Income Distribution Effects of a Finnish Work Incentive Trap Reform

Journal of Artificial Societies and Social Simulation

12 (3) 3

<https://www.jasss.org/12/3/3.html>

For information about citing this article, click here

Received: 02-Sep-2008 Accepted: 04-May-2009 Published: 30-Jun-2009

Abstract

Abstract|

|

(1) |

where W is the total income of a household and S is the number of household members. When transferring monetary figures between years, the money values have been made comparable by using the cost of living index. Ultimately, all figures correspond to year 2000 Euros. Figures are weighted. It is always mentioned whether the figures are calculated directly from the Income Distribution Statistics or whether the microsimulation model is used. The income levels are described by decile group means (and medians in some cases). The income inequality measures chosen are the GE(2)-ratio[2] and the Gini coefficient[3]. The Gini coefficient is not sensitive to observations on the edge but it shows the general trend of inequality, which is important when looking at the changes over the years. Other factors than work incentive reforms and changes in taxation, influencing the income and income distribution, are not analyzed here. In calculating the taxes the simulation model does not include taxes on capital or wealth tax. Thus, from the tax parameter in the original data the same items are eliminated. Reforms concerning capital taxation are not included.

| Table 1: Mean and median household disposable income (and standard errors of the mean) by income decile groups in 1996 and 1998 (in year 2000 euros) | ||||||||||||||

| | IDS* 1996 data | Simulation** 1996 data, 1996 legislation | IDS* 1998 data | Simulation** 1998 data, 1998 legislation | Simulation** 1996 data, 1998 legislation | Simulation** 1998 data, 1996 legislation | ||||||||

| Decile | Mean | SE | Med | Mean | Med | Mean | SE | Med | Mean | Med | Mean | Med | Mean | Med |

| 1 | 7589 | 64 | 8137 | 9043 | 9676 | 7682 | 69 | 8239 | 9630 | 10034 | 9103 | 9688 | 9169 | 9679 |

| 2 | 10668 | 19 | 10684 | 12049 | 12093 | 10875 | 21 | 10881 | 12489 | 12513 | 12072 | 12119 | 12259 | 12269 |

| 3 | 12370 | 16 | 12444 | 13582 | 13602 | 12712 | 18 | 12708 | 14002 | 14015 | 13649 | 13679 | 13839 | 13854 |

| 4 | 13896 | 15 | 13927 | 14869 | 14851 | 14386 | 17 | 14376 | 15444 | 15480 | 14944 | 14931 | 15349 | 15383 |

| 5 | 15272 | 14 | 15245 | 16201 | 16211 | 16068 | 16 | 16083 | 16931 | 16948 | 16282 | 16278 | 16837 | 16840 |

| 6 | 16767 | 14 | 16787 | 17573 | 17567 | 17789 | 18 | 17786 | 18501 | 18497 | 17663 | 17663 | 18404 | 18409 |

| 7 | 18356 | 17 | 18345 | 19086 | 19051 | 19696 | 20 | 19672 | 20269 | 20243 | 19195 | 19155 | 20138 | 20120 |

| 8 | 20455 | 23 | 20392 | 21138 | 21119 | 22089 | 25 | 22044 | 22569 | 22532 | 21256 | 21259 | 22451 | 22410 |

| 9 | 23599 | 33 | 23547 | 24051 | 23900 | 25575 | 38 | 25496 | 25980 | 25904 | 24156 | 24018 | 25867 | 25797 |

| 10 | 34682 | 337 | 30639 | 35219 | 31496 | 41020 | 821 | 33740 | 42728 | 34633 | 35287 | 31445 | 42598 | 34510 |

| Table 2: GE(2) and Gini coefficient for 1996 and 1998, IDS results and microsimulation model results | |||||||

Year of the data | IDS results* | Simulated results**, Year of the legislation | |||||

| 1996 | 1998 | ||||||

| GE(2) x 100 | Gini x 100 | GE(2) x 100 | Gini x 100 | GE(2) x 100 | Gini x 100 | ||

| 1996 | 11.13 | 22.49 | 9.54 | 20.33 | 9.5 | 20.31 | |

| 1998 | 23.95 | 24.98 | 25.68 | 23.56 | 25.16 | 23.17 | |

|

|

(2) |

where h is the number of working months, w(1-t) is the net monthly salary, y is the other income, X is the vector of all the other variables affecting the labor supply, and ε is the residual. The aim is to estimate labor supply elasticities for net monthly salary and other income, meaning the estimates for parameters β and γ.

|

|

(3) |

|

|

(4) |

where mwcells is the cell-specific average marginal wage, w(1-t) cells is the cell-specific average net wage rate and scells is the cell-specific average for income transfers dependent on the number of working months (Laine and Uusitalo 2001). The cell-specific marginal wage depends on average gross wages, tax rates and the average income transfers of individuals within each cell.

|

|

(5) |

where w is the monthly wage, t is the tax rate and h the working months. In addition to this, an individual receives income from property and income transfer s during the months she/he is not working (12 - h). When rewriting the DPI equation,

|

|

(6) |

it can be seen that other income y + 12 × s can be calculated by subtracting the marginal wage rate from the disposable income and multiplying it by the number of working months [w(1-t) - s] × h . All the figures are calculated by applying the cell means similarly with the marginal wage rate calculations. Since the disposable income is addressed at the household level in our data, the spouse's wage income and personal income transfers have to be subtracted from the household disposable income in order to arrive at a correct individual disposable income measure (Laine and Uusitalo 2001). The other income is

|

|

(7) |

| Table 3: Mean values of the labor supply function variables (in year 2000 Euros) | ||||

| 1996 | 1998 | |||

| Variable | Mean | Std.Dev. | Mean | Std.Dev. |

| Working months | 8.9 | 1.7 | 9.1 | 1.7 |

| Net wage | 1148 | 263 | 1208 | 276 |

| Transfers | 524 | 183 | 496 | 165 |

| Marginal wage | 584 | 173 | 707 | 209 |

| Other income/month | 1266 | 275 | 1357 | 303 |

| Table 4: Estimation results of the labor supply equation | ||||

| Variable | Estimate in Finnish marks | Std.Err. | Estimate in Euros | Std.Err. |

| Marginal wages | 0.239* | 0.143 | 1.421* | 0.85 |

| Other income | -0.094 | 0.119 | -0.556 | 0.705 |

| Year 1998 | -0.06 | 0.132 | -0.06 | 0.132 |

| Constant | 5.570** | 1.526 | 5.570** | 1.526 |

| Number of cells | 122 | 122 | ||

|

|

(8) |

where the equation shows the fitted value of months worked M for either 1996 or 1998, marked by i and either with or without the 1998 dummy d . The coefficients are from the equation run in the previous chapter: α is the constant, β is the coefficient for marginal wages, mw refers to marginal wages, γ is the coefficient for other income and y is the other income variable, D98 is the dummy for 1998 and finally Dcj is a cell-specific dummy for cell j . By applying the microsimulation model, the marginal wages and other income variables are calculated for each individual separately but whenever this was not possible the marginal wages and other income variables are transformed from the corresponding cell-specific data to individual level data. Those individuals belonging to cell 1 are given the marginal wage and other income figure from cell number 1 and so forth. Cell average figures are applied, due to the same reasons explained above.

|

|

(9) |

where Wi is the value for monthly income minus taxes. Monthly income includes market income, so-called other income as well as those social transfers which are dependent on months worked. The yearly income variable is combined at the level of households. From the household disposable income the 'old' yearly income is then subtracted and the 'new' corresponding yearly income is added. The 'old' yearly income refers to income obtained by using the months worked derived from the original data. And the 'new' yearly income is calculated by using the fitted values of the months worked.

| Table 5: GE(2) and Gini coefficient for fitted values of months worked, simulated results | ||||

| 1996 data 1996 legislation | 1998 data 1998 legislation | |||

| Year of fitted values | GE(2) | Gini coefficient | GE(2) | Gini coefficient |

| 1996 | 10.14 | 21.15 | 26.74 | 23.7 |

| 1998 | 10.3 | 21.16 | 25.54 | 23.76 |

| Table 6: Mean household disposable income by income decile groups with fitted values of months worked (in year 2000 Euros), simulated results | ||||

Decile | 1996 data, 1996 legislation, | 1996 data, 1996 legislation, | 1998 data, 1998 legislation, | 1998 data, 1998 legislation, |

| 1996 fitted values | 1998 fitted values | 1996 fitted values | 1998 fitted values | |

| 1 | 8644 | 8700 | 9199 | 9225 |

| 2 | 11577 | 11631 | 12070 | 12079 |

| 3 | 13160 | 13271 | 13731 | 13771 |

| 4 | 14519 | 14688 | 15291 | 15334 |

| 5 | 15992 | 16202 | 16824 | 16909 |

| 6 | 17467 | 17645 | 18447 | 18540 |

| 7 | 19037 | 19186 | 20269 | 20320 |

| 8 | 21082 | 21354 | 22574 | 22586 |

| 9 | 24011 | 24248 | 25851 | 25919 |

| 10 | 35182 | 35498 | 42312 | 42734 |

|

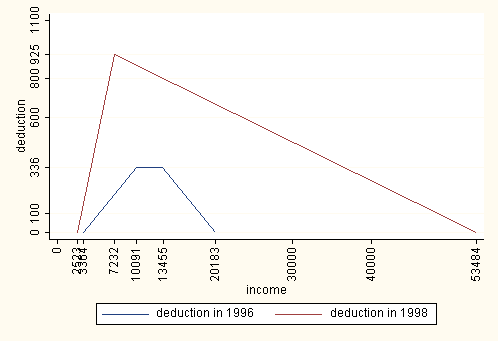

| Figure 1. Earned income deduction |

| Table 7: Tax rates in 1996 and 1998 | ||

| Taxable earned income, in Euros | Tax at the lowest level, in Euros | Tax at the amount exceeding the lowest level, % |

| 1996 | ||

| 7232-9923 | 8 | 7 |

| 9923-12278 | 197 | 17 |

| 12278-17492 | 597 | 21 |

| 17492-27415 | 1692 | 27 |

| 27415-48774 | 4371 | 33 |

| 48774- | 11420 | 39 |

| 1998 | ||

| 7737-10428 | 8 | 6 |

| 10428-13119 | 170 | 16 |

| 13119-18501 | 600 | 20 |

| 18501-29097 | 1677 | 26 |

| 29097-51466 | 4432 | 32 |

| 51466- | 11590 | 38 |

| Table 8: Communal day-care payments in 1996 in Helsinki, Euros/month | |||||

| Income limits of the day-care payments | |||||

| Size of the family | 1 | 2 | 3 | 4 | 5 |

| 2 | 992 | 1446 | 1564 | 1699 | 2641 |

| 3 | 1261 | 1766 | 1917 | 2102 | 3330 |

| 4 | 1547 | 2220 | 2388 | 2607 | 4121 |

| 5 | 1884 | 2557 | 2809 | 3112 | 4928 |

| Table 9: Communal day-care payments in 1997 (whole country), Euros/month | ||

| Size of the family | Minimum income limit | Percentage of deduction |

| 1-2 | 866 | 11.5 |

| 3 | 1068 | 9.4 |

| 4 | 1268 | 7.9 |

| Table 10: Home care subsidy in 1996 and 1997, Euros/month | |||

| Basic amount | Siblings supplement | Earnings-related compnent | |

| Year 1996 | 252 | 51 | 202 |

| Year 1997 | Care benefit 252/84/51 | Care allowance 168 | |

| Table 11: Determination of care allowance in 1997, Euros/month | ||

| Size of the family | Income limit | Percentage of deduction |

| 2 | 1159 | 11.5 |

| 3 | 1426 | 9.4 |

| 4 | 1694 | 7.9 |

|

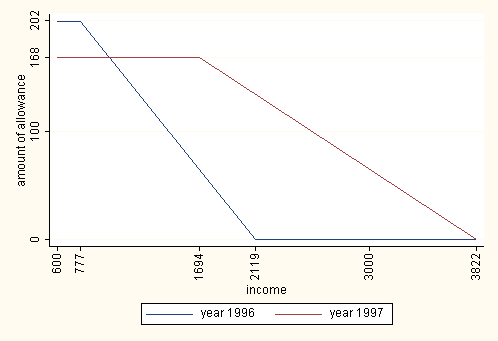

| Figure 2. Earnings related component of home care subsidy in 1996 and earnings related care allowance in 1997 for four member family |

Source:Kurjenoja 2000; Varma 1996; Varma 1997; Laine and Uusitalo 2001

2 The GE(2), half the squared coefficient of variation, belongs to the family of Generalized Entropy inequality indices. They have a property of being only indices that are additively decomposable by population subgroups, and several members can also be decomposed by income sources. Thus, they are very useful measures in studying the level, the trend and the structure of inequality. The GE(2) can have values ranging from 0 to infinity. Zero represents an equal distribution (all incomes identical) and higher values represent higher levels of inequality (see for exampleLitchfield 1999).

3 The Gini coefficient, or the relative mean difference, is a very direct measure of income inequality that takes note of differences between every pair of incomes. The Gini coefficient belongs to the summary measures of concentration and it describes the extent of inequality. It is usually viewed by using the Lorenz curve. The Lorenz curve is a graph of cumulative income shares against cumulative population shares. The Gini coefficient is the ratio of the difference between the diagonal, the absoluteequity, and the Lorenz curve to the triangular region underneath the diagonal (Foster and Sen 1997). The Gini coefficient ranges from a maximum of 1, which depicts perfect inequality, to 0, which depicts perfect equity.

4 The comment of the Referee is gratefully acknowledged.

5 The comment of a Referee is gratefully acknowledged.

6 The advantage of the method used is that the income transfers now describe all the transfers received by individuals in each cell weighted by the share of recipients of each transfer. Then alternative earnings do not have to be calculated separately for each income transfer. Furthermore, the expected net wage for those not working is acquired, which is an average wage for those of the same age, having similar education and being in a similar family situation (Laine and Uusitalo 2001).

7 The OLS regression was used to cell-mean data.

BLUNDELL, R., Duncan, A. and Meghir, C. (1998), 'Estimating labor supply responses using tax reforms', Econometrica 66(4), 827-861.

DUNCAN, A. and MacCrae, J. (1999), Household Labour Supply, Childcare Costs and In-Work Benefits: modelling the impact of the Working Families Tax Credit in the U.K. Paper presented to the Econometric Society European Meeting.

FINNISH Tax Laws (1998), Helsinki. In Finnish.

HEIKKILÄ, M. (1997), Justifications for cutbacks in the area of social policy, in 'The Cost of Cuts. Studies on cutbacks in social security and their effects in the Finland of the 1990s', STAKES, National Research and Development Centre for Welfare and Health, Helsinki, pp. 15-28.

HEIKKILÄ, M. and Uusitalo, H., eds (1997), The Cost of Cuts. Studies on cutbacks in social security and their effects in the Finland of the 1990s, number 208 in 'Reports', STAKES, National Research and Development Centre for Welfare and Health, Helsinki.

KOSUNEN, V. (1997), The recession and changes in social security in the 1990s, in M. Heikkilä H. Uusitalo, eds, 'The Cost of Cuts. Studies in cutbacks of social security and their effects in the Finland of the 1990s.', STAKES, National Research and Development Centre for Welfare and Health, Helsinki, pp. 41-68.

KURJENOJA, J. (2000), Income taxation as a medicine to incentive traps, Tax information 24, Central Association of Taxpayers, Helsinki. In Finnish.

KURJENOJA, J. (2004), For whom is the work worth while?, Tax information 39, Central Association of Taxpayers, Helsinki. In Finnish.

LAINE, V. and Uusitalo, R. (2001), Labour supply effects of the Finnish work incentives reform, Research 74, VATT, Government Institute for Economic Research, Helsinki. In Finnish.

LITCHFIELD, J. A. (1999), Inequality: Methods and Tools, STICERD, Suntory and Toyota International Centres of Economics and Related Disciplines, London School of Economics, London.

MATTILA-WIRO, P. (2006), Changes in the Distribution of Economic Wellbeing in Finland, VATT Research Reports 128, Helsinki.

NIINIVAARA, R. (1999), The assessment of the impementation of the proposals made by the Incentive Trap Task Force, Research 4/99, Ministry of Finance, Helsinki. In Finnish.

PRIME MINISTER'S OFFICE (1996), The final report of the Incentive Trap Task Force, Publications 5, Prime Minister's Office, Helsinki. In Finnish.

FOSTER, E. F. and Sen, A. (1997), On Economic Inequality, Oxford University Press, Oxford, Edition 2.

STATISTICS FINLAND (2003), Income distribution statistics 2001, Income and Consumption 13, Helsinki. In Finnish.

UUSITALO, H. (1997), Four years of recession: What happened to income distribution? , in M. Heikkilä H. Uusitalo, eds, 'The Cost of Cuts. Studies on cutbacks in social security and their effects in the Finland of the 1990s', STAKES, National Research and Development Centre for Welfare and Health, Helsinki, pp. 101-118.

VARMA (1996), Livelihood security 1996, Technical report. In Finnish.

VARMA (1997), Livelihood security 1997, Technical report. In Finnish.

VARMA (1998), Livelihood security 1998, Technical report. In Finnish.

Return to Contents of this issue

© Copyright Journal of Artificial Societies and Social Simulation, [2009]