Flaminio Squazzoni and Riccardo Boero (2002)

Economic Performance, Inter-Firm Relations and Local Institutional Engineering in a Computational Prototype of Industrial Districts

Journal of Artificial Societies and Social Simulation

vol. 5, no. 1

To cite articles published in the Journal of Artificial Societies and Social Simulation, please reference the above information and include paragraph numbers if necessary

<https://www.jasss.org/5/1/1.html>

Received: 3-Sep-2001 Accepted: 6-Jan-2002 Published: 31-Jan-2002

Abstract

Abstract

|

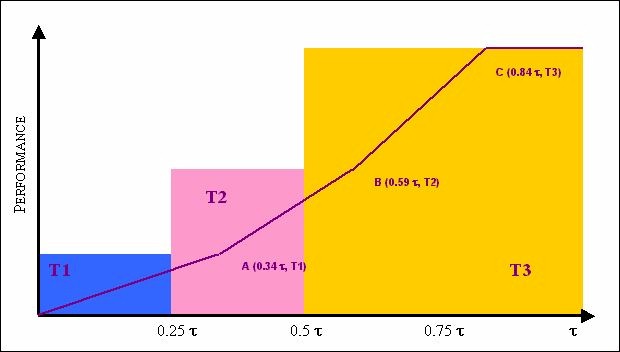

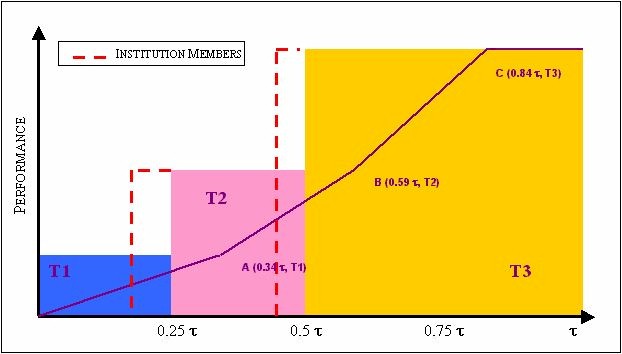

| Figure 1. The evolution of the technology and market environment: τ is the number of the cycles of simulation. T1, T2 and T3 are the three available technological regimes over time. The coloured areas define all the possible technological positions of firms in respect to the technology standard evolution, and all the related levels of performance which firms can achieve over time. Obviously, technological evolution is conceived as an irreversible process. |

|

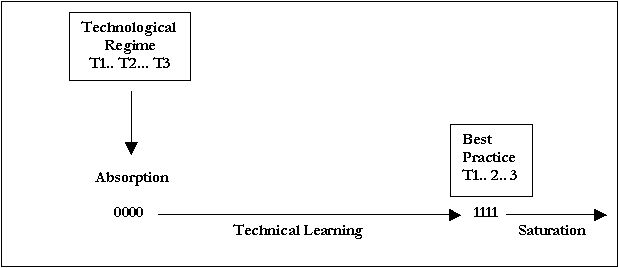

| Figure 2. Firms and technological leaning: phase of technology absorption, phase of organisational change, and phase of technology saturation |

|

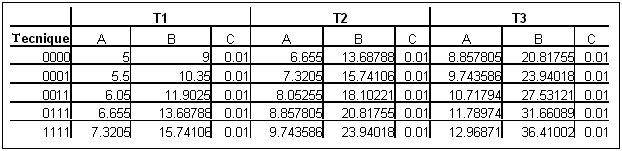

| Figure 3. Matrix of Technological and Technical Production Cost |

|

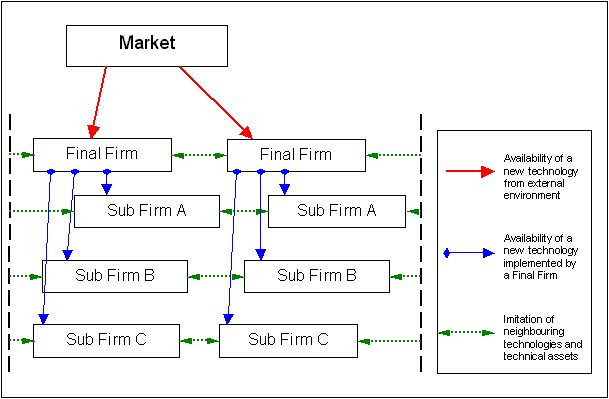

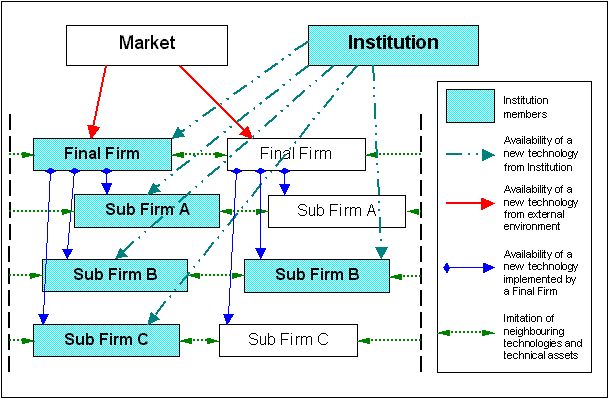

| Figure 4. The structure of the information flow |

|

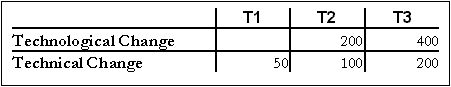

| Figure 5. Matrix of Technological and Technical Change |

|

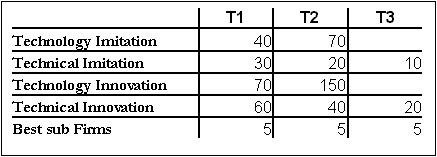

| Figure 6. Matrix of Information and Research Cost |

|

| Figure 7. Technological Information Flow Supported by the Institutional Action |

|

| Figure 8. Technological discovery and amplification of options for insider firms with Institution 2 |

|

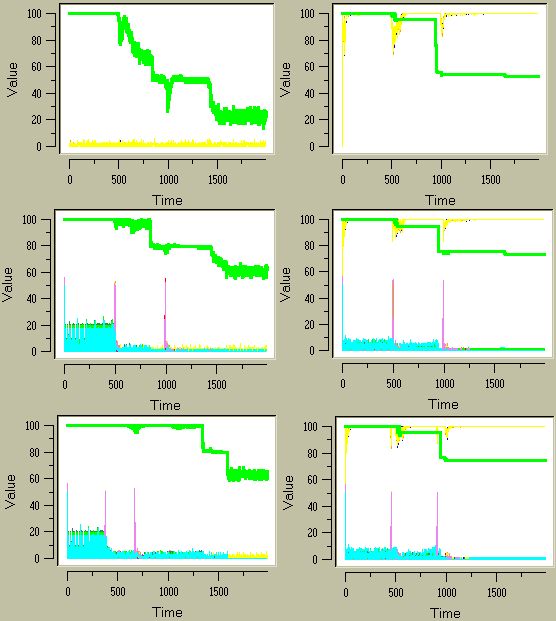

| Figure 9. Final firms matching market requests over time. On the left, all the experimental settings based on the "market-like district", while on the right, all the experimental settings based on the "partnership district". Top-down: at the first level, the outcome of the first two experimental settings ("market-like district" and "partnership district"); at the second level, the experimental setting with "Institution 1" on the previous ones; at the third level, the experimental setting with "Institution 2" on the first settings |

|

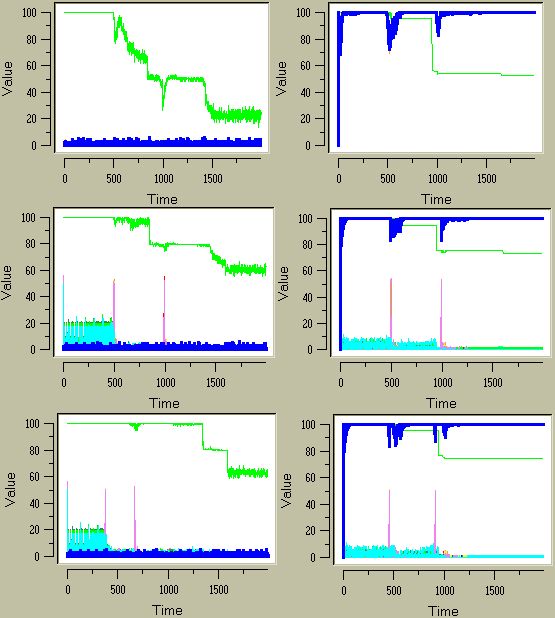

| Figure 10. The number of stable production chains over time. On the left, all the experimental settings based on the "market-like district", while on the right, all the experimental settings based on the "partnership district". Top-down: at the first level, the outcome of the first two experimental settings; at the second level, the outcome of the experimental setting with "Institution 1"; at the third level, the experimental setting with "Institution 2" |

|

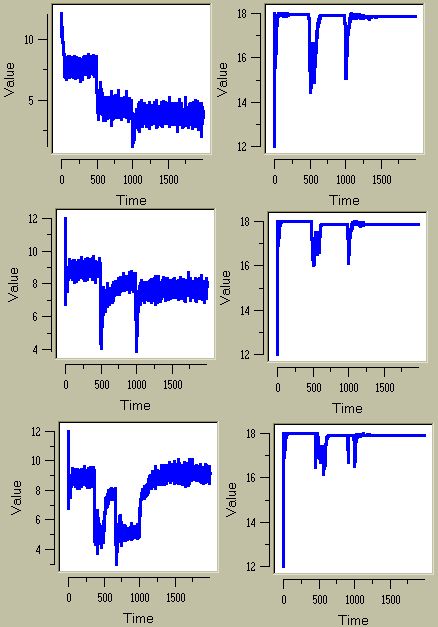

| Figure 11. Dynamics of the "aggregate" profit emerging by the production chains, measured in terms of "time compression value". "Institution 1 on market-like district" (on the left) and "Institution 1 on partnership district" (on the right) experimental setting |

|

| Figure 12. Comparison between the average of resources between insider and outsider firms over time (Top-down: Institution 1 and 2; on the left, "market-like district", on the right, "partnership district"). The value of 1 shows an homogeneous distribution of the average of resources between insider and outsider firms |

|

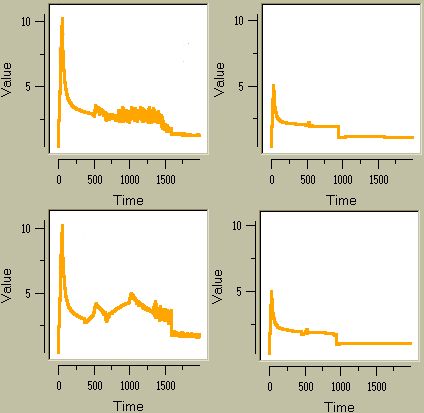

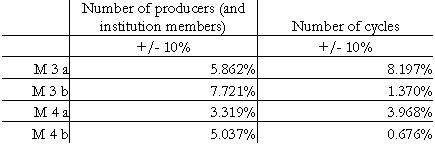

| Figure 13. Analysis of parameters. "M 3 and M 4 a" are Institution 1 and 2 on the "market-like district". "M3 and 4 b" are Institution 1 and 2 on the "partnership district" |

2 We can taxonomically assume that the difference between an industrial district and a more general industrial cluster, or a network of geographically agglomerating firms, is that the self-organising dynamics of the first one are based on long-term interactions and vertical and horizontal complex connections amongst spatially located firms, working into the same space of the segmentation of the market, and give rising to an high integrated production system. This is the reason why we speak about an industrial district, rather than about a more generic kind of industrial cluster. Another statement is that our prototype refers to a traditional picture of industrial district, to say a network of firms working into traditional industrial sectors (for example, not a high-technology production cluster) and within an environment not characterised by the proximity of universities or scientific research institutions devoted to R&D activities (for example, the famous case of Silicon Valley).

3 Ideas about the difference between "radical" and "incremental" paths of innovation, and related strategies of "exploration" and "exploitation", derive from evolutionary economics literature. For example, see: Antonelli (1995); Dosi (2000); Dosi and Nelson (1996); March (1991); Caccomo (1996); Marengo and Willinger (1997); Nooteboom (1999).

AMIN A and COHENDET P (2000), Organisational Learning and Governance through Embedded Practices, Journal of Management and Governance, 4, 1/2. pp. 93-116.

ANDERSON P W, ARROW K, PINES D. (1988) (Eds.), The Economy as an Evolving Complex System, Santa Fe Institute on the Sciences of Complexity, Addison- Wesley.

ANTONELLI C (1995), The Economics of Localized Technological Change and Industrial Dynamics, Kluwer Academic Press, Boston.

ARRIGHETTI A and SERAVALLI G (Eds.) (1999), Istituzioni intermedie e sviluppo locale, Donzelli, Rome, Italy.

ARTHUR B W (1994), Increasing Returns and Path Dependence in Economics, Michigan Press.

ARTHUR B W, DURLAUF S N, LANE D (Eds.) (1997), The Economy as an Evolving Complex System II, Santa Fe Institute on the Sciences of Complexity, Addison- Wesley.

AUYANG S Y (1998), Foundations of Complex- System Theories in Economics, Evolutionary Biology, and Statistical Physics, Cambridge University Press.

AXELROD R (1997), The Complexity of Cooperation. Agent-Based Models of Competition and Cooperation, Princeton University Press, Princeton, New Jersey.

AXTELL R (2000), Why Agents? On the Varied Motivations for Agents Computing in the Social Sciences, Center for Social and Economic Dynamics, Working Paper No. 17.

BALLOT G AND TAYMAZ E (1997), The Dynamics of Firms in a Micro-to-Macro Model: The Role of Training, Learning and Innovations, Journal of Evolutionary Economics, 7, 4. pp. 425-457.

BALLOT G AND TAYMAZ E (1999), Technological Change, Learning and Macro- Economic Coordination: An Evolutionary Model, Journal of Artificial Societies and Social Simulation, vol. 2, no. 2 <http://www.soc.surrey.ac.uk/jasss/2/2/3.html>

BELUSSI F (1996), Local Systems, Industrial Districts and Institutional Networks: Towards a New Evolutionary Paradigm of Industrial Economies, European Planning Studies, 4. pp. 1-15.

BELUSSI F and GOTTARDI G (Eds.) (2000), Evolutionary Patterns of Local Industrial Systems. Towards a Cognitive Approach to the Industrial District, Ashgate, Aldershot Brookfield Singapore Sydney.

BIANCHI P (1990), Innovating in the Local Systems of Small and Medium Sized Enterprises: The Experience of Tuscany, Entrepreneurship & Regional Development, 2. pp. 57-69.

BIANCHI P and GIORDANI M G (1993), Innovation Policy at the Local Level and at the National Level. The Case of Emilia-Romagna, European Planning Studies, Vol. 1, No. 1. pp. 25-41.

BOERO R (2001), "SWIEE- A Swarm Web Interface for Experimental Economics", in Luna F and Perrone A (Eds.), Agent-Based Methods in Economics and Finance: Simulations in Swarm, Kluver Academic Publishers, Boston/Dordrecht/London. pp. 87-107.

BOERO R, and SQUAZZONI F (2001), A Computational Prototype of Industrial District, forthcoming. <http://www.eco.unibs.it/segdss/paper/Prototype.pdf>

BRENNER T (2001), Simulating the Evolution of Localized Industrial Clusters- An Identification of the Basic Mechanisms, Journal of Artificial Societies and Social Simulation, vol.4, no.3 <http://www.soc.surrey.ac.uk/jasss/4/3/4.html>.

CACCOMO J - L (1996), Technological Evolution and Economic Instability: Theoretical Simulations, Journal of Evolutionary Economics, 6, 2. pp. 141-155.

CARLSSON B (1994), "Technological Systems and Economic Performance", in Dodgson M and Rothwell R (Eds.), The Handbook of Industrial Innovation, Edgar Publishing Company, Vermont Brookfield. pp. 13-24.

CARLSSON B, ELIASSON G, and TAYMAZ E (1997), "Micro-Macro Simulation of Technological Systems: Economic Effects of Spillovers", in Carlsson B (eds), Technological Systems and Industrial Dynamics, Kluwer Academic Publishers, Boston. pp. 255-278.

CAVESTRO W, and DURIEUX C (2000), Firmes, réseaux et apprentissage, in Économie et Sociétés, Séries F, 37, 9. pp. 87-100.

COHEN W, and LEVINTHAL D (1990), Absorptive Capacity: A New Perspective on Learning and Innovation, Administrative Science Quarterly, 35. pp. 128-152.

CONTE R (2000) The Necessity of Intelligent Agents in Social Simulation, in Ballot G, Weisbuch G (Eds.), Applications of Simulation to Social Sciences, Hermes Science Publishing Ltd, Oxford. pp. 19-38.

COOKE P and MORGAN K (1998), The Associational Economy. Firms, Regions, and Innovation, Oxford University Press, New York.

DAVID P (1994), Why are Institution the 'Carriers of History'?: Path Dependence and the Evolution of Conventions, Organizations and Institutions, Structural Change and Economic Dynamics, vol. 5, no. 2. pp. 205-220.

DEI OTTATI G (1994), Co-operation and Competition in the Industrial Districts as an Organizational Model, in European Planning Studies, No. 4.

DEPERRU D (1996), Economia dei consorzi tra imprese, EGEA, Milan.

DOSI G (2000), Innovation, Organization and Economic Dynamics. Selected Essays, Edward Elgar, Cheltelham, UK, Northampton, MA, USA.

DOSI G and NELSON R (1996), An Introduction to Evolutionary Theories in Economics, Journal of Evolutionary Economics, 4, 2. pp. 153-172.

DURLAUF S N and YOUNG P H (Eds.) (2001), Social Dynamics, The MIT Press, Cambridge, Massachusetts.

ELIASSON G (1991), Modeling the Experimentally Organized Economy. Complex Dynamics in an Empirical Micro-Macro Model of Endogenous Economic Growth, Journal of Economic Behavior and Organization, 16. pp. 153-182.

EPSTEIN J M and AXTELL R (1996), Growing Artificial Societies from the Bottom-Up, MIT Press, Cambridge, Massachusetts.

FIORETTI G (2001), Information Structure and Behaviour of a Textile Industrial District, Journal of Artificial Societies and Social Simulation, vol. 4, No. 4 <http://www.soc.surrey.ac.uk/jasss/4/4/1.html>

GILBERT N (1996) Holism, Individualism and Emergent Properties. An Approach from the Perspective of Simulation, in Hegselmann R, Mueller U and Troiztsch K G (Eds.), Modelling and Simulation in the Social Sciences from the Philosophy of Science Point of View, Kluwer Academic Publishers, Dordrecht / Boston / London. pp. 1-27.

GILBERT N and DORAN J (Eds.) (1994), Simulating Societies. The Computer Simulation of Social Phenomena, UCL Press, London.

GILBERT N and TERNA P (2000), How to Build and Use Agent-Based Models in Social Science, Mind & Society, I, 1. pp. 57-72.

GLASMEIER A K (1999), Territory-based Regional Development Policy and Planning in a Learning Economy: The Case of 'Real Service Centers" in Industrial Districts, European Urban and Regional Studies, Vol. 6, No.1. pp. 73-84.

HASSINK R (1996), Technology Transfer Agencies and Regional Economic Development, European Planning Studies, Vol. 4, Issue 2.

HOLLAND J H (1995), Hidden Order. How Adaptation Builds Complexity, Perseus Books, Cambridge, Massachusetts.

HOLLAND J H (1998), Emergence from Chaos to Order, Perseus Books, Cambridge, Massachusetts.

HOWELLS J (1999), "Regional Systems of Innovation?", in Archibugi D, Howells J, and Michie J (Eds.), 1999, Innovation Systems and Policy in a Global Economy, Cambridge University Press. pp. 67-93.

LANE D (1993), Artificial World and Economics, Part II, Journal of Evolutionary Economics, 3, 3. pp. 177-197.

LANE D (2001), Complexity and Local Interactions: Towards a Theory of Industrial Districts, Paper presented to the conference "Complexity and Industrial Districts", Montedison Foundation, Milan, Italy, June 2001.

LISSONI F (2001), Knowledge Codification and the Geography of Innovation: The Case of Brescia Mechanical Cluster, Research Policy 30, forthcoming.

LAZERSON M H and LORENZONI G (1999), The Firms that Feed Industrial Districts: A Return to the Italian Source, Industrial and Corporate Change, vol. 8, N. 2.

LORENZEN M (2001), Localized Learning and Policy: Academic Advice on Enhancing Regional Competitiveness through Learning, European Planning Studies, Vol. 9, No. 2.

LUNA F and PERRONE A (Eds.) (2001), Agent-Based Methods in Economics and Finance: Simulations in Swarm, Kluver Academic Publishers, Boston/Dordrecht/London.

LUNA F and STEFANSSON B (Eds.) (2000), Economic Simulations in Swarm: Agent- Based Modeling and Object Oriented Programming, Kluver Academic Publishers, Boston/Dordrecht/London.

LUNDVALL B- K (1999), "Technology Policy in the Learning Economy", in Archibugi D, Howells J, and Michie J (Eds.), 1999, Innovation Systems and Policy in a Global Economy, Cambridge University Press. pp. 19-34.

MALMBERG A and MASKELL P (1997), Towards an Explanation of Regional Specialization and Industry Agglomeration, European Planning Studies, Vol. 5, Issue 1.

MARCH J G (1991), Exploration and Exploitation in Organizational Learning, Organization Science, 2, 1. pp. 71-87.

MARENGO L, WILLINGER M (1997), Alternative Methodologies for Modeling Evolutionary Dynamics: An Introduction, Journal of Evolutionary Economics, 7, 4. pp. 331-338.

MEYER-STAMER J M (1999), From Industrial Policy to Regional and Local Location Policy: Experience from Santa Caterina/Brazil, Bulletin Latin American Research, Vol. 18, No. 4. pp. 451-468.

NELSON R R (1998), "The Co-Evolution of Technology, Industrial Structure, and Supporting Institutions", in Dosi G, Teece D J, and Chytry J (Eds.), Technology, Organization, and Competitiveness. Perspectives on Industrial and Corporate Change, Oxford University Press, New York. pp. 319- 335.

NOOTEBOOM B (1999), Learning, Innovation and Industrial Organization, Cambridge Journal of Economics, 2. pp. 127-150.

NOOTEBOOM B (2000), Learning by Interaction, Absorptive Capacity and Governance, Journal of Management and Governance, 4, 1/2. pp. 69-92.

NORTH D C (1990), Institutions, Institutional Change, and Economic Performance, Cambridge University Press, Cambridge.

PARRI L (1991), Politiche regionali per l'innovazione tecnologica: Rhône-Alpes ed Emilia Romagna, Stato e Mercato, 31. pp. 77-115.

PILOTTI I (2000), Networking, Strategic Positioning and Creative Knowledge in Industrial Districts, Human System Management, 19. pp. 121-133.

RICCIARDI C A, BESONE A and DEBERNARDI M C (1999), "Le relazioni interorganizzative tra PMI: dal rapporto di fornitura alla partnership strategica", in ISTUD (Eds.), Le discontinuità nello sviluppo delle piccole imprese, Il Sole24ore, Milan, Italy. pp. 141-188.

SIGNORINI F L (Eds.) (2000), Lo sviluppo locale. Un'indagine della Banca d'Italia sui distretti industriali, Donzelli, Rome. pp. XIII- XL.

STABER U (2001), The Structure of Networks in Industrial Districts, International Journal of Urban and Regional Research, Vol. 25.3. pp. 537-552.

TERNA P (1998), Simulation Tools for Social Scientists: Building Agent Based Models with Swarm, Journal of Artificial Societies and Social Simulation, vol. 1, 2. <http://www.soc.surrey.ac.uk/jasss/1/2/4.html>.

TERNA P (2001), Creating Artificial Worlds: A Note on Sugarscape and Two Comments, Journal of Artificial Societies and Social Simulation, vol. 4, no.2. < http://www.soc.surrey.ac.uk/jasss/4/2/9.html>.

TULZEMANN VON G N (2000), Technology Generation, Technology Use and Economic Growth, European Review of Economic History, 4. pp. 121-146.

UZZI B (1996), The Sources and Consequences of Embeddedness for the Economic Performance of Organizations: The Network Effect, American Sociological Review, vol. 61. pp. 674-698.

VERSPAGEN B (2001), Economic Growth and Technological Change: An Evolutionary Interpretation, Directorate for Science, Technology and Industry, OECD, Working Paper 2001/1.

WHITFORD J (2001), The Decline of a Model? Challenge and Response in the Italian Industrial Districts, Economy and Society, vol. 30, No. 1. pp. 38-65.

YOU J- I and WILKINSON F (1994), Competition and Cooperation. Towards Understanding Industrial Districts, Review of Political Economy, 6, 3. pp. 259-278.

Return to Contents of this issue

© Copyright Journal of Artificial Societies and Social Simulation, [2002]