Javier Pajares, Adolfo López and Cesáreo Hernández (2003)

Industry as an Organisation of Agents: Innovation and R&D Management

Journal of Artificial Societies and Social Simulation

vol. 6, no. 2

To cite articles published in the Journal of Artificial Societies and Social Simulation, please reference the above information and include paragraph numbers if necessary

<https://www.jasss.org/6/2/7.html>

Received: 30-Sep-2002 Accepted: 16-Feb-2003 Published: 31-Mar-2003

Abstract

Abstract

|

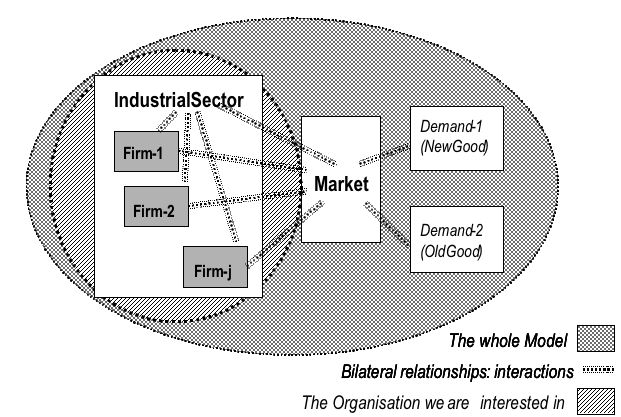

| Figure 1. Model structure and agents |

|

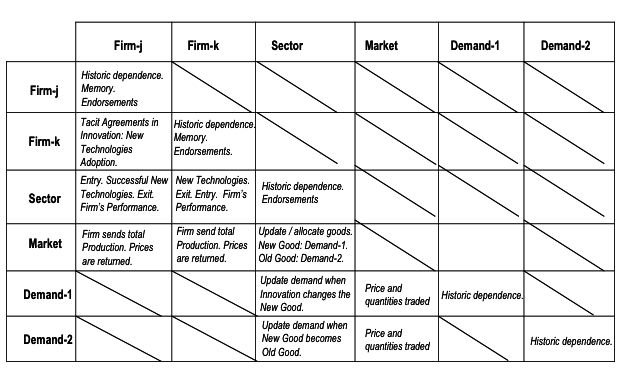

| Table 1. Interactions among agents in the model |

|

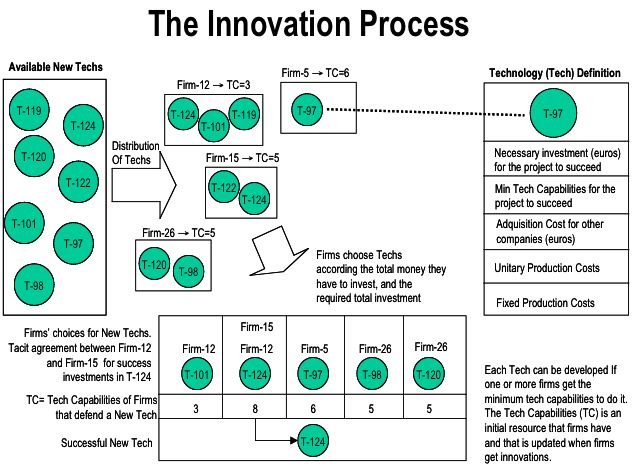

| Figure 2. Representation of the process that leads to successful innovation |

|

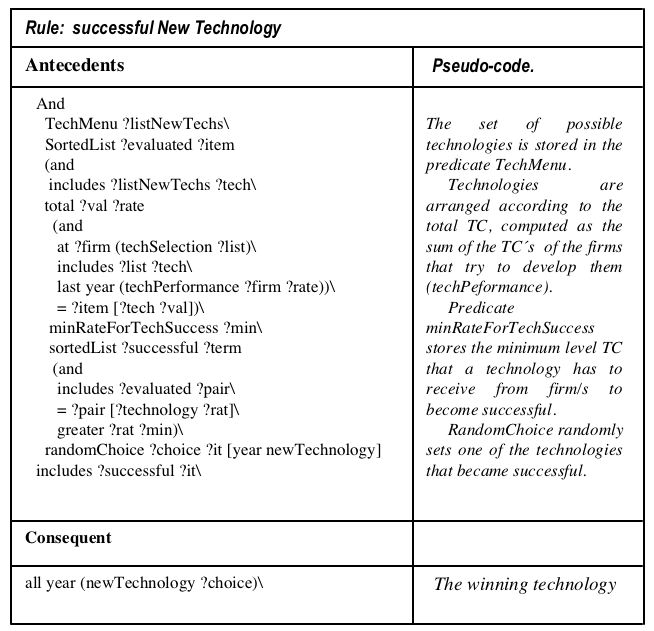

| Table 2. This rule determines which technology will be the successful one |

|

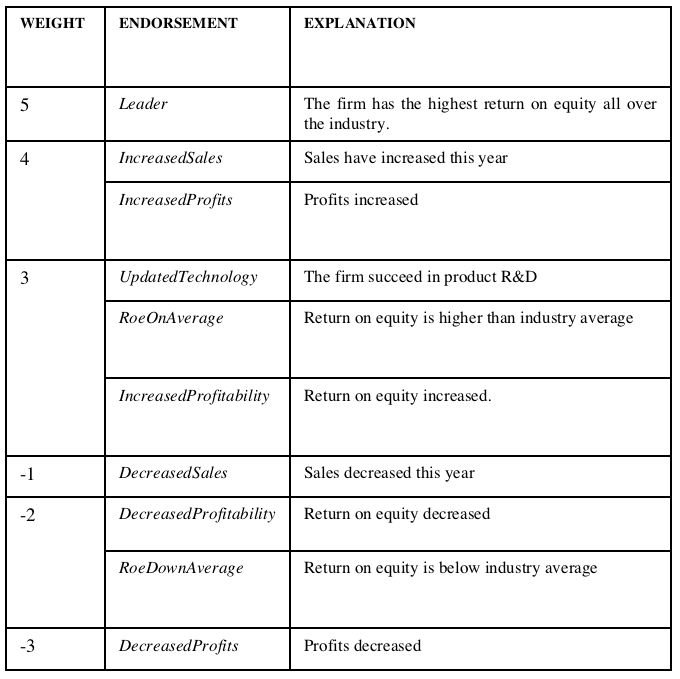

| Table 3. Endorsement scheme |

|

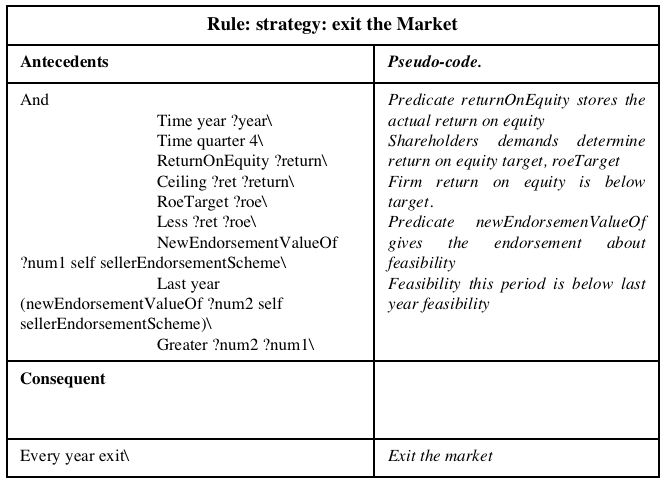

| Table 4. Rule that implements the decision to leave the market |

|

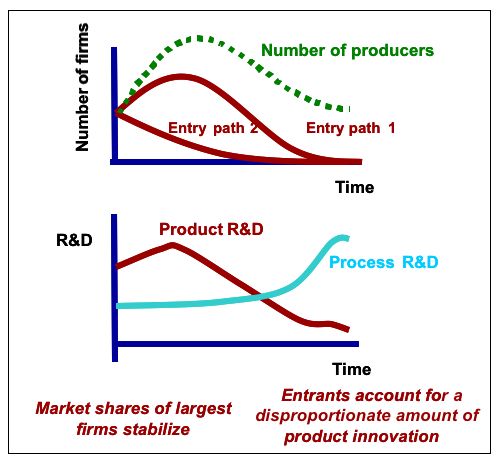

| Figure 3. Stylised facts in industry life cycle dynamics |

|

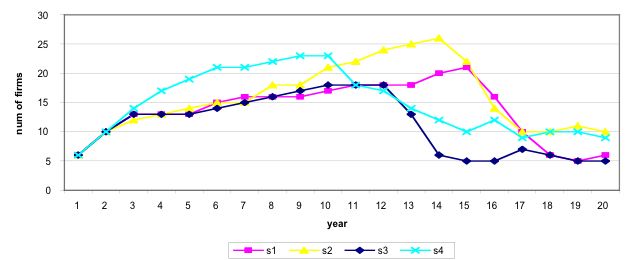

| Figure 4. 1st Scenario. Evolution of the number of firms in the industry |

|

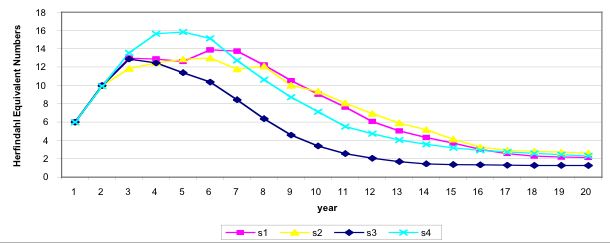

| Figure 5. 1st Scenario. Herfindahl equivalent numbers. Lower numbers imply higher concentration levels |

|

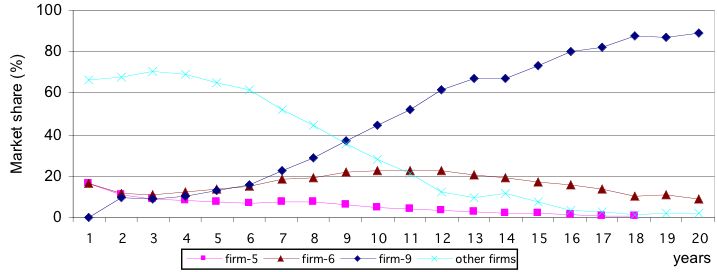

| Figure 6. 1st Scenario. Market share evolution for major companies |

|

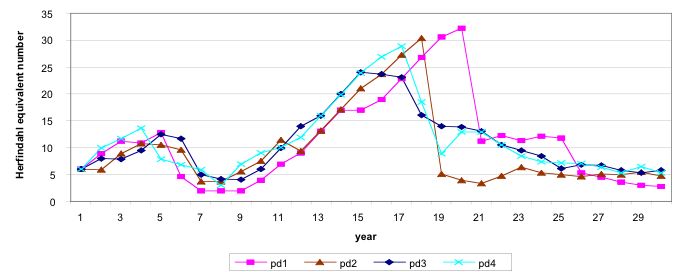

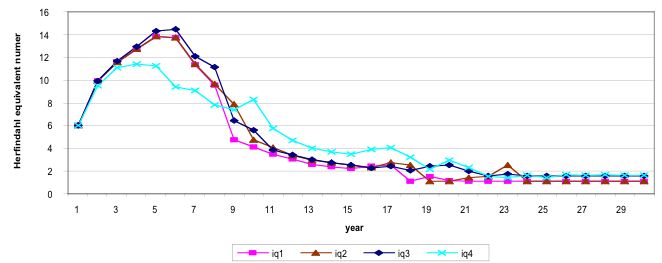

| Figure 7. 2nd Scenario. Herfindahl equivalent number |

|

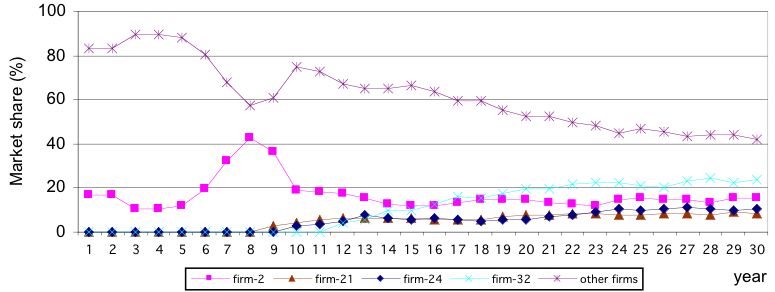

| Figure 8. 2nd Scenario. Market shares |

|

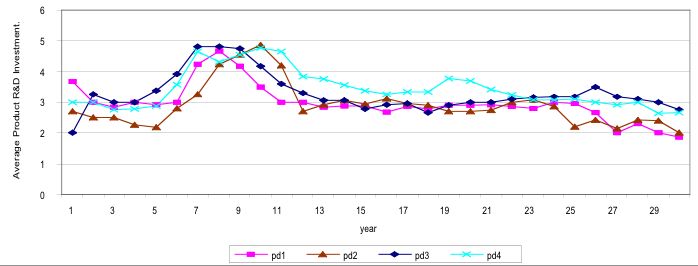

| Figure 9. 2nd Scenario. Industry average product R&D expenditure reaches a maximun as firm learn |

|

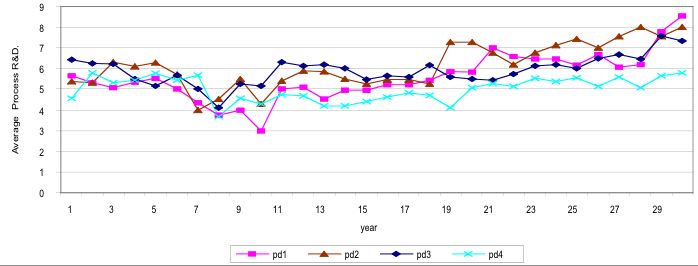

| Figure 10. 2nd. Scenario. Industry average process R&D investmen |

|

| Figure 11. 3rd Scenario. Industry average process R&D investment |

BOSCHMA, R.A. and LAMBOY (1999): "Evolutionary Economics and Economic Geography". Journal of Evolutionary Economics, 9, pp: 411-429.

COHEN, P.R. (1985): Heuristic Reasoning: An Artificial Intelligence Approach. Pitman Advanced Publishing Program, Boston.

EDMONDS, B., MOSS, S. Y WALLIS, S. (1996):"Logic, Reasoning and A Programming Language for Simulating Economic and Business Processes with Artificial Intelligent Agents", in Eid-Dor (ed.): Artificial Intelligence in Economics and Management. Kluwer, Ac. Pub. Boston.

DE BRESSON, C. and TOWNSEND, J. (1981): "Multivariate Models of Innovations: Looking at the Abernathy-Utterback Model with Other Data". Omega, 9(4), pp: 429-36.

DOSI, G., MARENGO, L., BASSANI, A. Y VALENTE, M (1999): "Norms as Emergent Properties of Adaptive Learning: The Case of Economic Routines". Journal of Evolutionary Economics, 9(1), pp:5-26.

GORT, M. and KLEPPER, S. (1982): "Time Paths in the Diffusion of Product Innovations". Economic Journal, 92(367), pp: 630-53.

KAWASNICKI, W. (1996): Knowledge, Innovation and Economy: An Evolutionary Exploration. Edward Elgar Publishing Ltd.

KLEPPER, S. (1996): "Entry, Exit, Growth, and Innovation over the Product Life Cycle". American Economic Review, 86(3), pp: 562-583.R

KLEPPER, S (2002): "The Evolution of the U.S. Automobile Industry and the Detroit as its capital". Paper presented at 9th Congress of International Joseph A. Schumpeter Society, Gainesville, Florida, March.

KLEPPER, S, and GRADDY, E. (1990): "The Evolution of New Industries and the Determinants of Market Structure". Rand Journal of Economics, 21(1), pp:27-44.

KLEPPER, S. and SIMONS, K.L. (1993): "Technological Change and Industry Shakeouts". Mimeo, Carnegie Mellon University.

MOSS, S., GAYLARD, H., WALLIS, S. Y EDMONDS, B. (1998): "SDML: A Multi-Agent Language for Organisational Modelling". Computational & Mathematical Organization Theory, vol 4(1), pp:43-49.

MOSS, S. (1995): "Control Metaphors in the Modelling of Economic Learning and Decision-Making Behavior". Computational Economics, 8, pp:283-301.

MOSS, S. (1998): "Critical Incident Management: An Empirically Derived Computational Model". Journal of Artificial Societies and Social Simulation (JASSS), 1(4) <https://www.jasss.org/1/4/1.html>.

NELSON, R.R and WINTER, S.G.; (1982): An Evolutionary Theory of Economic Change. Belknop Harvard.

OLTRA, V. and YILDIZOGLU, M. (1998): "Learning and Expectations in R&D Decisions", BETA-THEME Working Paper. Université Louis Pasteur. France.

UTTERBACK, J.M. and ABERNATHY, W.J. (1975): "A Dynamic Model of Process and Product Innovation". Omega, 3(6), pp: 639-56.

UTTERBACK, J.M. and SUREZ, F.F. (1993): "Innovation, Competition and Industry Structure". Research Policy, 22(1), pp: 1-21.

YILDIZOGLU, M. (1999): "Competing R&D Strategies in an Evolutionary Model". BETA-THEME Working Paper. Université Louis Pasteur. France.

Return to Contents of this issue

© Copyright Journal of Artificial Societies and Social Simulation, [2003]