Bernd-O. Heine, Matthias Meyer and Oliver Strangfeld (2005)

Stylised Facts and the Contribution of Simulation to the Economic Analysis of Budgeting

Journal of Artificial Societies and Social Simulation

vol. 8, no. 4

<https://www.jasss.org/8/4/4.html>

For information about citing this article, click here

Received: 02-Oct-2005 Accepted: 02-Oct-2005 Published: 31-Oct-2005

Abstract

AbstractAs regards the process of economic change and development in capitalist societies, I suggest the following 'stylized facts' as starting point for the construction of theoretical models: (1) The continued growth in the aggregate volume of production and in the productivity of labour at a steady trend rate; no recorded tendency for a falling rate of growth of productivity. (2) A continued increase in the amount of capital per worker, whatever statistical measure of 'capital' is chosen in this connection. (…) (Kaldor 1961/1968:178).

|

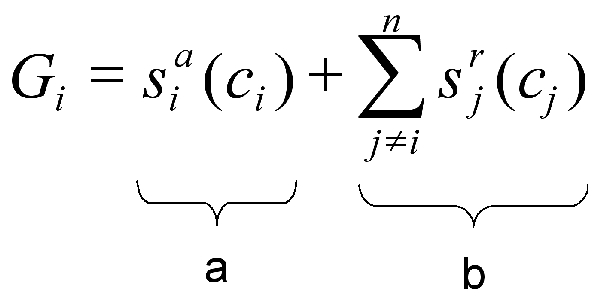

| Figure 1. A divisional manager's compensation according to the Groves scheme |

| Table 1.1: Empirical findings about the stability of collusion by cluster | |||

| Cluster | Findings about Collusion | Implications | Stylised Fact |

| Individuals/ Firms | The setting that stabilises collusion most strongly is a relatively small number of competing firms. (F13, statistical analysis) | Small group size stabilises collusion. | SF "Group Size" |

| "Previous [experimental, the authors] studies indicate that collusion sometimes occurs in duopolies, but is very rare in markets with more than two firms." The same tendency is observed in the current experiments. (F20, experiment) | Small group size stabilises collusion. | ||

| There is high concentration in the market: the four colluding firms have a market share of 99%. (F22, case study) | High concentration implies that a small number of firms dominate the market, stabilising collusion. | ||

| Even if there are about 50 buyers in total, if there are few large buyers, there is collusion among the large buyers. (F1, case study) | High concentration implies that a small number of firms dominate the market, stabilising collusion. | ||

| Collusion is more likely when the affected firms have a large market share. (F8, statistical analysis) | High concentration implies that a small number of firms dominate the market, stabilising collusion. | ||

| Even with many participants (nine), collusion can occur if the product characteristics limit cross-regional shipping. (F21, case study) | Limited transportation implies the formation of sub-markets with a small number of participants ("niches") and therefore stabilises collusion. | ||

| Tendering procedures for individual projects support collusion even in markets with many participants because only a few firms are participating in the tendering. (F3, case study) | A single tendering procedure can be considered as a sub-market, in which a small group size stabilises collusion. | ||

| Table 1.2: Empirical findings about the stability of collusion by cluster | |||

| Cluster | Findings about Collusion | Implications | Stylised Fact |

| Situation | "Collusion often breaks down in the last round." (F17, experiment) | The imminent and certain termination of the interaction destabilises collusion. | SF "Time Horizon" |

| As the discount rate increases, the percentage of colluding subjects declines. (F6, experiment) | An increase in the discount rate shortens the relevant time horizon, thereby destabilising collusion. | ||

| Market environments relatively free of complications such as product diversity or demand variability stabilise collusion. (F14, statistical analysis) | Uncomplicated market settings stabilise collusion. | SF "Setting" | |

| More information about the market (demand and cost functions) favours collusion, as players tend to use strategies that are the best responses to the behaviour of the other firms in the previous round. (F15, experiment) | The more information is available, the more effectively actors can avoid or handle complications in the market setting. Therefore, information about the market stabilises collusion. | ||

| The empirical results show that collusion is more likely when the firms in question are regionally concentrated. (F11, statistical analysis) | Short distances between the participating firms reduce complexity in terms of regional diversity and allow for easy monitoring, thus stabilising collusion. | ||

| The empirical results show that collusion is more likely when there are large cooperatives in the market. (F12, statistical analysis) | The presence of large umbrella organisations reduces market complexity for the relevant players. | ||

| More information about quantity supplied and profits of other firms in the market leads to increased competition as firms tend to increase quantity to imitate the rival firm with the highest profit (in comparison to aggregate information only). (F16, experiment) | In the experimental setting reported, specific information inhibits the formation of collusion, because the firms try to imitate the most successful player. | ||

| Table 1.3: Empirical findings about the stability of collusion by cluster | |||

| Cluster | Findings about Collusion | Implications | Stylised Fact |

| Situation | Potential risk reduction in terms of pricing and fluctuations in the workload favours collusion. (F5, case study) | Benefits of collusion include risk reduction with respect to pricing and capacity utilisation. | SF "Benefits" |

| Collusion is more likely when market demand is price inelastic. (F7, statistical analysis) | Price inelasticity implies that higher prices do not affect demand proportionally, leading to higher benefits from collusion that sets higher prices. | ||

| At the time the collusion commenced, prices rose significantly although raw material prices remained unchanged. (F23, case study) | A high impact on prices indicates that collusion yielded substantial benefits. | ||

| When collusion broke down, market prices declined substantially. (F25, statistical analysis) | A high impact on prices indicates that collusion yielded substantial benefits. | ||

| Collusion is more likely when the importance of the particular market for the sellers (in which collusive arrangements are proposed) is neither excessively low (the market is not really important to the seller) nor excessively high (there are no other potential markets). (F10, statistical analysis) | Very low importance implies minimal benefits to be gained. Excessively high importance implies high risk, potentially offsetting the benefits of collusion. | ||

| Table 1.4: Empirical findings about the stability of collusion by cluster | |||

| Cluster | Findings about Collusion | Implications | Stylised Fact |

| Course of Events | In experiments with fixed pairs, partial collusion can be observed, but this does not apply to randomly matched pairs. (F18, experiment) | Constant group composition stabilises collusion. | SF "Group Composition" |

| New and different participants lower the risk of collusion in auctions. (F2, statistical analysis) | Inhomogeneous and changing group composition destabilise collusion. | ||

| Participants in collusive agreements try to avoid destabilisation because of market entry by collective acting. (F4, case study) | New entrants destabilise collusion. | ||

| Collusion is more likely when crops have long cultivation times. (F9, statistical analysis) | Long cultivation times represent a barrier to entry, thereby stabilising group composition. | ||

| After a price war, collusion was successfully re-established and maintained for a relatively long period. (F26, statistical analysis) | The reported price war can be interpreted as means of demonstrating the ability to harm defectors. The increased credibility of the threat to punish defectors stabilises collusion. | SF "Enforcement" | |

| When the cartel suspected that cheating had occurred, the cartel cut prices for a time so as to enforce behaviour consistent with the collusive agreement, and then returned to collusive price. (F24, statistical analysis) | The price cut demonstrates the ability to harm defectors, establishing a credible threat which stabilises collusion. | ||

| Miscellaneous Aspects | Sequential (in comparison to simultaneous) price setting destabilises collusion in duopolies. (F19, experiment) | The reported experimental results are based on the models of Stackelberg and Cournot, implying a very specific setting that restricts the validity of the findings. Therefore, the findings do not constitute stylised facts. | See text |

| Table 2: Overview of the stylised facts derived | |

| Name of Stylised Fact | Description |

| SF "Group Size" | Small effective group size stabilises collusion. |

| SF "Time Horizon" | Long time horizons stabilise collusion. |

| SF "Setting" | Uncomplicated settings (low dynamics, low complexity, high transparency etc.) stabilise collusion. |

| SF "Benefits" | High attainable benefits stabilise collusion. |

| SF "Group Composition" | Stable group composition stabilises collusion. |

| SF "Enforcement" | Effective enforcement strategies stabilise collusion. |

|

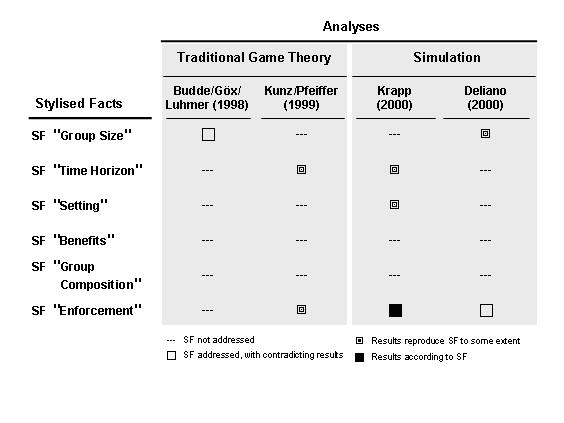

| Figure 2. Overview of comparative analysis |

| Table 3.1: Extraction of findings about the stability of collusion in selected empirical studies | |||

| Study | Empirical Method and Context | Findings about Collusion | No. |

| Banerji/Meenakshi (2004): Buyer Collusion and Efficiency of Government Intervention in Wheat Markets in Northern India: an Asymmetric Structural Auctions Analysis | Case study of auction process of two wholesale wheat markets in northern India (supplemented with information from market committee records and personal interviews) | Even if there are about 50 buyers in total, if there are few large buyers, there is collusion among the large buyers (cf. p. 248). | F1 |

| Beckmann (2004): Art Auctions and Bidding Rings: Empirical Evidence from German Auction Data | Statistical analysis of a survey among German auctioneers and auction houses | New and different participants lower the risk of collusion in auctions (cf. p.135). | F2 |

| Doree (2004): Collusion in the Dutch Construction Industry: an Industrial Organization Perspective | Case study of collusion in the Dutch construction industry based on interviews and a study of documents | Tendering procedures for individual projects support collusion even in markets with many participants because only a few firms are participating in the tendering (cf. p. 151). | F3 |

| Participants in collusive agreements try to avoid destabilisation because of market entry by collective acting (cf. p. 151). | F4 | ||

| Potential risk reduction in terms of pricing and fluctuations in the workload favours collusion (cf. p. 152). | F5 | ||

| Feinberg/Husted (1993): An Experimental Test of Discount-Rate Effects on Collusive Behavior in Duopoly Markets | Experimental study of the influence on time preference on collusive duopoly equilibria | As the discount rate increases, the percentage of colluding subjects declines (cf. p. 157). | F6 |

| Table 3.2: Extraction of findings about the stability of collusion in selected empirical studies | |||

| Study | Empirical Method and Context | Findings about Collusion | No. |

| Filson (2001): Market Power and Cartel Formation: Theory and an Empirical Test | Statistical analysis of the development of marketing orders (specific form of legal cartel) in the fresh market of the USA | The empirical results for legal cartels* show that collusion is more likely when ... | |

| ... market demand is price inelastic (cf. p. 478). | F7 | ||

| ... the affected firms have a large market share (cf. p. 478). | F8 | ||

| ... crops have long cultivation times (cf. p. 478). | F9 | ||

| ... the importance of the particular market for the sellers (in which collusive arrangements are proposed) is neither excessively low (the market is not really important to the seller) nor excessively high (there are no other potential markets). (cf. p. 478). | F10 | ||

| ... the firms in question are regionally concentrated (cf. p. 478). | F11 | ||

| ... there are large cooperatives in the market (cf. p. 478). | F12 | ||

| *Because the setting under investigation is a special case where collusion is legal (and therefore easily observable) and enforcement is limited in that a two third majority of all market participants is needed, Filson claims that his findings apply to the collusion phenomenon in general (cf. p. 466-467,477). | |||

| Fraas/Greer (1977): Market Structure and Price Collusion: an Empirical Analysis | Statistical analysis of illegal explicit price collusion | The setting that stabilises collusion most strongly is a relatively small number of competing firms (cf. p. 42). | F13 |

| Market environments relatively free of complications such as product diversity or demand variability stabilise collusion (cf. p. 42). | F14 | ||

| Huck/Normann/Oechssler (1999): Learning in Cournot Oligopoly: an Experiment | Experiment designed to test various learning theories in the context of a Cournot oligopoly | More information about the market (demand and cost functions) favours collusion, as players tend to use strategies that are the best responses to the behaviour of the other firms in the previous round (cf. p. 89,92). | F15 |

| More information about quantity supplied and profits of other firms in the market leads to increased competition as firms tend to increase quantity to imitate the rival firm with the highest profit (in comparison to aggregate information only) (cf. p. 89,92). | F16 | ||

| Table 3.3: Extraction of findings about the stability of collusion in selected empirical studies | |||

| Study | Empirical Method and Context | Findings about Collusion | No. |

| Huck/Wieland/Normann (2001): Stackelberg Beats Cournot: on Collusion and Efficiency in Experimental Markets | Experimental study conducted with university students | "Collusion often breaks down in the last round." (p. 756) | F17 |

| In experiments with fixed pairs, partial collusion can be observed, but this does not apply to randomly matched pairs (cf. p. 750). | F18 | ||

| Sequential (in comparison to simultaneous) price setting destabilises collusion in duopolies (cf. p. 750). | F19 | ||

| Huck/Normann/Oechssler (2004): Two are Few and Four are Many: Number Effects in Experimental Oligopolies | Meta analysis of 19 n-firm Cournot experiments completed by a series of actual experiments studying oligopolies with two, three, four, and five firms | "Previous [experimental, the authors] studies indicate that collusion sometimes occurs in duopolies, but is very rare in markets with more than two firms."(p. 440) The same tendency is observed in the current experiments (cf. p. 443). | F20 |

| Kamerschen/Morgan (2004): Collusion Analysis of the Alabama Liquid Asphalt Markets | Case study from 1961-1978 | Even with many participants (nine), collusion can occur if the product characteristics limit cross-regional shipping (cf. p. 681). | F21 |

| There is high concentration in the market: the four colluding firms have a market share of 99% (cf. p. 681). | F22 | ||

| At the time the collusion commenced, prices rose significantly although raw material prices remained unchanged (p. 691). | F23 | ||

| Porter (1983): A Study of Cartel Stability: the Joint Executive Committee (JEC), 1880-1886 | Statistical analysis of volume and price information about the JEC, a transportation cartel | When the cartel suspected that cheating had occurred, the cartel cut prices for a time so as to enforce behaviour consistent with the collusive agreement, and then returned to collusive price (cf. p. 302). | F24 |

| When collusion broke down, market prices declined substantially (cf. p. 312). | F25 | ||

| Slade (1987): Interfirm Rivalry in Repeated Games: an Empirical Test of Tacit Collusion | Statistical analysis of the Vancouver retail gasoline market | After a price war, collusion was successfully re-established and maintained for a relatively long period (cf. p. 248). | F26 |

2 For an overview, see Lambert (2001).

3 Holland and Miller (1991:367) state this problem quite straightforwardly: "Usually, there is only one way to be fully rational, but there are many ways to be less rational."

4 Positive research, in contrast to normative research, aims at neutrally explaining empirical observations (cf. Blaug 1998).

5 The term "generative mechanism" is used following Lawson (1989). For the purposes of this paper we only use it to distinguish two levels: A first level of results and second level that leads to these results (generative mechanism).

6 The aim is not only validation, but also a deeper and wider understanding of a phenomenon (cf. Olsen 2004). For an in-depth discussion of this form of research see Creswell (2003). Modell (2005) gives an exemplary overview of accounting research triangulating between surveys and case studies.

7 The importance of criticism in science is the central to Popper's understanding of science as exposed already in Popper (1934/1959). Other authors such as Peirce or Habermas have emphasised in particular the social and especially discursive processes enabling critical discussion leading to a convergence in beliefs of scientists (cf. Hands 2001:218-221).

8 Using the standard epistemological distinction between the "context of discovery" and "context of justification", the ex ante use of the stylised-facts-concept can be located in the former. According to traditional philosophy of science, the emphasis of criticism has to be given to the latter (cf. Popper 1934/1959:27-34). Recently, this view has been criticised, because, if the complete set of scientific hypotheses to be tested has a certain bias, this bias cannot be eliminated by strict tests. Consequently, one should also take into account the context of discovery (cf. Okruhlik 1994/1998:200-205). Against this background, the concept of stylised facts provides a more systematic approach of hypothesis generation in the often neglected context of discovery (cf. Lawson 1989:67).

9 The German philosopher of science Albert coined the term "Modell-Platonismus" (Model Platonism) for this type of modelling, in which model construction becomes an end in itself (cf. Albert 1963/1967).

10 From the perspective of model evaluation however, the creating researcher's set of stylised facts should not be used again: an additional reference to the successful explanation of the stylised facts does not add any value, because they can no longer serve as a neutral point of reference. It has to be assumed that the researcher already tailored his model to the stylised facts, so he intentionally created a fit to them. This will be desirable if the stylised facts are generally accepted, but this would render an explicit model evaluation concerning its "fit" unnecessary. In the other case, were the researcher stated his own view of the stylised facts, as Kaldor did, an explicit model evaluation would be biased.

11 This also circumvents the caveats of "ad hocery" and "immunisation", since model results are given and evaluated relative to each other.

12 Explanation is not reduced to the deduction of correct predictions from the model, but also means isolating the "mechanism" that leads to the results. Models explain by producing insights, they exhibit how the results are produced. With reference to simulation models see in particular Chang and Harrington (in press), for a general discussion of this point see also Meyer (2004:9-59).

13 Nevertheless, the caveat from above applies: the combined use of stylised facts for model construction and evaluation reduces the value of this claim substantially. However, this does not change the structure of the argument (and suggests a division of labour), so that it can still provide an insightful illustration.

14 More precisely, this means that after successful explanation of stylised facts, the necessity for testing shifts to the next level: the mechanisms a model uses to reproduce stylised facts now have to be tested as well, otherwise the model adds little more value than a thought experiment, "demonstrating only that a hypothesized process could be the source of some stylized fact" (Cohen 1999:375).

15 This should be considered a methodological case study on how the concept of stylised facts can be used to answer the two questions addressed in the introduction. The selection of studies is representative in the sense, that two different modelling techniques have been used, which allows for a comparison, and it covers a whole debate. However, it is also possible to apply this approach to a discussion in which only one modelling technique has been used so far. Moreover, the discussion on the susceptibility of the Groves mechanism is quite new. Therefore, the number of contributions in this field is limited, thus manageable. Finally, there has been sufficient empirical research on the collusion phenomenon, which is important for the derivation of stylised facts.

16 Compensation, by assumption, is tied to a division's absolute performance, because compensation for the relative profit per unit of capital invested would lead to massive underinvestment, since each manager then has the incentive to disregard less profitable projects to avoid dilution of the most profitable project.

17 Other incentive mechanisms are for example the Weitzman scheme, the Osband-Reichelstein scheme, profit pooling or a bonus pool. For an overview, see Burgess and Metcalfe (1999).

18 If M2 reports truthfully while M1 still overstates the returns, M2 will receive a higher compensation in the case where exaggeration of M1 for sr1.1 and sr1.2 is high enough to allocate all capital to M1. Otherwise, he will receive the same compensation, but never less.

19 See Baker (1999) for an overview.

20 For example, the effect of changing participants can be observed far more easily in auctions (cf. Beckmann 2004) than in cartels. In general, the integration of different perspectives and research backgrounds also provides a means of coping with the problem of theory-ladeness: one must be aware that empirical studies do not state neutral "facts" but are already "theory laden", which can never be avoided. This point has already been made clearly by Popper: "[O]bservations, and even more so observation statements and statements of experimental results, are always interpretations of the facts observed; they are interpretations in the light of theories." (Popper 1934/1959:107). "[W]e might say that these facts do not exist as facts before they are singled out from the continuum of events and pinned down by statements - the theories which describe them." (Popper 1946/1996:214). For a good discussion of the problem of "theory-ladeness", see also Hands (2001:91-93,102-109).

21 Two objections can be made to such an inference. First, it is a specific type of inductive inference so that universality cannot be guaranteed. Secondly, this inference is based on the considerations and judgement of the authors of this paper. Ideally, the derivation of stylised facts would be accompanied by a discussion of a much larger group of experts. However, we tried to make the procedure as transparent as possible, which facilitates and hopefully encourages further discussion. Accordingly, this list should not be considered to be definitive, but as a first contribution to an ongoing discussion among experts in the field of collusion based on empirical research.

22 Namely, Filson (2001), Doree (2004), Banerji and Meenakshi (2004), Kamerschen and Morgan (2004), Huck, Wieland and Normann (2001), Feinberg and Husted (1993), Fraas and Greer (1977), Slade (1987), Porter (1983), Beckmann (2004), Huck, Normann and Oechssler (2004) and Huck and Normann (1999). Our selection focussed mainly on recent refereed journal articles and was complemented by studies from journals with an accounted expertise for the area of industrial organization, where collusion is traditionally discussed. However, this is a very wide area of research and we do not claim to be exhaustive since this section has only an illustrative purpose. Moreover, the study of Waller and Bishop (1990) had to be excluded, because their experimental design does not allow for the investigation of the stability of collusion (cf. Waller and Bishop 1990:835).

23 To give an overview of the origin of the results we name the methods used in the underlying analysis. Nevertheless, we face a given range of empirical studies and can therefore only state when a stylised fact is particularly well founded or particularly doubtful. The identified gaps can only be filled by further empirical studies from collusion researchers. As our analysis is based on 12 articles the chances for a complete triangulation of the stylised facts are limited.

24 This implies that SF "Time Horizon" is not as well founded as SF "Group Size". Nevertheless, we state it, since it is a broad tendency we identified in the available empirical data. Future studies should strengthen the existing empirical evidence.

25 F16 suggests that the stylised fact derived should be refined to account for exceptions like the reported one, e.g. by distinguishing different types of settings. Hence, a case study might be important in two ways, adding another empirical method and allowing a more detailed analysis of different factors that raise or reduce complications in the setting.

26 We use "Benefits" as an overall perspective representing gains from collusion net of associated losses, risks etc. F10 reports the case where farmers that have no other markets to sell to, face a substantial risk, because any production exceeding the selling quota stipulated by the collusive agreement would turn into waste, potentially causing substantial losses (at least in terms of opportunity costs). In contrast, farmers that have at least one alternative market (beyond the reach of the collusive agreement) to sell their crops, do not face this risk, because they can offer any overproduction there (cf. Filson 2001:469-470).

27 Because striving for benefits can be regarded as the driving force leading to collusion, SF "Benefits" is unique in the way that it is assumed to apply in most empirical studies: actors have an incentive to collude in order to gain the associated, substantial benefits. Therefore collusion is expected or observed. Statistical analyses and case studies cannot vary the potential benefits in a given setting and would therefore have to engage in a complicated comparison across settings. Furthermore, the benefits to be gained from collusion are difficult to determine, often involving very noisy indicators. Experiments seem better suited to the purpose, but to our knowledge, there are no experiments addressing the influence of varying benefits on the stability of collusion. These aspects might explain the indirect empirical evidence we refer to when deriving SF "Benefits".

28 More empirical evidence of enforcement issues would be desirable. In particular, case studies and experiments would complement the existing statistical analyses.

29 The problem of theory-ladeness is of particular importance in this case (see note 20).

30 From the perspective of collusion research, these stylised facts represent an attempt to outline the broad tendencies relating to the stability of collusion that emerge in the available empirical studies. Although our set of empirical studies is not exhaustive due to the illustrative purpose of this section, we are confident that the stylised facts identified represent a solid basis for a discussion of the characteristic features of the collusion phenomenon and its representation in theoretical models.

31 Interestingly, they state this result without reference to any empirical evidence.

32 Compared to a finite game with a fixed number of rounds, the uncertainty about the end does not allow for backward induction. The backward induction argument is as follows: If it is rational to defect in the last round, rational players anticipate this in the second last round. This will be anticipated in the round before and so one. Therefore, by using backward induction in a finite game, it can be shown that collusive agreements are not stable.

33 Axelrod (1984:20) describes "tit for tat" as "the strategy which cooperates in the first move and then does whatever the other player did for the previous move."

34 This concept has been developed to address credibility in games with the intention to overcome the restrictions posed by the subgame perfection solution concept. The original paper is Kreps and Wilson (1982). For a good introduction, see Gardner (1995:239-254).

35 Furthermore, his analysis refers to the more general class of relative incentive schemes. In such a scheme, the compensation of a manager does not depend solely on his absolute achievements, but is also influenced by the achievements of others. Krapp shows that the collusion problem for relative incentive schemes has the same structure as for the Groves mechanism and therefore the results of his model can be applied to the Groves mechanism (Krapp 2000:262-266). In Krapp's model the collusion parameter is effort, but this does not change the structure of the arguments.

36 For a complete list and discussion of the strategies used in the tournament, see Krapp (2000:268).

37 In a round robin, each participant faces all the other participants individually playing a specified number of rounds, in Krapp's model 1000 (cf. Krapp 2000:269).

38 This aspect conforms well to a more general discussion of the performance of the "tit for tat" strategy and particularly Axelrod's own work on this subject (cf. Wu and Axelrod 1995), although Krapp does not make this reference.

39 The reasons for this can be found by considering in detail the process of the respective interactions: the strategy "reputation" suffers from large losses in the early interactions with an unfriendly player, which has a strong effect on performance subject to high discount rates (cf. Krapp 2000:263).

40 For description of these characteristics, see Deliano (2000:49-51). Based on these variables, Deliano (2000:54-61) develops a quite complex structural model describing how the respective behaviour is determined. For example, the managers' decision whether to report truthfully or not depends on his impatience (modelled as a probability). A higher impatience leads with a higher probability to a truthful report (cf. Deliano 2000:54-55).

41 Cf. Deliano (2000:114,119,124), e.g. comparing the results for two and four involved managers the percentage of managers with exaggerated reports decreases from 57,7% to 34,1% (cf. Deliano 2000:131).

42 Unfortunately, he does not even state which kind of observable pattern should be interpreted as collusive behaviour. He defines measures for "individual" and "collective" behaviour, but does not specify their meaning concerning collusion (cf. Deliano 2000:98-100).

43 For a further elaboration on this conjecture, see e.g. Kreps ( 1990/1991:95-107).

44 Although the SF "Benefits" remained unaddressed in the context of the problem under examination, several simulation models like Nachbar (1992), Fogel (1993), Kirchkamp (2000) and Mueller (1987) are analysing the impact of variations of the payoff tables for the PD on the effectiveness of specific strategies.

45 Carley (1992) gives a good example on how the effect of exchanging agents can be analysed using a simulation model.

46 Emphasis should be placed on "established". There is an extensive discussion on the empirical validity of game theory, but, for the purpose of this section, we focus on arbitrariness and a lack of robustness in models. As already noted, this cannot be a substitute for empirical testing.

47 For details on the folk theorem, see Fudenberg and Maskin (1986).

48 This is another indication that the result with respect to SF "Time Horizon" in the threat model can be considered a "by-product" of technical requirements.

49 This information would be of particular importance because of possible path-dependency effects, e.g. for the "trigger" strategy, high variations in results can be expected, as the outcome of the strategy is very sensitive to the point in time when (permanent) punishment is triggered (cf. Krapp 2000:268).

50 In addition, the chosen characteristics do not seem to be exhaustive as other characteristics like envy could also be supposed to influence the behaviour of managers.

51 To give an example, with respect to the number of past and previous periods taken into account by an agent, he informs the reader that the value four is chosen. He mentions only a pretest, according to which an increase to eight does not produce "significant changes" (cf. Deliano 2000:85-86).

52 This is not necessarily a problem inherent to the approach taken by Deliano. For better constructed models also addressing the issue of endogenous generation of strategies, see for example Macy (1996) or Axelrod (1997).

53 In this respect, our derivation of stylised facts is only an initial step in an ongoing, critical discussion among the experts in a field.

AXELROD, R (1984). The Evolution of Cooperation. New York: Basic Books.

AXELROD, R (1997). Evolving new Strategies: the Evolution of Strategies in the Iterated Prisoner's Dilemma. In Axelrod, R (Ed.): The Complexity of Cooperation : Agent-Based Models of Competition and Collaboration. New Jersey: Princeton University Press, pp. 10-32.

BAKER, J (1999). Developments in Antitrust Economics. The Journal of Economic Perspectives, Vol. 13, No. 1, pp. 181-194.

BANERJI, A and MEENAKSHI, J V (2004). Buyer Collusion and Efficiency of Government Intervention in Wheat Markets in Northern India: an Asymmetric Structural Auctions Analysis. American Journal of Agricultural Economics, Vol. 86, No. 1, pp. 236-253.

BECKMANN, M (2004). Art Auctions and Bidding Rings: Empirical Evidence from German Auction Data. Journal of Cultural Economics, Vol. 28, No. 2, pp. 125-141.

BLAUG, M (1998). The Positive-Normative Distinction. In Davis, J B, Hands, D W and Mäki, U (Ed.): The Handbook of Economic Methodology. Cheltenham: Elgar, pp. 370-374.

BOLAND, L A (1987/1994). Stylized Facts. In Eatwell, J, Milgate, M and Newman, P (Ed.): The New Palgrave Dictionary of Economics, Vol. 4. repr. with corrections. London: Macmillan Press, pp. 535-536.

BUDDE, J, GÖX, R and LUHMER, A (1998). Absprachen beim Groves-Mechanismus: eine spieltheoretische Analyse. Zeitschrift für Betriebswirtschaftliche Forschung, Vol. 50, No. 1, pp. 3-20.

BURGESS, S and METCALFE, P (1999). Incentives in Organisations: a Selective Overview of the Literature with Application to the Public Sector. (CMPO) Working Paper: 99/016. University of Bristol, Bristol.

CARLEY, K (1992). Organizational Learning and Personnel Turnover. Organizational Science, Vol. 3, No. 1, pp. 20-46.

CHANG, M-H and HARRINGTON, J E (in press). Agent-Based Computational Economics. In Judd, K L and Tesfatsion, L (Ed.): Agent-Based Models of Organisations: Handbook of Computational Economics II. Amsterdam: North-Holland.

CHE, Y-K and KIM, J (2004). Collusion-Proof Implementation of Optimal Mechanisms. Working Paper. University of Wisconsin Madison.

COHEN, M (1999). Commentary on the Organization Science Special Issue on Complexity. Organization Science, Vol. 10, No. 3, pp. 373-376.

CRESWELL, J W (2003). Research Design: Qualitative, Quantitative, and Mixed Methods Approaches. 2nd ed. Thousand Oaks: Sage Publications.

DELIANO, M (2000). Computersimulation als Instrument zur Analyse von Anreizsystemen: eine Untersuchung am Beispiel des Groves-Mechanismus. Munich: Privat Publishing House.

DOREE, A G (2004). Collusion in the Dutch Construction Industry: an Industrial Organization Perspective. Building Research & Information, Vol. 32, No. 2, pp. 146-156.

FEINBERG, R M and HUSTED, T A (1993). An Experimental Test of Discount-Rate Effects on Collusive Behavior in Duopoly Markets. Journal of Industrial Economics, Vol. 41, No. 2, pp. 153-160.

FILSON, D (2001). Market Power and Cartel Formation: Theory and an Empirical Test. Journal of Law and Economics, Vol. 44, No. 2, pp. 465-480.

FOGEL (1993). Evolving Behaviors in the Iterated Prisoner's Dilemma. Evolutionary Computation, Vol. 1, No. 1, pp. 77-97.

FRAAS, A G and GREER, D F (1977). Market Structure and Price Collusion: an Empirical Analysis. Journal of Industrial Economics, Vol. 26, No. 1, pp. 21-44.

FRIEDMAN, M (1953/1989). The Methodology of Positive Economics. In Friedman, M (Ed.): Essays in Positive Economics. 15th ed. Chicago: Univ. of Chicago Press, pp. 3-43.

FUDENBERG, D and MASKIN, E (1986). The Folk Theorem in Repeated Games with Discounting or with Incomplete Information. Econometrica, Vol. 54, No. 3, pp. 533-554.

GARDNER, R (1995). Games for Business and Economics. New York: Wiley.

GROVES, T (1973). Incentives in Teams. Econometrica, Vol. 41, No. 4, pp. 617-631.

GROVES, T and LOEB, M (1979). Incentives in a Divisionalized Firm. Management Science, Vol. 25, No. 3, pp. 221-230.

HANDS, D W (2001). Reflection Without Rules-Economic Methodology and Contemporary Science Theory. Cambridge: Cambridge University Press.

HAUSMAN, D M (1994/1995). Why Look Under the Hood? In Hausman, D M (Ed.): The Philosophy of Economics: an Anthology. 2. ed., reprint. Cambridge: Cambridge Univ. Press, pp. 217-222.

HOLLAND, J H and MILLER, J H (1991). Artificial Adaptive Agents in Economic Theory. American Economic Review, Vol. 81, No. 2, pp. 365-370.

HUCK, S and NORMANN, H-T (1999). Learning in Cournot Oligopoly: an Experiment. Economic Journal, Vol. 109, No. 454, pp. 80-95.

HUCK, S, NORMANN, H-T and OECHSSLER, J R (2004). Two are Few and Four are Many: Number Effects in Experimental Oligopolies. Journal of Economic Behavior & Organization, Vol. 53, No. 4, pp. 435-446.

HUCK, S, WIELAND, M and NORMANN, H-T (2001). Stackelberg Beats Cournot: on Collusion and Efficiency in Experimental Markets. The Economic Journal, Vol. 111, No. 474, pp. 749-765.

KALDOR, N (1961/1968). Capital Accumulation and Economic Growth. In Lutz, F A and Hague, D C (Ed.): The Theory of Capital. Reprint. London: Macmillan, pp. 177-222.

KAMERSCHEN, D R and MORGAN, J E J (2004). Collusion Analysis of the Alabama Liquid Asphalt Markets. Applied Economics, Vol. 7, No. 36, pp. 673-693.

KIRCHKAMP, O (2000). Spatial Evolution of Automata in the Prisoner's Dilemma. Journal of Economic Behavior & Organization, Vol. 43, No. 2, pp. 239.

KRAPP, M (2000). Relative Leistungsbewertung im dynamischen Kontext: eine Analyse der Kollusionsproblematik bei wiederholter Delegation. Zeitschrift für Betriebswirtschaftliche Forschung, Vol. 52, No. 5, pp. 257-277.

KREPS, D M (1990/1991). Game Theory and Economic Modelling. Oxford: Clarendon Press.

KREPS, D M and WILSON, R (1982). Sequential Equilibria. Econometrica, Vol. 50, No. 4, pp. 863-894.

KUNZ, A H and PFEIFFER, T (1999). Investitionsbudgetierung und implizite Verträge: Wie resistent ist der Groves-Mechanismus bei dynamischer Interaktion? Zeitschrift für Betriebswirtschaftliche Forschung, Vol. 53, No. 8, pp. 203-222.

LAMBERT, R A (2001). Contracting Theory and Accounting. Journal of Accounting & Economics, Vol. 32, No. 1-3, pp. 3-87.

LAWSON, T (1989). Abstraction, Tendencies and Stylised Facts: a Realist Approach to Economic Analysis. Cambridge Journal of Economics, Vol. 13, No. 1, pp. 59-78.

LINDENBERG, S (1992). The Method of Decreasing Abstraction. In Coleman, J S and Fararo, T J (Ed.): Rational Choice Theory: Advocacy and Critique. Newsbury Park: Sage Publications, pp. 3-20.

MACY, M (1996). Natural Selection and Social Learning in Prisoner's Dilemma. In Liebrand, W B G and Messick, D M (Ed.): Frontiers in Social Dilemmas Research. Berlin, pp. 235-266.

MÄKI, U (1998). Realism. In Davis, J B, Hands, D W and Mäki, U (Ed.): The Handbook of Economic Methodology. Cheltenham: Elgar, pp. 404-409.

MARCET, A and NICOLINI, J P (2003). Recurrent Hyperinflations and Learning. American Economic Review, Vol. 93, No. 5, pp. 1476-1498.

MEYER, M (2004). Prinzipale, Agenten und ökonomische Methode. Von einseitiger Steuerung zu wechselseitiger Abstimmung. Tübingen: Mohr.

MILGROM, P R and ROBERTS, J (1992). Economics, Organization and Management. Englewood Cliffs, New Jersy.: Prentice-Hall.

MODELL, S (2005). Triangulation between Case Study and Survey Methods in Management Accounting Research: an Assessment of Validity Implications. Management Accounting Research, Vol. 16, No. 2, pp. 231-254.

MUELLER, U (1987). Optimal Retaliation for Optimal Cooperation. Journal of Conflict Resolution, Vol. 31, No. 4, pp. 692-724.

NACHBAR, J H (1992). Evolution in the Finitely Repeated Prisoner's Dilemma. Journal of Economic Behavior and Organization, Vol. 19, No. 3, pp. 307-326.

OKRUHLIK, K (1994/1998). Gender and the Biological Sciences. In Curd, M and Cover, J A (Ed.): Philosophy of Science : the Central Issues. New York: Norton, pp. 192-208.

OLSEN, W (2004). Triangulation in Social Research: Qualitative and Quantitative Methods Can Really Be Mixed. Developments in Sociology, Vol. 20, No. 1, pp. 103-121.

POPPER, K R (1934/1959). The Logic of Scientific Discovery. New York: Basic Books.

POPPER, K R (1946/1996). Why are the Calculi of Logic and Arithmetic Applicable to Reality? In Popper, K R (Ed.): Conjectures and Refutations: the Growth of Scientific Knowledge. 5th ed. (rev.). London: Routledge, pp. 201-214.

PORTER, R H (1983). A Study of Cartel Stability: the Joint Executive Committee, 1880-1886. Bell Journal of Economics, Vol. 14, No. 2, pp. 301-314.

ROBERTS, K (1987/1994). Collusion. In Eatwell, J, Milgate, M and Newman, P (Ed.): The New Palgrave Dictionary of Economics, Vol. 4. repr. with corrections. London: Macmillan Press, pp. 482-484.

SLADE, M E (1987). Interfirm Rivalry in Repeated Games: an Empirical Test of Tacit Collusion. Journal of Industrial Economics, Vol. 35, No. 4, pp. 499-516.

SOLOW, R M (1969/1988). Growth Theory: an Exposition. Paperback ed. New York, NY: Oxford Univ. Press.

WALLER, W S and BISHOP, R A (1990). An Experimental Study of Incentive Pay Schemes, Communication, and Intrafirm Resource Allocation. Accounting Review, Vol. 65, No. 4, pp. 812-836.

WU, J and AXELROD, R (1995). How to Cope with Noise in the Iterated Prisoner's Dilemma. Journal of Conflict Resolution, Vol. 39, No. 1, pp. 183-189.

Return to Contents of this issue

© Copyright Journal of Artificial Societies and Social Simulation, [2005]