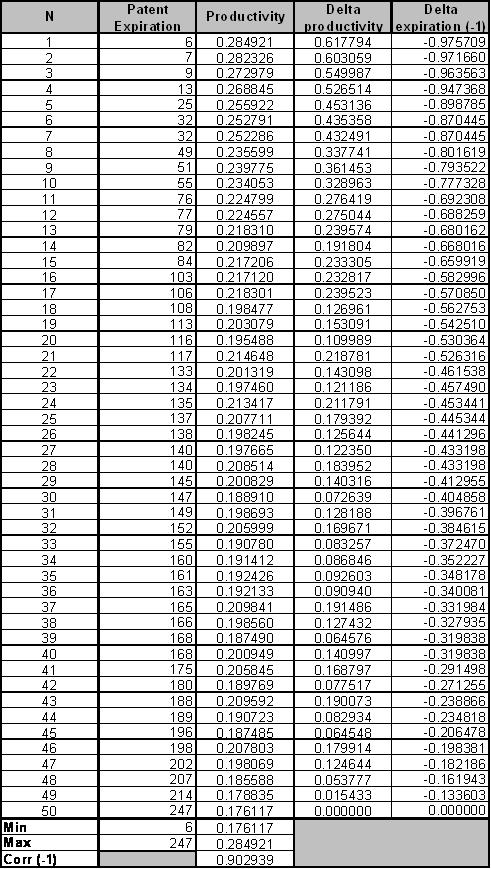

- 4.23

- The figure 5 shows an early correlation between the patent duration and the productivity levels that the simulated economy reaches, by grouping each set of five simulations picking the first, second etc. of each experiment under different values of the patent expiration parameter.

- 4.24

- The results obtained by running fifty simulations, five hundred production cycles long, with random values for patent expiration demonstrate the existence of a negative correlation between patent rights and innovation.

Figure 5. Correlation between patent expiration and productivity. - 4.25

- The longer the patent right is the less the productivity level grows, as graphically illustrated by the figure 6. The obtained correlation index is about -0.9; the distribution of the obtained results shows a remarkable relative difference between the best case (patent expiration = 6) and the worst one (patent expiration = 214). The two figures, respectively figure 6 and figure 7, illustrate the distribution of the average productivity values and the distribution of the relative difference between each value and the worst case one.

- 4.26

- The productivity difference (dp) has been computed as: dpi = pi / min(p) - 1. Where pi represents the productivity of the i-th experiments and min(p) the minimum productivity level achieved in all the experiments. A similar algorithm has been employed to compute the patent expiration difference (dpe): dpei = pei / max(pe) - 1.

Figure 6. Distribution of the average productivity during fifty experiments with different settings of the patent expiration parameter

Figure 7. Distribution of the relative differences versus the worst case. The second knowledge trade-off: the regional dissemination of knowledge

- 4.27

- The second issue addressed by the simulation concerns the role of the distribution in regional space of knowledge generating institutions, like research laboratories, universities and so on, in promoting and sustaining the innovation.

- 4.28

- We want to test the hypothesis that the dissemination of knowledge favours the growth of the system. This very first stage of the research has been focused on the influence that different architectural distributions of the knowledge producers have on the dynamic of the innovation process.

- 4.29

- The distribution in regional space of knowledge producers (hereafter KP) is a valuable source for the recombinant generation of new technological knowledge as they provide the opportunity to all the other co-localized agents to access part of their proprietary knowledge in the form of knowledge spillovers (Ozman 2009).

- 4.30

- In order to maintain the model at a useful level of simplicity, the knowledge producers have been dummied by some highly evolved firms whose distribution will affect the possibility for other firms to take advantage of the technological knowledge spilling from them.

- 4.31

- The distribution of knowledge has been simulated by inserting a small number of firms endowed with a high level of technological knowledge (so called 'genius') into an environment populated by a wide set of less developed firms.

- 4.32

- The different distributions of genius and their number have been experimented in several scenarios, i.e. under diverse set up of some basic parameters that determine the quality of information available, the limits to the physical relocation, the capability to observe and copy others' strategy and so on.

- 4.33

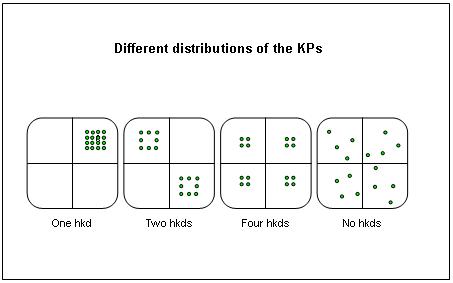

- Four different distributions for knowledge producers have been studied and compared by observing their effects upon the evolution of the productivity, to ensure the distributions were stable knowledge producers were not allowed to change their position into the physical space. In the four different spaces we find 250 normal firms and a certain number of knowledge-intensive ones (KP).

- 4.34

- In each space the distribution of the high-tech firms is set up as follows:

- one high knowledge district (One hkd): all the KPs are placed, very close among them, in a small area at the centre of the space,

- two high knowledge districts (Two hkds): the total number of KPs is split between two areas, the first located at the centre of the right upper quarter of the space and the former at the centre of the left lower one,

- four high knowledge districts (Four hkds): here the KPs are distributed around four points, respectively at the centre of each quarter the whole space could be divided into,

- no high knowledge district (No hkds): each KP is assigned a random position into the space and lives alone.

- 4.35

- The basic population of each region (about 250 agents, due to the fact each agent is assigned a random space tossed following a uniform distribution) is randomly spread into the space.

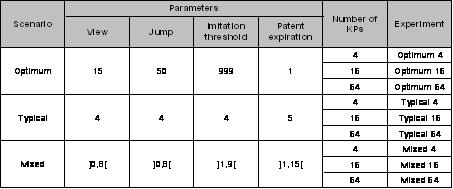

- 4.36

- Each set of experiments has been based upon a different combination of four parameters, so called scenario, each of them has been assigned a name:

- optimum: is the scenario devoted to re-create the theoretical condition of perfect information and mobility. Here agents have a large view, knowledge is fully available and moving is always possible,

- typical: here the capabilities of the firms are limited to plausible amounts, in order to take in account the typical limits existing into the real world,

- mixed: the parameters have been randomly set up for each simulation, choosing their values into an assigned range that include the "typical" values.

- 4.37

- For each scenario a set of three different experiments have been done, by using, respectively 4, 16 and 64 KPs for each space. By varying the number of KPs the difference between each KPs distribution model could be differently stressed: with 4 KPs for each space, there is few difference between the diverse distribution of them and, practically, the Four hkds is one of the possible distributions of the No hkds scenario.

- 4.38

- The more the number of KPs is increased the higher become the difference among the four distribution.

Table 1. Parameter configurations for each experiment. - 4.39

- Each experiment has been repeated for fifty times always changing the random number distribution to simulate different dynamics and validate the robustness of the obtained results.

- 4.40

- Random numbers were used to simulate some decision, to pick up neighbours spilling relevant external knowledge and to determine in which direction and how far to move. For the Mixed scenario random numbers are used to toss the parameters value each within the appropriate range, as illustrated in Table 1 where parameters for each scenario and simulation are shown.

Figure 8. Configuration of the spaces for the simulations. - 4.41

- At the end of each experiment the average productivity level for each region and for the whole population have been computed, at this very first stage of the research these were the only data it has been decided to concentrate on.

- 4.42

- Since the initial endowment of the firms in each region was set to the same amount, the market was unique both for factors and products, it is possible to assume differences among the reached level of productivity were mainly due to the different distribution of the KPs; the figure 8 shows this distribution.

Results of the Optimum scenario

- 4.43

- The "Optimum" scenario has been set up to validate the model under the classic assumption of perfect information and mobility: provided that each regional space is simulated by a square lattice 100 cells wide, jumping in each direction of 50 cells means have a perfect mobility, as well as because the maximum distance between the worst and the best technology has been limited, in these simulations, to 200 and knowledge absorption threshold of 999 means that each technology could be copied. The patent expiration set to one means that each adopted technology becomes quasi-public in the successive production cycle, so each technology could be copied as soon as it has been adopted.

- 4.44

- The value of the view parameter would have been set to fifty too, as for the jump one, but fifteen demonstrated to be enough to allow a good circulation of information and guarantee the majority of the enterprises reached the higher technological level in a very short time.

- 4.45

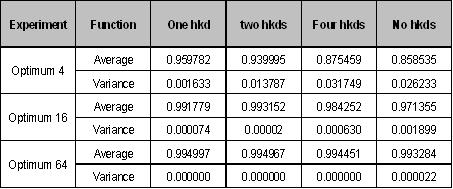

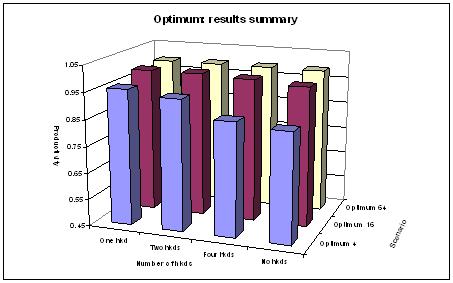

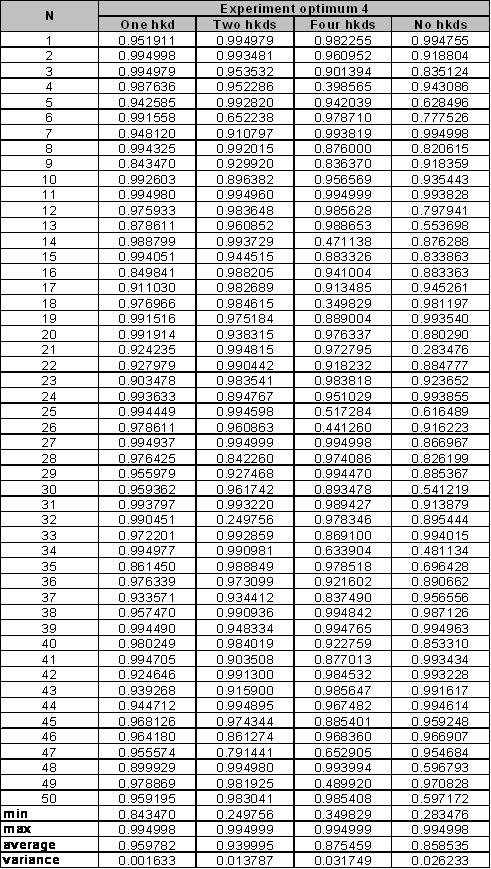

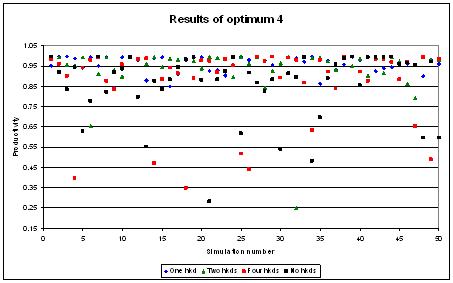

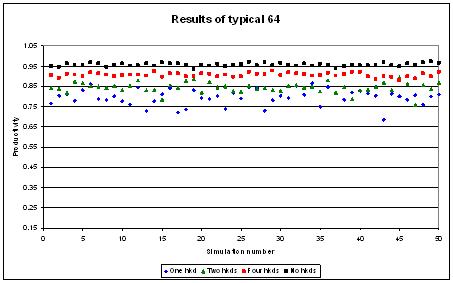

- Under the optimum conditions, the concentrated distributions of KPs, as the One hkd and Two hkds seem to give some advantages, as shown by the results briefly summarized into the table 2: here are reported, for each experiment, the average results, first row, obtained during fifty runs, with different random distributions, each of them 250 whole production cycles long, the variance is reported too, in the second row.

Table 2. synthesis of the results obtained by running the Optimum scenario. - 4.46

- With high levels of information quality, mobility, and capability of firms to absorb technological knowledge from each other, and no patent protections, the concentrated distribution of knowledge centres seem to give better results than the disseminated one, even if the advantage becomes smaller and smaller when the number of KPs grows.

- 4.47

- Starting from the scenario with only 4 KPs the disseminated region reached only 0.85 productivity after 250 production cycles, whereas the full concentrated one reached 0.95, with an advantage of about 0.1, but this difference fell to 0.02 and 0.001 respectively with 16 and 64 KPs.

- 4.48

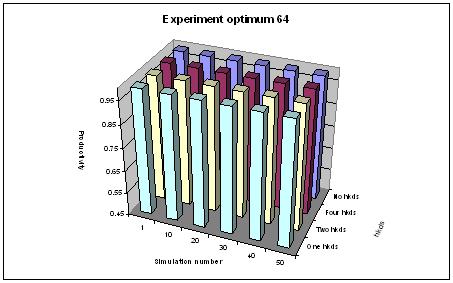

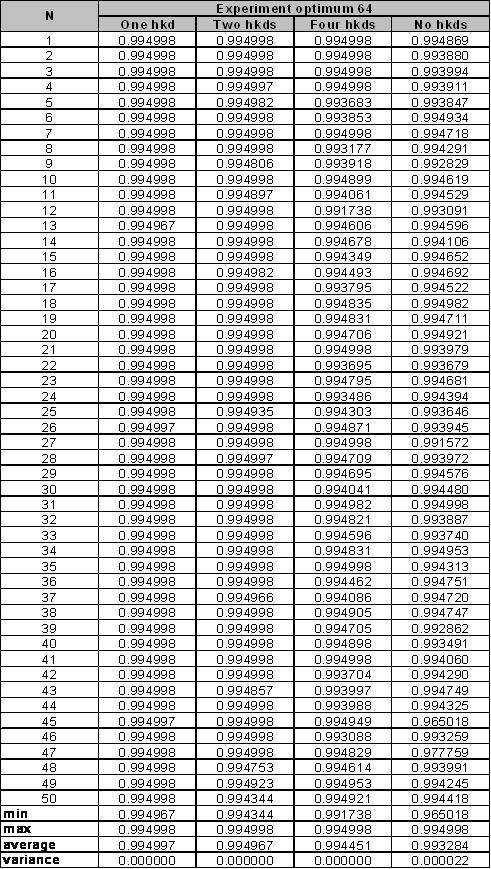

- The trend shown by the average values systematically appears in each single simulation as the figure 9 graphically illustrates for the experiment Optimum 64: the graph reported the final results of each of the 50 simulations.

Figure 9. Results of several simulations of the experiment optimum 64 Results of the Typical scenario

- 4.49

- This configuration set has been obtained by giving the four parameters realistic and plausible values, the regional neighbourhood of each firm has been presumed to be 64 cells wide, about 1/100 the whole extension of the simulated world, where each cell was able to host more than one enterprise. Pretending this neighbourhood to be the maximum extension a firm would have been able to reach, the possibility to move has been limited at the same amount.

- 4.50

- Innovation cannot be done too fast, the absorption and recombination of external technological knowledge implies the modification of products and production processes and the upgrading of the skills of the staff: it is not plausible that an enterprise can absorb unlimited amounts of external technological knowledge. The limit of 4, represents 1/50 of the maximum technology a firm can reach in the whole evolution, and four hundred times the ability each enterprise is pretended to acquire each cycle by means of the "learning by doing".

- 4.51

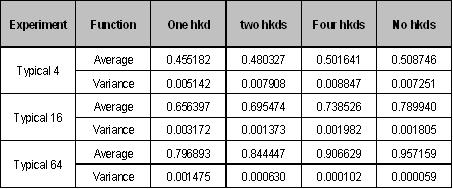

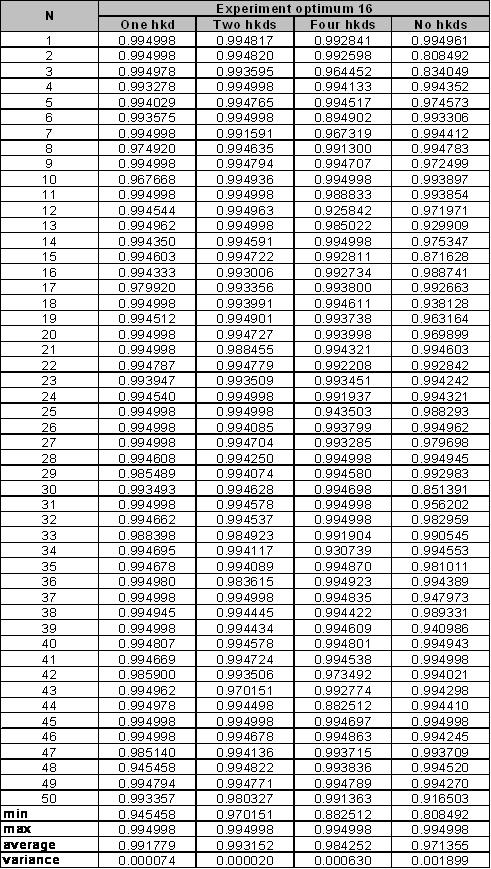

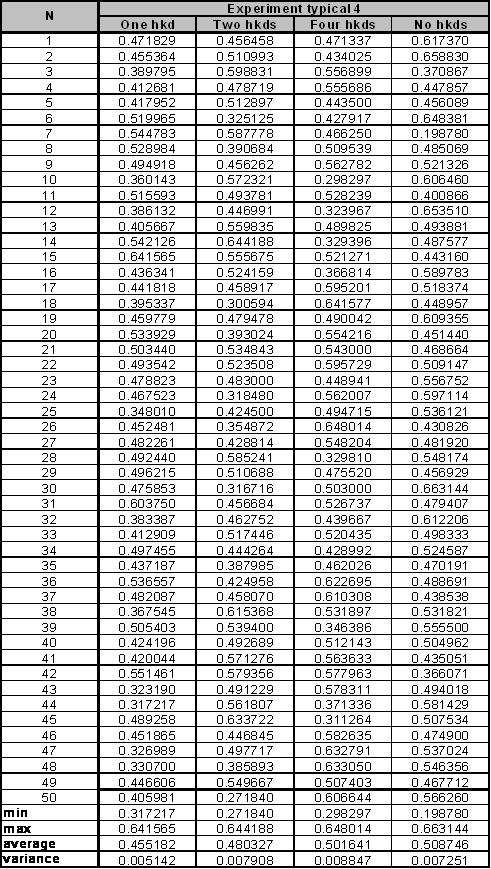

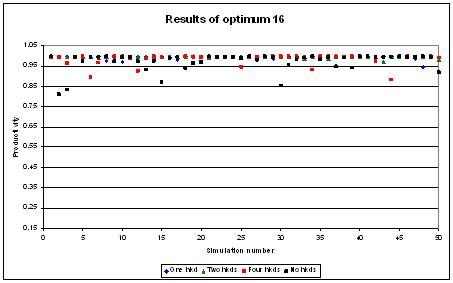

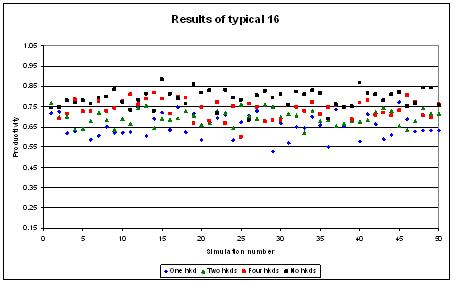

- It is also plausible that new techniques could be protected by a license, usually technical patents last for five years, because each step of the simulation is pretended to last for one year, the expiration of patent rights has been set up to five. Practically each firm can observe and absorb the other technologies only if they are five cycles old. All these limitations reduced the speed of evolution, so experiments for this scenario has been based upon one thousand cycles simulations long, even though the enterprises reached productivity levels less than them obtained in the, non realistic, Optimum scenario. The interesting results is that, under more realistic conditions relevant indications about the better distribution of KPs seem to appear; as in the table 3, where are shown the average results of fifty runs for each experiment using the Typical scenario.

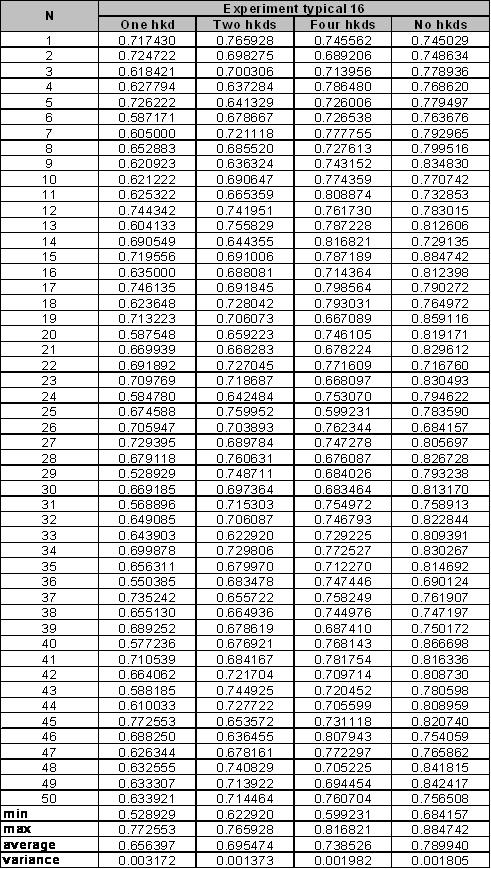

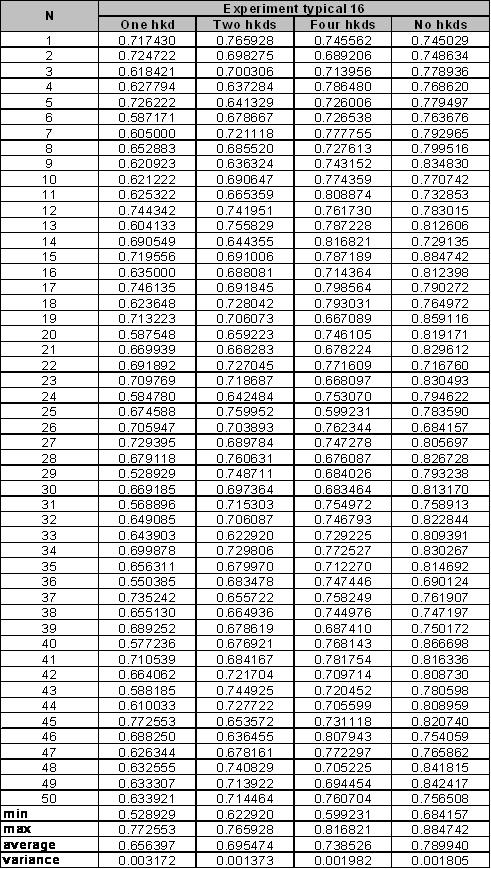

Table 3. synthesis of the results obtained by running the Typical scenario. - 4.52

- In all the three setups of KPs, the disseminated distribution provides better results, and the distance become higher the higher the number of KPs is.

- 4.53

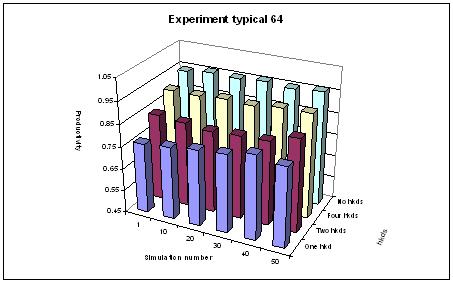

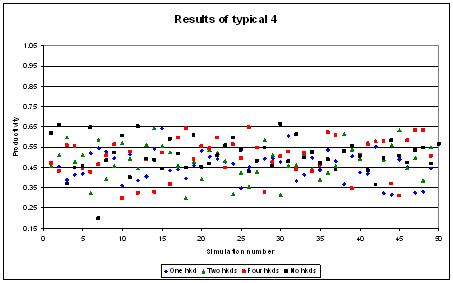

- Analysing the four regions it is evident that the more the KPs are spread, the better become the results, the advantage grows significantly passing from the One hkd scenario region to the No hkds one, reaching, for 64 KPs, 0,16. Figure 10 shows the results obtained during the 50 simulations for the experiment typical 64.

Figure 10. Results of several simulations of the experiment typical 64 - 4.54

- More disseminated distributions of the KPs seem to be more effective in facilitating the innovation and in promoting technical progress, a plausible explanation could be that more disseminated distributions allow a major number of firms to access knowledge; similar configurations, like four hkds and no hkds in presence of four KPs only, gave very close results, confirming this explanation.

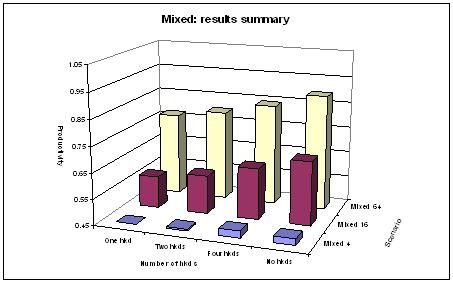

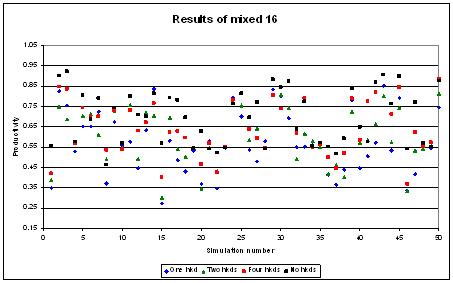

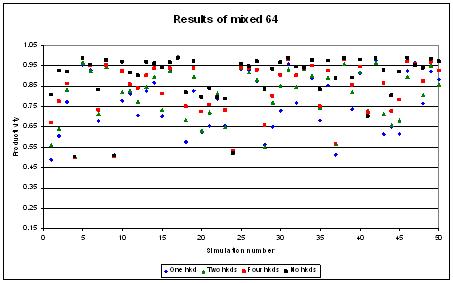

Results of the Mixed scenario

- 4.55

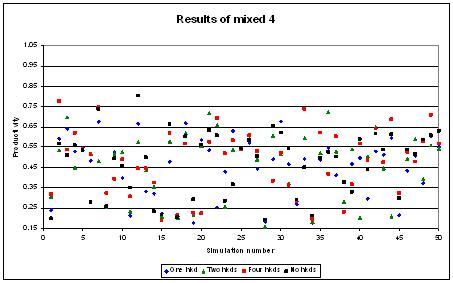

- The Mixed scenario has been built to test the results obtained into the typical one, here the parameters set up is always changing, values are randomly tossed in ranges that are distributed around the typical parameters value.

- 4.56

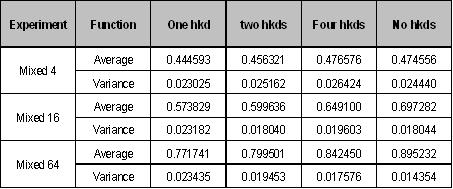

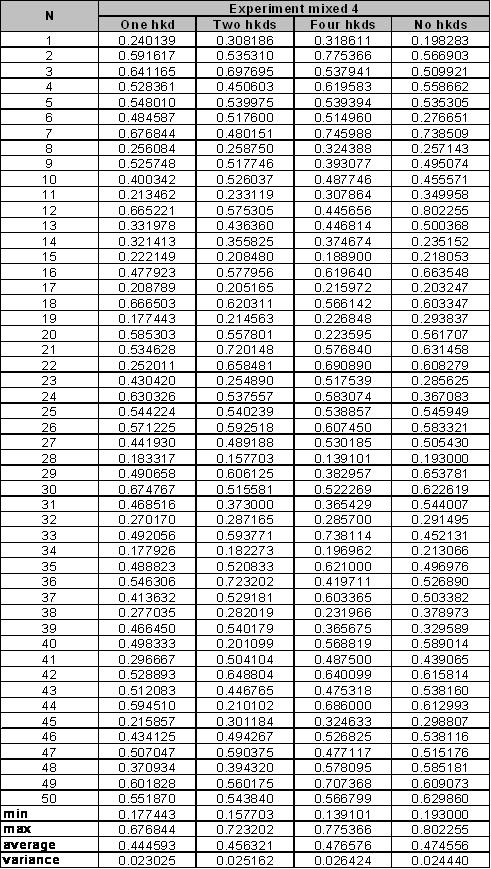

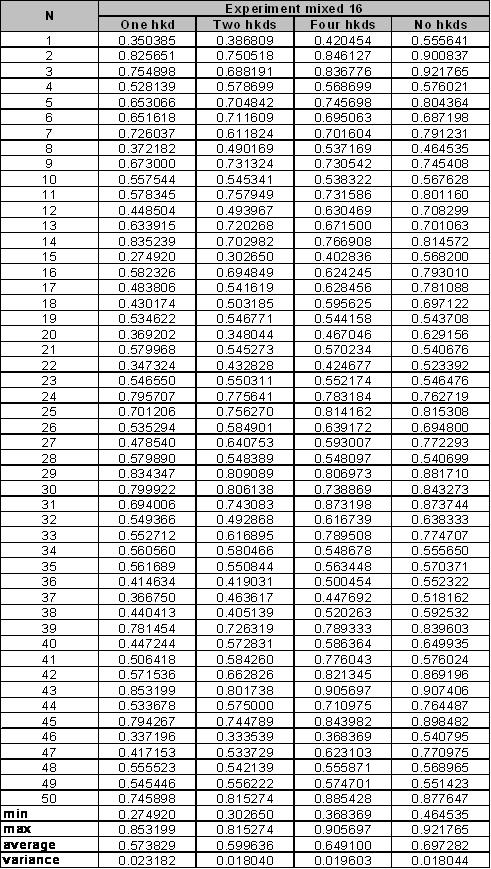

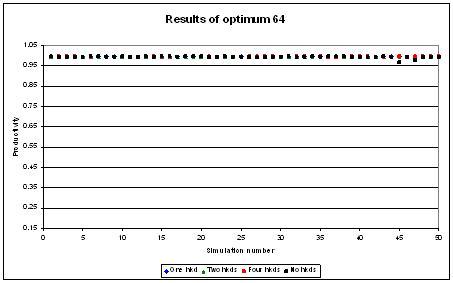

- The results, reported in table 4, confirm those obtained by running the typical scenario, so the previous reasoning about the importance of a disseminated distribution for KPs seems to be reinforced, as well as the observation about the similarity between the distribution Four hkds and No hkds in presence of four KPs only.

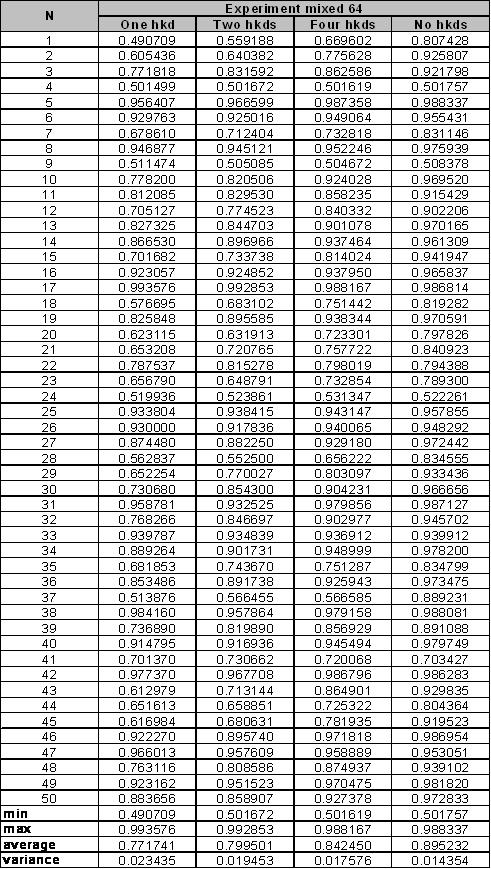

Table 4. synthesis of the results obtained by running the Mixed scenario. - 4.57

- The difference among the four distribution is less strong, due to the fact the combination of parameters allowed configurations closer to the Optimum scenario than the Typical ones, the phenomenon is clearly shown into the graph in figure 11.

Figure 11. Results of several simulations of the experiment mixed 64 - 4.58

- Taking advantage of the array of experimental configurations that agent based simulations offer, we have generated a wide set of alternative scenarios.

- 4.59

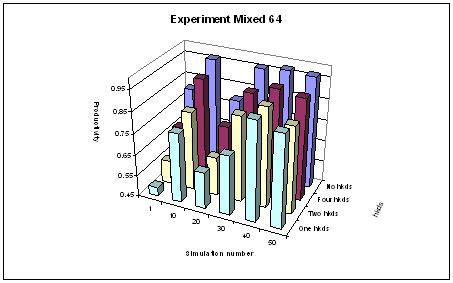

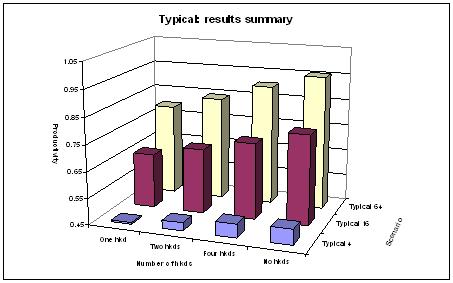

- For a comparative summarization it is possible to refer to the graphs in figures from 12 to 14 where the data shown before are mixed in a bar diagram.

Figure 12. Comparison among results of the optimum scenario - 4.60

- Whereas in the Optimum scenario results are very similar for the three different distributions, the advantage of the "No hkds" distribution is clear in the scenario Typical and Mixed.

Figure 13. Comparison among results of the typical scenario - 4.61

- The bar diagrams show also the performance of the disseminated distributions are better the higher is the number of KPs, reinforcing the argument about the similarity of distributions in presence of few KPs.

Figure 14. Comparison among results of the mixed scenario

Policy implications

Policy implications

- 5.1

- The implications for research and innovation policy are important: better access conditions to technological knowledge and better dissemination of existing technological knowledge enable firms to find better their way toward technological enhancement so as to become more competitive and profitable. Let us consider them in turn.

- 5.2

- Intellectual property rights regimes should be designed so as to increase the possibility for imitators and users of external knowledge to take advantage of existing proprietary knowledge. The implementation of non-exclusive intellectual property rights might favour the dissemination of technological knowledge. The enforcement of compulsory royalty payments for all use of proprietary knowledge should prevent the reduction of appropriability conditions and hence the decline of incentives to funding research activities.

- 5.3

- The demise of 'intramuros' research activities concentrated within the research laboratories of large corporations and the implementation of open innovation systems that favour the outsourcing of the recombinant generation of technological knowledge to specialized knowledge-intensive business companies, and academic departments might help the dissemination of technological knowledge.

- 5.4

- The access to technological knowledge should be increased favouring the distribution of universities and public research centres across the system so as to improve the proximity of firms to the available pools of public knowledge and reduce the distance of peripheral regions from the knowledge spillovers. In a similar vein the inflow of foreign direct investment and the location of advanced multinational companies should be favored as a tool for local firms to access the spillovers of higher levels of technological competence.

- 5.5

- The dissemination of existing technological knowledge should become the object of dedicated policy tools. The strengthening of the relations between the business community and the public research system and specifically between firms and universities might help the effective dissemination of knowledge and knowledge generating competence. Public policy should support all interactions between academics and firms favouring the actual creation of additional pecuniary knowledge externalities with the provision of subsidies and fiscal allowances to all contracts between firms and the academic system. The dissemination and implementation of a fabric of good quality public research centers and universities through out the system is likely to generate better results that the concentration of centers of worldwide excellence in a few spots. For the same reasons the mobility of skilled and creative scientists and experts among firms and between firms and research institutions at large can become the target of dedicated research policy interventions aimed at spreading competence and technological expertise.

Conclusion

Conclusion

- 6.1

- This paper has implemented an evolutionary approach that integrates strong Marshallian and Schumpeterian traits with the recent advances in the economics of complexity, innovation can be considered as an emerging property of an economic system that takes place when its structural characteristics provide access to external knowledge as an indispensable input into the generation of new technological knowledge. Building upon the Marshallian legacy, external knowledge is considered an indispensable input, together with internal research activities, into the recombinant generation of new knowledge. The reappraisal of the Schumpeterian notion of innovation as a conditional result of a form of reaction to un-expected events, led to articulate the hypothesis that the reaction of myopic but creative agents, that try and cope with the changing conditions of their product and factor markets, may lead to the effective recombinant generation of new technological knowledge and hence the actual introduction of productivity enhancing innovations when they are embedded in an organized complexity where they can actually take advantage of the external knowledge available within the innovation system into which they are embedded.

- 6.2

- In this context ABM enabled to explore the effects of alternative institutional. organizational and architectural configurations of the knowledge structure of the system in assessing the chances to pursue effectively the recombinant generation of new technological knowledge and to introduce technological innovations. The introduction of innovations is analyzed as the result of systemic interactions among learning agents. The reaction of agents may become creative, as opposed to adaptive, so as to lead to the introduction of productivity enhancing innovations when external knowledge can be accessed at low costs and used in the recombinant generation of new technological knowledge. Building upon agent-based simulation techniques the paper has explored the effects that alternative configurations of the intellectual property right regimes and architectural configurations of the system play in assessing these costs and hence the chances to perform effectively the recombinant generation of new technological knowledge.

- 6.3

- The results of the ABM confirm that a system characterized by high levels of knowledge dissemination is actually more effective in promoting the rates of introduction of technological innovations. The results however show that systems characterized by high levels of concentration could offer advantages in terms of faster discovery, due to the close relations that could be established among the knowledge producers. The implementation of an ABM has enabled the rigorous framing of a complex system dynamics where innovation is the emerging property that takes place when a number of complementary conditions qualify the reaction of firms and make them creative. The simulation model can be applied to control the implications of an array of alternative settings and hypotheses concerning appropriability conditions, intellectual property rights regimes, knowledge generation routines and, most important, policy interventions that can alter the structure of knowledge flows so as to increase the levels of organization of the complexity of a system.

- 6.4

- Taking inspiration from Schumpeter and Marshall, and the recent developments in the analysis of the economic complexity of technological change, the ABM has shown the systemic conditions that make innovation possible. Innovation is an emergent property of the organized complexity of a system because innovation is as the outcome of a situated and localized reaction when it can take advantage of a collective and situated process, embedded in institutional as well structural settings, and involving the combination of in-house and external knowledge and capabilities. Additionally the uncertain outcome of these endeavours is portrayed as stochastic functions (lotteries) emphasizing that there is no automaticity as regards success in both activities. In this context an important aspect of the present elaboration is that the spatial distribution of innovation activities is explained endogenously from the interaction of competing firms.

- 6.5

- Summarizing the results of the present simulation it seems to be possible to pretend that the more the knowledge producers, like universities and advanced science-base corporations, are spread upon the territory and the faster and more effective becomes the innovation process. Myopic but creative firms coping with the changing conditions of their product and factor markets are better able to improve their reaction and make it creative, as opposed to adaptive, when technological knowledge is disseminated in the regional, institutional and technological spaces.

APPENDIX

APPENDIX

-

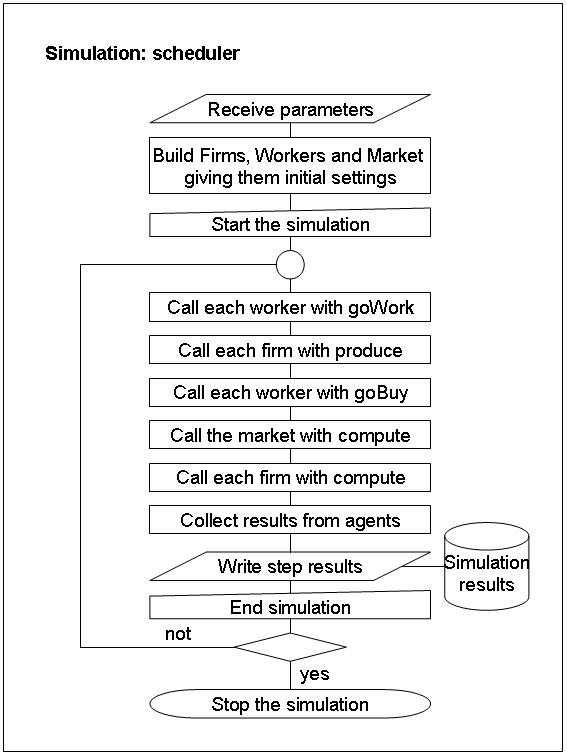

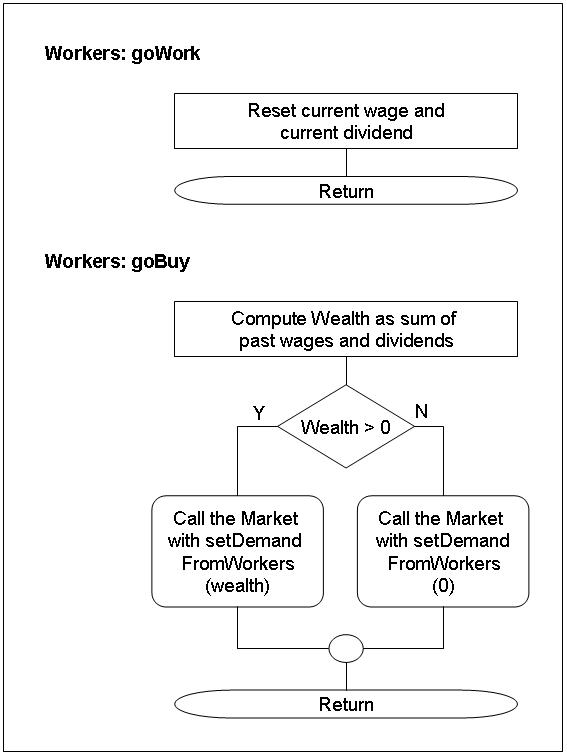

A - The pseudo code of the model

Repeat-until the end of the simulation Each worker Computes its own wealth as sum of wages and dividends Each agent Computes the average profit of the neighbourhood Sends order to the market to buy factor Computes its final production as employed factor * productivity Sends to the market the supplied quantity of product Upgrades its own potential Each worker Sends to the market its own demand equal to its whole wealth The market Computes sell prices for product as demand / supply Computes buy prices for factor as a linear function of the demand for factor Each agent Computes its income as production * sell price Computes the amount of wages as employed factor * buy price + research costs Computes its profit or loss by subtracting wages from the income Computes dividends to pay as profit / workers Pays wages to the workers Pays dividend to the workers If profit greater than zero Increases demand for factor by 1% Else Decreases demand for factor by 1% End-if If profit is far from the neighbourhood profit If enough potential has been cumulated Increases productivity Decreases potential Increases research costs Else Looks for neighbouring technologies to absorb If found Upgrades productivity Increases research costs Else Moves randomly to another location Increases research costs End-if End-if Else If a randomly tossed number is lower than the patent duration If enough potential has been cumulated Increases productivity Decreases potential Increases research costs Else Looks for neighbouring technologies to absorb If found Upgrades productivity Increases research costs End-if End-if End-if End-if The model Computes statistics Writes statistics on the output files End-repeat-until

B - Flow diagrams describing the model processes

Figure 15. Process performed by the simulation scheduler

Figure 16. Processes performed by the workers

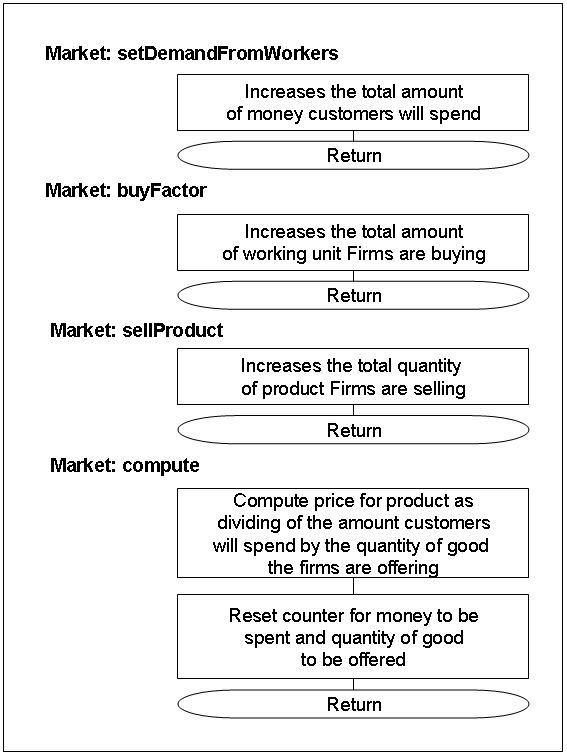

Figure 17. Processes performed by the market

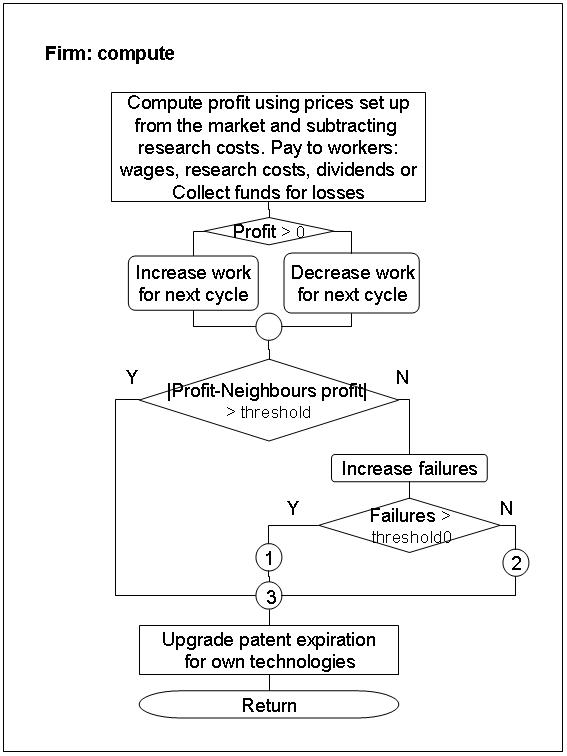

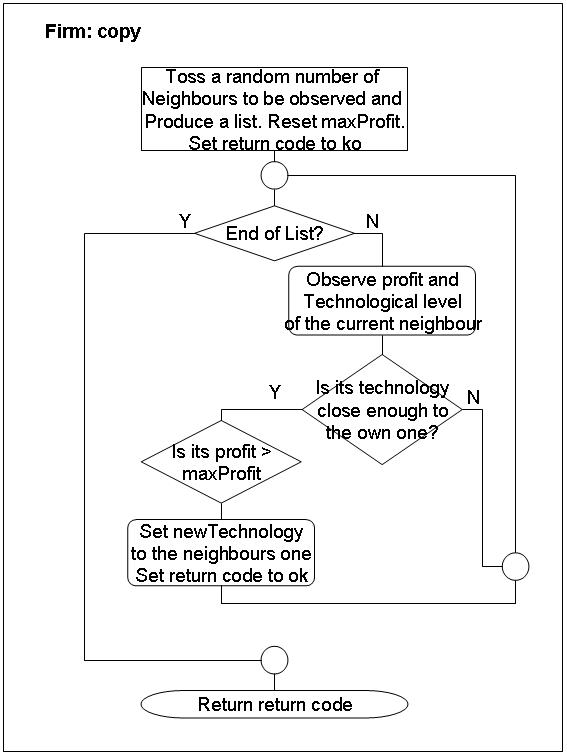

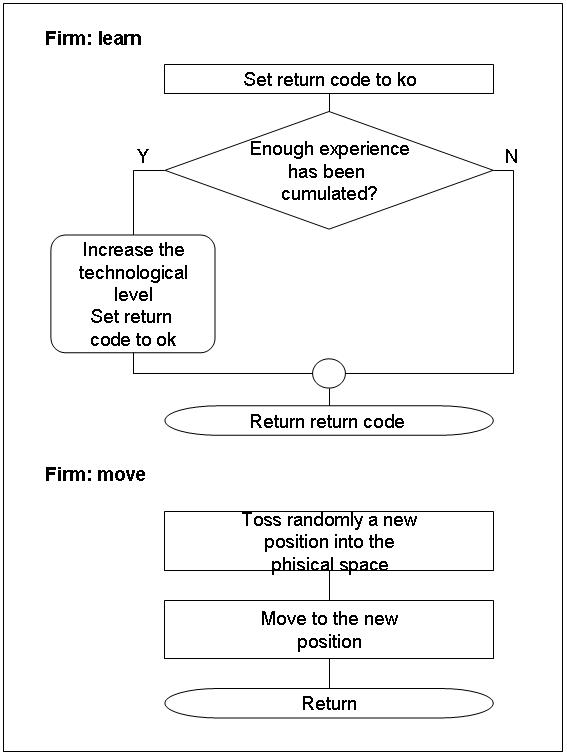

Figure 18. Processes performed by the firms - part 1

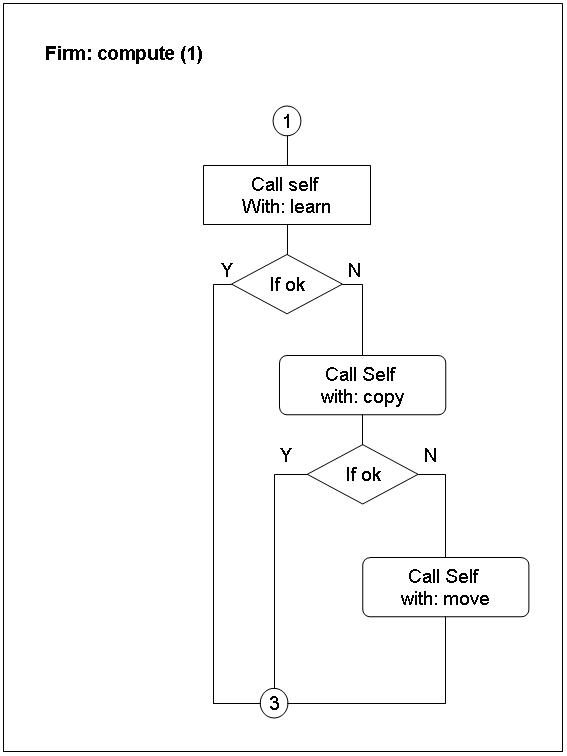

Figure 19. Processes performed by the firms - part 2

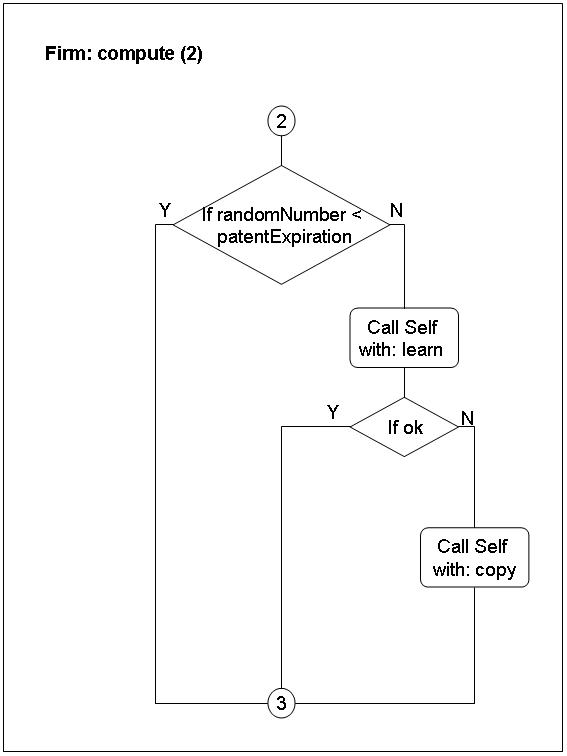

Figure 20. Processes performed by the firms - part 3

Figure 21. Processes performed by the firms - part 4

Figure 22. Processes performed by the firms - part 5 C - The analytical representation of the model

- 8.1

- This appendix presents the analytical organization of the simulation model and the founding equations.

- 8.2

- The production activity is specified following a simple linear function:

- Oi = πi Li.

Where the output (O), of a generic i-th enterprise, depends upon the employed labour (L) and its productivity (π). The latter can vary between 0 and 1. Customers (i.e. workers, share holders and researchers) spend the whole amount they earn in buying goods, so the selling price for goods is simply computed as: - p = Y/Σ Oi.

Where Y represents the whole amount earned by the customers and n is the number of enterprises operating into the simulated economy, hence Y accounts for the sum of W the amount of wages, R the expenses for research and D the dividends: - Y = W + R + D.

The unit wage (w) for a single work unit is the same for each enterprise; it is centrally computed as a linear function: - w = 50 + 0.005ΣLi.

Each enterprise pays its workers a total amount of wages (W) of: - Wi = wLi.

The whole amount of wages is simply computable as: - W = ΣWi.

The research costs is directly related to the distance between the old and the new position of the enterprise in each space: - Ri = dTi + dFi.

Where dT and dF are the technological and regional distance covered by the firm in its innovation process. The whole amount research suppliers receive is: - R = ΣRi.

Naming P the profit of a generic enterprise gives the following equation: - Di = Pi = pOi - Wi - Ri.

Where D could be less than zero if a loss had to be reintegrated. The amount of dividends paid to the whole systems is: - D = ΣDi.