Müge Özman (2007)

Network Formation and Strategic Firm Behaviour to Explore and Exploit

Journal of Artificial Societies and Social Simulation

vol. 11, no. 1 7

<https://www.jasss.org/11/1/7.html>

For information about citing this article, click here

Received: 15-Jan-2007 Accepted: 03-Dec-2007 Published: 31-Jan-2008

Abstract

Abstract|

|

(1) |

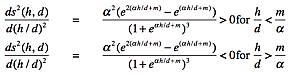

where we define the function s(.,.) as

|

|

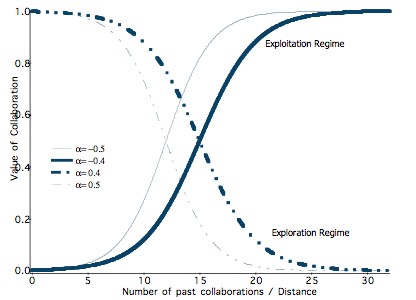

vij the value of collaboration between firm i and j, kj is the knowledge level of firm j, βij is a parameter to account for the error term that firm i might commit in forming its expectation regarding the value of its collaboration with firm j, hij is the number of times firm i and j have collaborated in the past, dij is the geographical distance between firms i and j, and α is a parameter that we vary to control for stability of the industry and tacitness of knowledge. According to Equation (1), the higher is the value of firm j's knowledge, the more value firm i places on their collaboration.

|

| Figure 1. |

|

|

(2) |

where we define g(.,.) as

|

|

with

|

|

(3) |

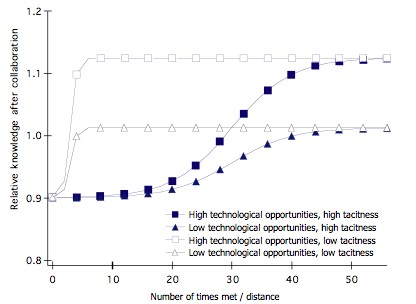

where sij is as explained in Equation (1). Equation (2) tells that, the extent of learning depends on a) history and distance as revealed by function s(.,.) and b) technological opportunities. Technological opportunities are measured by parameter γ which is the third dimension of the industry regime. According to function g(.,.) learning in a collaboration depends on the relative knowledge levels between firms i and j. In modelling increases in a firm's knowledge as a result of the receipt of new knowledge (See Cowan et al. 2004 for this type of learning function):

|

|

| Figure 2 Absorption and Innovation |

|

| Figure 3 Relative Knowledge Levels under different levels of Technological Opportunities and Tacitness |

|

|

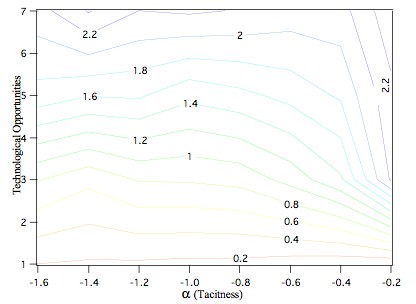

where dij is the distance between firms i and j, and hij is the number of times i and j have collaborated. The average is taken over all firms in the population. Higher values of the spatial strength index reflect the tendency in the population to form strong ties with close firms. Lower values of the index reflect a tendency to form weak ties with distant firms. Figure 4 shows this measure.

|

|

| Figure 4 Spatial Strength Index |

|

|

where cmax is the degree of the firm with the highest connections, ci is the degrees of actor i. The term in the denominator gives the maximum possible value of difference among all actors (Wasserman and Faust 1994).

|

|

| Figure 5 Degree Centrality |

|

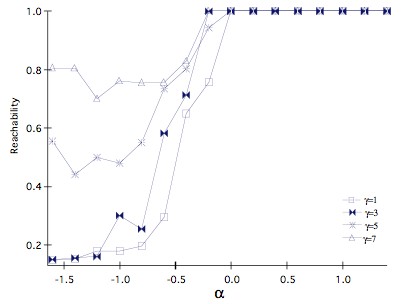

| Figure 6 Reachability |

|

| Figure 7 Average Reachability among Network Members |

2 The firms are knowledge intensive firms, where their contacts with other firms in the industry are important mechanisms for organizational learning and increasing their innovative capacity.

3 See Appendix for derivatives.

4 Here, we use the time subscript (t+1) because this updated knowledge level will be used in the partner selection process of the next period (t+1).

5 To calculate reachability in the network, the software UCINET was used (Borgatti et. al. 2002).

|

|

|

AUDRETSCH D B and Feldman, M P (1996) Knowledge spillovers and the geography of innovation and production. American Economic Review 86, 630--640

BECKMAN, C M, Haunschild, P R, Philips D J (2004). Friends or Strangers? Firm specific uncertainty, Market uncertainty and Network partner selection. Organization Science, 15(3): 259-275.

BORGATTI, S P, Everett, M G and Freeman, L C (2002) UCINET for Windows: Software for Social Network Analysis. Harvard: Analytic Technologies.

BURT R S (1992) Structural Holes: The structure of competition. New York: Academic Press.

COLEMAN J S (1988) Social capital in the creation of human capital. American Journal of Sociology, 94, 95-120

COWAN R, Jonard N and Ozman M (2004) Knowledge Dynamics in a Network Industry. Technological Forecasting and Social Change, 71(5), 469-84

GARGIULO B, Bennassi M (2000) Trapped in Your Own Net? Network Cohesion, Structural Holes and Adaptation of Social Capital. Organization Science, 11(2), 183-196

GRANOVETTER M S (1973) The Strength of Weak Ties. American Journal of Sociology, 78(6), 1360-80.

GRANOVETTER M S (1985) Economic Action and Social Structure: The Problem of Embeddedness. American Journal of Sociology, 91, 481-510

MARCH J (1991) Exploration and Exploitation in Organizational Learning. Organization Science, 2: 71-87.

OLIVER, C (1991) Network Relations and Loss of Organizational Autonomy. Human Relations, 44(9): 943-961.

OLIVER, A (2001) Strategic Alliances and the Learning Life-Cycle of Biotechnology Firms. Organization Studies, 22(3):467-489.

POWELL, WW, Koput, KW and Smith-Doerr, L (1996) Interorganizational Collaboration and the Locus of Innovation: Networks of Learning in Biotechnology. Administrative Science Quarterly, 41:116-145.

ROSENKOPF L, Metiu A and George V P (2001) From the Bottom Up? Technical Comitee Activity and Alliance Formation. Administrative Science Quarterly, 46(4): 748-772.

ROTHAERMEL, F.T. and D.L. DEEDS (2004) Exploration and Exploitation alliances in biotechnology: a system of new product development. Strategic Management Journal, 25: 201-221.

ROWLEY T, Behrens D and Krackhardt D. (2000) Redundant Governance Structures: An Analysis of Structural ad Relational Embeddedness in the Steel and Semiconductor Industries. Strategic Management Journal, 21, 369-86.

UZZI B (1997) Social Structure and Competition in Interfirm Networks: The Paradox of Embeddedness. Administrative Science Quarterly, 42(1): 35-67.

WASSERMAN, S and Faust, K (1994) Social Network Analysis: Methods and Applications. New York and Cambridge, Cambridge University Press.

Return to Contents of this issue

© Copyright Journal of Artificial Societies and Social Simulation, [2008]