Abstract

Abstract

- In this paper, we investigate the interactions among

oligarchs, political parties, and voters using an agent-based modeling

approach. We introduce the OLIGO model, which is based on the spatial

model of democracy, where voters have positions in a policy space and

vote for the party that appears closest to them, and parties move in

policy space to seek more votes. We extend the existing literature on

agent-based models of political economy in the following manner: (1) by

introducing a new class of agents – oligarchs – that represent leaders

of firms in a common industry who lobby for beneficial subsidies

through campaign donations; and (2) by investigating the effects of

ideological preferences of the oligarchs on legislative action. We test

hypotheses from the literature in political economics on the behavior

of oligarchs and political parties as they interact, under conditions

of imperfect information and bounded rationality. Our key results

indicate that (1) oligarchs tend to donate less to political campaigns

when the parties are more resistant to changing their policies, or when

voters are more in-formed; and (2) if Oligarchs donate to parties based

on a combination of ideological and profit motivations, Oligarchs will

tend to donate at a lower equilibrium level, due to the influence of

lost profits. We validate these outcomes via comparisons to real world

polling data on changes in party support over time.

- Keywords:

- Multi-Agent Models, Lobbying, Public Choice, Bounded Rationality, Voting Behavior, Social Simulation

Introduction

Introduction

- 1.1

- Oligarchs are defined in the political economics literature

as leaders of firms in a common industry that has barriers to entry (Stigler 1964; Acemoglu 2008). The term oligarch

refers to a broad class of individuals – broadly speaking, members of

"interest groups" (Downs 1957)

or "pressure groups" (Rubin 1975)

for leaders of firms in an industry with barriers to entry, which lobby

the government for legislative action to favor their common interest.

Examples of oligarchs include "economic groups," such as industries and

corporations (Stigler 1971),

and "privileged groups" of individuals with a common interest, such as

trade associations (Olson 1965).

Oligarchs in an industry may tacitly collude, without directly

communicating with each other, seeking to "capture" legislation that

benefits them (Stigler 1964).

- 1.2

- Pressure groups may be able to capture legislation through

their influence, even in cases where the legislation benefits the

oligarchs but has a cost to the rest of society (Stigler 1971). Special

interest groups can obtain benefits, at a cost to the voters, because:

(1) voters have imperfect information about politics and may not know

the special interest benefits exist; and (2) political parties are

willing to risk alienating voters by favoring special interests, if the

parties are rewarded with campaign contributions that make up for the

votes lost (Rubin 1975; Stigler 1971).

- 1.3

- Empirical research shows that oligarch spending influences

political outcomes in the US. Gilens and Page (2014)

found that economic elites and business-oriented interest groups both

had independent influences on policy outcomes, but the median voter did

not. In a related study, Baumgartner, Berry, Hojnacki, Leech, and

Kimball (2009)

concluded that trade associations (e.g., the American Petroleum

Institute) and corporations are more likely to mobilize effectively on

an issue of particular interest to them than mass-based interest groups

(e.g., labor unions, American Association of Retired Persons). Based on

these studies, Gilens and Page (2014)

have fittingly claimed that American democracy is subject to "economic

elite domination" and "biased pluralism," where biased pluralism means

that business-oriented interest groups have a disproportionately large

effect on policy outcomes.

- 1.4

- In this paper, we investigate the interactions among

oligarchs, political parties, and voters using an agent-based modeling

approach. We introduce the OLIGO model, which is based on the spatial

model of democracy (Kollman,

Miller, & Page 1992; Laver

2005), where voters have positions in a policy space and vote

for the party that appears closest to them, and parties move in policy

space to seek more votes. We extend previous work by Laver in the

following manner: (1) by introducing a new class of

agents—oligarchs—that represent leaders of firms in a common industry

who lobby for beneficial subsidies through campaign donations; and (2)

by investigating the effects of ideological preferences of the

oligarchs on legislative action.

- 1.5

- In doing so, we extend the literature by contributing a new

model of special interest groups' campaign donations that combines

elements from agent-based models of voter-party interaction (Kollman, Miller, & Page 1992;

Laver 2005), with

elements from economic models of special interest group behavior (Rubin 1975; Bardhan & Mookherjee 2000).

We verify the model's correctness with a series of basic hypothesis

tests, such as to show that Parties in our model adopt a mean

ideological position near the center of policy space. Furthermore, we

validate the model's fit to real world data by comparing changes over

time in Party support in our model with 10 years of nationwide polling

data on party support in the US. We also provide results from novel

simulation experiments where oligarchs have ideological preferences,

and show that oligarchs have a lower equilibrium level of political

action and influence, when they allow ideological rather than profit

motivations to guide their campaign donations. That is, if oligarchs

choose which party to support based on ideological goals instead of

expected profits, and adjust their donation levels based strictly on

subsequent profits, then equilibrium donation levels will be lower.

- 1.6

- Our work accomplishes the following goals: (1) We show that the simple rules agents follow in our model are sufficient to capture much of the complex dynamics of this politico-economic system; (2) we verify and validate the results from prior studies that used analytic methods, using an alternative, agent-based modeling method; (3) we propose a novel finding regarding the nature of the equilibrium state of campaign donations of oligarchs with ideological preferences; and (4) we derive support for the claim that the OLIGO model is a useful test environment for novel hypotheses about oligarchs' campaign donation behavior.

Politico-Economic

Models and Agent-Based Models (ABMs)

Politico-Economic

Models and Agent-Based Models (ABMs)

-

Prior work on Politico-Economic Models using ABM

- 2.1

- Political scientists have studied oligarch behavior, or

special interest group behavior in general, through building

"politico-economic models" (Frey

& Schneider 1975). The economic theory of politics

provides a theoretical foundation for these models, in the idea that

politics can be understood as a competition for influence among agents

who seek to increase their own individual utilities. In a

politico-economic model, parties compete for votes, and special

interest groups seek to increase profits by competing for political

influence and beneficial legislation. During a run cycle of a typical

politico-economic model, a "popularity function" executes, where voters

vote for the party with the most favorable policy position, and a

"reaction function" executes, where parties change their policy

positions to seek more votes in the next cycle (Frey

& Schneider 1975). Examples of such models include

Rubin (1975), Aumann and

Kurz (1977), and Brock and

Magee (1978).

- 2.2

- More recently, Grossman and Helpman (1996) presented a model where

two political parties compete for votes in a policy space with two

issue dimensions. In this model, some voters are "informed" and others

are "uninformed," where informed voters have more accurate knowledge

about parties' positions in policy space and are less susceptible to

campaign advertising. Bardhan and Mookherjee (2000)

developed a model that is especially similar to the model we will

present here, although Bardhan and Mookherjee's model is analytic

rather than agent-based. Bardhan and Mookherjee's model has two

political parties competing for votes in an environment with one lobby

group and voters who are either informed or uninformed. Informed voters

vote for the party that maximizes their utility, while uninformed

voters vote for whichever party spends more on campaigning.

- 2.3

- The dynamics among oligarchs, voters, and political parties

make up a complex, emergent system, where aggregate outcomes, such as

the mean tax rate over time, emerge from interactions between

individual agents. For example, parties do not follow any explicit rule

that tells them to remain near the center of policy space or to favor

oligarchs' preferences, but these party behaviors emerge from the joint

influence of voters and donors. Similarly, special interest group

members are not compelled to donate more money to a political campaign

when voters are more susceptible to advertising, but theorists contend

that campaign donors do behave in this way (Grossman

& Helpman 1996). A political party's donation total

emerges from influences like voters' reactions to advertising and

oligarchs' tendency to free ride or to cooperate by making a donation.

- 2.4

- A multi-agent-based model does not gloss over differences

among agents that may affect their behavior, in order to derive an

analytic equilibrium solution. Instead, it retains much of the

complexity of the real world system, modeling outcomes as samples from

a stochastic process in which many distinct agents evolve over time.

Therefore, such an approach may be preferable to differential

equation-based approaches traditionally used by political economists (Bardhan & Mookherjee 2000).

Political economics models have several characteristics that make the

agent-based approach especially useful. Agents in an economic model of

politics are assumed to act in self-interest. Aggregate outcomes such

as parties moving toward the preferences of the median voter emerge

from the interaction of many self-interested agents, as in an

agent-based model. Furthermore, agents in a voter-party model have

incomplete information about the state of the system, such as what each

party would do if in office, or what each voter would do if the parties

changed policy positions. Agent-based models are appropriate tools for

modeling complex systems such as this, where there is limited

information and bounded rationality. Finally, agent-based models are

fully observable as they progress, so it is feasible to analyze their

outcomes and changes over time in ways that may not be possible in

analytic models.

- 2.5

- Kollman, Miller, and Page (1992)

presented a seminal agent-based model of interactions between voters

and political parties. In this model (known as the KMP model), two

parties compete for votes from a set of voters. Voters in the model

know each party's position in policy space and vote for the party that

is closest to them. Parties can change their positions in a discrete

policy space with 15 dimensions and 7 possible values in each

dimension. Parties seek either to maximize votes or to maximize a

function of votes and distance from a preferred policy position. The

authors tested a variety of party strategies, to evaluate which

strategies would allow parties to compete most effectively and maximize

expected utility over time. Laver (2005)

extended this work by developing a new agent-based model of voter-party

interactions. In this model, the policy space has only two dimensions,

so it is easier to visualize. Laver introduced a new strategy, called

the Hunter strategy, which performs well in spite of its simplicity. In

this strategy, a party moves again in the same direction across policy

space as in the last cycle, if its votes increased; otherwise, the

party chooses a different direction at random and moves that way. In

this paper, we further extend this literature by introducing Oligarchs

as a new class of computational agents, and by investigating the

effects of ideological preferences of the oligarchs on legislative

action.

Key Definitional Issues

- 2.6

- Before we proceed further, it is important to clarify some

definitional issues regarding the following terms: Oligarch donations,

taxes and the timescale represented by each run cycle in our models.

- 2.7

- In our work, Oligarch "donations" need not be thought of as

only representing campaign contributions in an election year. Donations

can also represent any effort made by a business-oriented interest

group (i.e., an Oligarch) to support a Party or win its favor, at a

cost to the Oligarch.

- 2.8

- The "tax" that distributes income from Voters to Oligarchs

need not be thought of as a direct subsidy to Oligarchs and tax on

Voters, but as any government policy that benefits Oligarchs

financially at a cost to society. Stigler (1971)

lists common examples such as a protective tariff, regulatory barriers

to market entry for competitors, and price controls; Smith (2000) adds increased government

spending in the oligarchs' industry and corporate tax exemptions; and

Olson (1965) also notes lax

regulatory policies as a favor to an industry that costs society

something. Hence, it is plausible that the "tax rate" in our model may

fluctuate more rapidly and widely than real tax rates typically do,

because it represents the effect of particularistic policies that are

apt to change rapidly.

- 2.9

- Laver (2005)

explained that his model does not depict election campaigns with its

discrete time steps, but rather simulates continual change in party

positions and voter intentions. Kollman, Miller, and Page (1992) specified that in their

model, parties learn about voter intentions of how to vote through

"test elections," or opinion polls, not only through election year

results. The OLIGO model, as is typical in agent-based models of

democracy, lets the most recent winning Party set the policy at each

step, which in the context of continuous updating can be viewed as

letting the Party with greater mandate in current Voter support set

policy. To validate the rate at which party support changes over time

in our model, we ran our model for 120 steps after the warm-up period

and compared the change in party support at each cycle to data from 10

years of monthly opinion polls on US voter support for the Democratic

and Republican parties, based on data from monthly Gallup polls

collected from January 2004 to December 2013 (Gallup

2014). The Gallup poll asked voters if they are Democrats,

Democrat leaning, Republicans, Republican leaning, or independent. It

is important to note that given our goal of creating a model that can

be validated by empirical data from the Gallup poll surveys, we

directly adopted and implemented these categorical definitions in our

model. We added the percentages for each category, to produce a time

series of voters who would vote for each party. In constructing our

time series of party support in this way, we assume that surveyed

voters who support or lean toward a party would be more likely to vote

for a candidate of that party, if an election were held immediately.

- 2.10

- Our results indicate that variations on our basic model called the Party-Ideo-Motivated Model and the All-Ideo-Motivated Model match the polling results closely in terms of variance over time and central tendency, as will be shown in the results section. Although 1000 steps representing 1 month each represents 83 years of real time, too long for our model to plausibly represent, this longer number of steps is helpful for steady state parameter estimation, and we will show that the behavior of our model over shorter intervals is consistent with trends in real world polling data.

The

OLIGO model

The

OLIGO model

- 3.1

- In this section we present a description of the OLIGO

model, based on the ODD (Overview, Design concepts, Details) protocol (Grimm et al. 2006). The OLIGO

model is implemented in NetLogo (Wilensky

1999). The model's source code can be found at

http://www.openabm.org/model/3990/version/1/view. The description given

here concerns our basic model, which we will refer to as the

Ideo-Indifferent Model (IIM) when necessary for clarification. Two

variant models, the Party-Ideo-Motivated Model (PIMM) and

All-Ideo-Motivated Model (AIMM), are introduced at the end of this

section.

Purpose

- 3.2

- To investigate how oligarchs (i.e., owners of firms in an

industry with barriers to entry by new firms), could decide how much to

invest in lobbying democratic parties for subsidies, and how responsive

parties might be to influence from the oligarchs' campaign donations,

in light of politicians' goal of increasing their votes.

Entities, state variables, and scales

- 3.3

- Our model contains three entity types: Oligarchs, Parties,

and Voters. 5 Oligarchs, 2 Parties, and 100 Voters are created for each

model run. These entity types interact as follows: Oligarchs donate

money to the Party that advocates a higher redistributive tax in favor

of the Oligarchs, and Oligarchs receive money from the tax enacted by

the winning Party after each election. Parties receive votes from

Voters and receive money in the form of campaign donations from

Oligarchs. The incumbent Party sets the tax rate that redistributes

money from Voters to Oligarchs. Voters give votes to the Party that

appears closer to them in policy space, based on their policy position,

their salience along the olig and ideo

axes, and the amount of campaign funding each Party has received.

Voters give money to Oligarchs based on the tax rate.

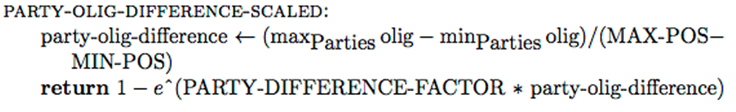

- 3.4

- All entities in the model are positioned in a policy space,

which has two axes: the ideo axis, representing the

ideological dimension of political belief, and the olig

axis, which represents the special interests of Oligarchs. The level of

the tax on Voters that funds the Oligarchs' subsidy is determined by

the incumbent Party's position on the olig policy axis. Oligarchs

donate money exclusively to the Party with higher olig position, and

Voters all hold the minimum position along the olig axis. Voters are

distributed along the ideo axis, in contrast, from a random normal

distribution with mean at the center (0), and with a standard deviation

of 1/3 the radius of the space along that axis (Laver

2005). While the olig axis determines the level of

redistributive tax on Voters producing a subsidy to Oligarchs, the ideo

axis represents the spectrum of Voter beliefs on other political

issues. As such, the ideo axis may be thought of as the "principal

component" of Voter beliefs that are "orthogonal to" beliefs about the

desirable level of subsidy to Oligarchs. In the real world, this axis

might represent the continuum of conservative to liberal views on

social issues.

- 3.5

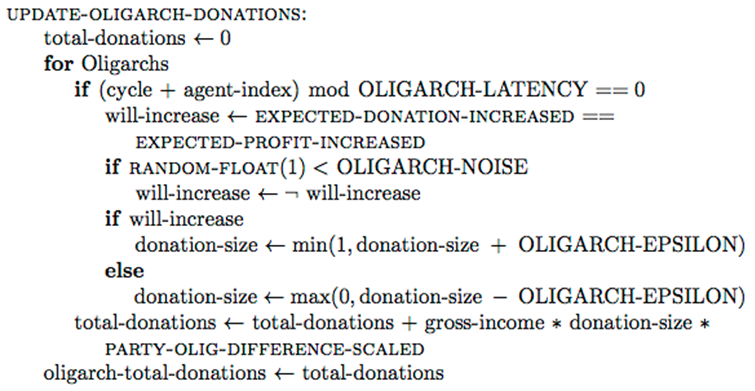

- Oligarchs seek to increase profits,

which represent the difference between their subsidy and the amount

spent on campaign contributions. Their only available action is to

increase or decrease their campaign contribution by a fixed step size.

Each Oligarch has a gross-income constant

representing the amount of money the Oligarch earns at each time step.

An Oligarch has a donation-size variable indicating

the fraction of its gross-income it can donate to the Party that

proposes a higher redistributive tax. The effect of the party policy on

the net income of oligarchs is represented as subsidy

to oligarchs. The Oligarch can change its donation-size over time to

adapt to its environment. Each Oligarch has a memory of the most recent

subsidy it received, and uses this knowledge to decide whether to

increase or decrease its donation-size proportionally.

- 3.6

- Note that in our model, the gross-income

constant represents the oligarch's income before the

effect of political policy (i.e., subsidies) and the oligarch's

campaign donations. Allowing an oligarch's gross income, before subsidy

and campaign donations, to vary based on factors such as incumbent

party ideo position, would be an interesting extension to the model,

but it is beyond the scope of the present work, given our focus on

identifying the relationship between subsidies and the oligarch's

donation.

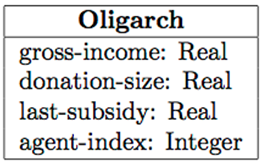

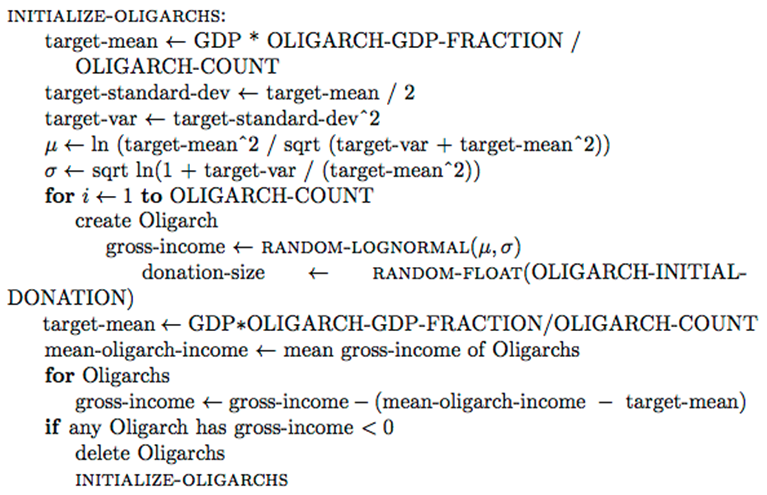

Figure 1. Oligarch entity variables. - 3.7

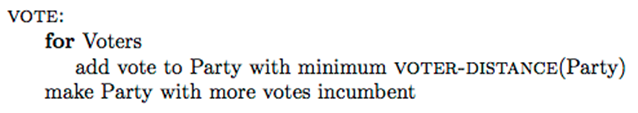

- Voters seek to minimize the distance of the incumbent Party

from themselves along the ideo policy axis, and to decrease the tax

they pay. Voters are modeled as reflex agents, which increase the

salience they ascribe to the olig axis with greater probability when

the tax rate is high. Voters have a position along the ideo policy

axis. Voter positions along the ideo axis are initialized randomly from

a normal distribution. Voters have an olig-salience

variable (Figure 2), which

represents the relative salience a Voter ascribes to the olig policy

axis, compared to the ideo policy axis. For example, a Voter with an

olig-salience of 1/3 will consider its distance from a Party along the

olig axis to be only half as important as its distance from the Party

along the ideo axis. A two-dimensional policy space with salience has

been used in prior models, such as De Marchi (1999).

Voters choose to vote for the Party that appears to be closer in policy

space, based on the Party's policy position, the Voter's olig-salience

value, and the level of campaign contributions the Party has received.

The more campaign donations a Party receives from Oligarchs, the closer

it will appear to each Voter, and the more likely it will be to win

many votes.

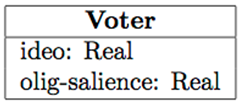

Figure 2. Voter entity variables. - 3.8

- Parties seek more votes, by changing their positions in

policy space. Parties have a position along the ideo and olig axes

(Figure 3), and both of these

positions are initialized randomly from a normal distribution with a

standard deviation of 1/3 the radius of the policy space along its

axes. Parties change their positions in policy space along each axis,

at every time step, by a fixed step size in either direction. Parties

have a memory of which way they moved at the last step, and of whether

their vote totals increased or decreased, which they use to decide

which way to move in the next step.

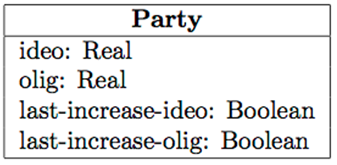

Figure 3. Party entity variables. - 3.9

- We tested model variations where OLIGARCH-GDP-FRACTION was

set to 0.02 or 0.1 instead of to 0.05. Results for these model

variations will be shown in the results section, as increasing Oligarch

income relative to Voter income seems to increase the effect of

Oligarchs' influence on political outcomes. The range of Oligarch

incomes used in our study is comparable to real world revenue for major

US industries and corporations relative to the total economy. That is,

in 2011 the total revenue of Fortune 500 companies was $10.8 trillion,

while the top 12 US-based oil companies had 2013 revenues of $1.4

trillion, and Apple Inc. had 2013 revenue of $170 billion. Major oil

corporation revenue was thus about 13% of the Fortune 500 total in this

period, and Apple Inc. revenue was about 1.6% of the Fortune 500 total (Apple Inc. 2013; CNN Money 2013). So an

OLIGARCH-GDP-FRACTION of 0.01-0.10 appears plausible as a

representation of the revenue of a large corporation or industry.

- 3.10

- Voters have a VOTER-AD-DECAY-FACTOR which affects the

extent to which there is a diminishing return from increased campaign

donations. VOTER-AWARENESS determines how likely a Voter is to increase

its olig-salience value, when there are high tax rates.

VOTER-MEMORY-STRENGTH determines how quickly a Voter's olig-salience

value decreases over time, when the Voter has not noticed high tax

rates recently. And VOTER-MIN-DISTANCE-SCALE is the minimum fraction of

the actual distance to a Party that a Voter can be made to perceive as

the true distance, when a Party has high campaign donations.

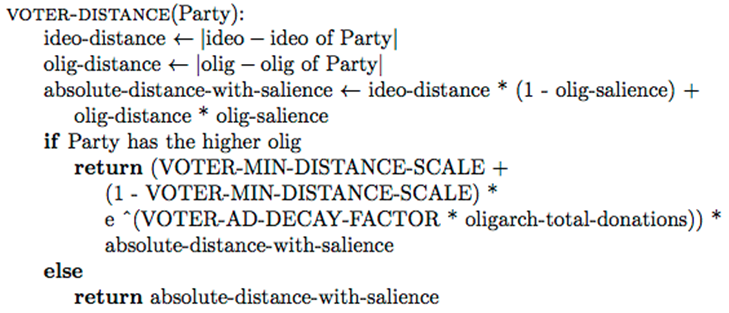

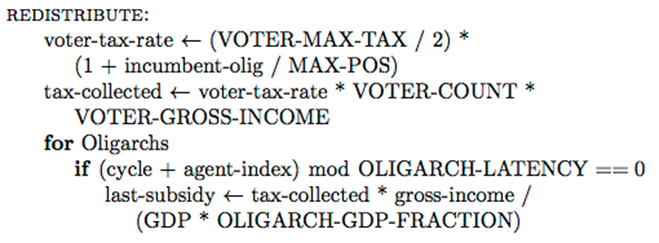

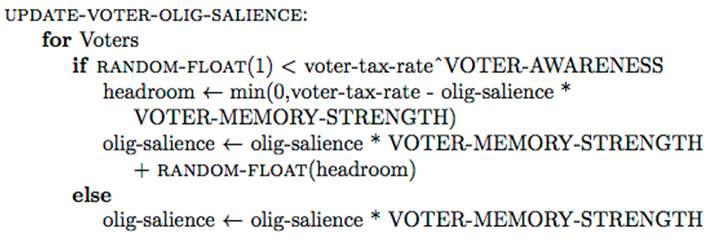

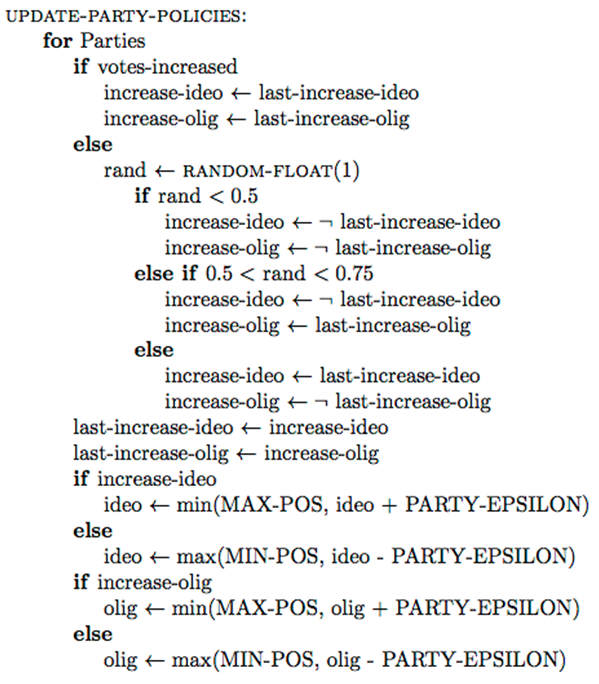

Process overview and scheduling

- 3.11

- After Voter, Oligarch, and Party entities have been

initialized, each run of the OLIGO model consists of 1300 cycles of the

step procedure, of which only the last 1000 are analyzed. We discard

the first 300 cycles of each run to remove the startup effect, or

initial transient bias, that is present before the run reaches a steady

state; this is sometimes called the replication-deletion approach to

analyzing the steady state of a system. We chose 300 cycles as the

length of the discarded warm-up period through Welch's graphical

approach, as described in Law and Kelton (1991).

That is, we plotted the mean profit (our output variable of interest)

across 100 independent runs, against the step number from 1 to 1300,

and converted the plot to a moving average to smooth out noise. We then

selected 300 steps as the number that seemed by inspection to precede a

steady state in the moving average graph. For comparison, Laver (2005) uses 150 cycles of warm-up

and 250-1000 cycles per run.

- 3.12

- At each step, the following events happen, in order: (1)

Oligarchs update their donation-size values, and thus their campaign

donations; (2) Voters vote for the Party that appears closer to them in

policy space; (3) the elected Party sets the tax rate, and money is

redistributed from Voters to Oligarchs; (4) Voters update their

olig-salience values; and (5) Parties update their positions in policy

space (Figure 4). In each of

these stages, entities perform their actions in a random order, but the

model is structured such that the order of agents' actions is

irrelevant within a given stage. One can think of the agents of any

entity type as acting simultaneously. The sequence of stages in each

run cycle is adapted from similar models in the literature, such as

Grossman and Helpman (1996).

- 3.13

- We use a run length of 1000 "steady state" cycles in our

experiments, which may appear to be quite long. The benefit of long run

duration is less noise in estimates of steady state model behavior, and

this benefit may be why Laver (2005)

also used runs of length up to 1000 cycles. As we discussed in an

earlier section, similar to Laver (2005)

and Kollman, Miller, and Page (1992),

our model represents continuous adaptation of Parties and Voters

between elections. Thus a single run cycle may be viewed as the

shortest interval in which parties can react by adjusting their

policies to a perceived change in public support. For example, an

opinion polling cycle may be the closest real system equivalent to a

run cycle, rather than an election cycle.

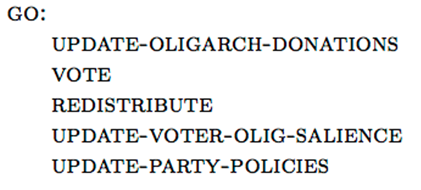

Figure 4. Main module. Pseudocode for the submodels will be introduced below. Design concepts: Basic principles

- 3.14

- The OLIGO model fits into the class of "partial

politico-economic models" (Frey

& Schneider 1975), as it represents interactions

between firms motivated by profit and political parties motivated by

votes. We model Voters and Parties with policy vectors in a

two-dimensional space, where Voters vote for the Party that appears

closer to them. As Blais, Nadeau, Gidengil, and Nevitte (2001) pointed out, some

theorists have suggested using a "directional model" where Voters vote

for the Party whose position is furthest from center in the same

direction as the Voter along each policy axis, but the "proximity

model" described here is more prevalent and has been more strongly

supported by prior studies.

- 3.15

- The OLIGO model follows in the tradition of Downs (1957) by modeling utility

seeking voters and vote seeking parties, but with bounded rationality

and uncertainty leading to heuristic behavior rather than optimizing

behavior. Downs' model includes interest groups as "favor buyers" who

use campaign donations or other benefits to seek influence in party

policies, which reflects the Oligarchs in our model. The number of

Oligarch agents in our model is fixed over time, and the Oligarchs

tacitly collude, without communicating with each other, to capture

legislation in their benefit (Stigler

1964). Oligarchs are thus a "privileged group" in Mancur

Olson's terms, as there are few enough of them and their interests are

close enough that they are all likely to invest in helping the group

politically, even without being compelled to (Olson

1965). We model this special interest legislation as a direct

subsidy to the Oligarchs, paid for by the Voters, who are also the

taxpayers (Stigler 1971; Becker 1983; Aumann & Kurz 1977). At

each step of a model run, Oligarchs decide how much to donate to the

campaign of the Party that proposes a higher redistributive tax in

their favor (Rouchier &

Thoyer 2006; Becker 1983).

Oligarchs seek to increase their expected profit, which is the

difference between the subsidy they expect to receive and the donation

they make to a Party (Becker 1983).

We assume that Oligarchs donate only to one Party, the Party that

proposes a higher redistributive tax (Brock

& Magee 1978; Rubin

1975).

- 3.16

- Oligarchs in our basic model, called the Ideo-Indifferent

Model (IIM), and the Party-Ideo-Motivated Model variation (PIMM) have

no preference over Party positions on the ideo axis, so the Oligarchs'

donations are based entirely on Party olig positions. Recall that the

winning Party olig position determines the amount of the subsidy

Oligarchs receive, so only the olig axis affects Oligarchs' profits.

Thus, the Oligarchs' common business interests are modeled as

orthogonal to the ideological interests of Voters. We relax this

assumption in the All-Ideo-Motivated Model (AIMM), a variant of the

model introduced below. But there is reason to model Oligarchs'

political preferences as orthogonal to the core interests of Voters on

the ideo axis. Smith (2000)

notes that political action committees (PACs) generally seek

"particularistic" policy change, not "unifying" policy change. That is,

PACs seek policies that affect a narrow constituency and are not highly

salient to most voters. PACs direct their funds mainly to issues that

are "narrower, less visible" and lack a "mass opinion" of the public.

These policies are not partisan but can be supported equally well by a

conservative or liberal party. Baumgartner, Berry, Hojnacki, Leech, and

Kimball (2009) found

that lobby groups' agendas were different from that of the general

public, in that most issues addressed by special interest lobbyists

received little press coverage and were unknown to most voters.

- 3.17

- The political system in our model has two Parties that

compete in a winner-take-all election at every step of a run, where the

winning Party sets the tax rate for all Voters (Bendor,

Diermeier, & Ting 2003; Brock

& Magee 1978; De

Marchi 1999). Building on Laver (2005),

parties in our model follow a "Hunter" strategy as they seek to

increase votes. In a Hunter strategy, an agent will repeat its previous

action if the agent received an improved payoff in the most recent run

cycle; otherwise, the agent chooses an action that is somehow the

opposite of its previous one. In our model, Parties will move in policy

space in the same direction as they moved in the last step, if their

votes increased; otherwise, they will move in a different direction. We

model Parties as being influenced indirectly by donations from a

special interest lobby, as suggested by Rouchier and Thoyer (2006) and by Stigler (1971).

- 3.18

- Voters in the OLIGO model vote for the closer Party in

policy space, adjusted for the Voter's salience value along each axis,

and for the campaign donations each Party received. We use Voter

salience differences along policy dimensions to model the way Voters

are generally ignorant about special interest legislation unless they

have been significantly harmed by that legislation, which may allow

oligarchs in an industry group to capture a redistributive tax (Stigler 1971; Becker 1958; McKelvey & Ordeshook 1986;

Baumgartner, Berry,

Hojnacki, Leech, & Kimball 2009).

- 3.19

- Following Stigler (1971),

Voters in our model are more likely to increase the salience value they

assign to the olig dimension, the higher the current tax rate. The tax

assessed to a Voter can be seen as a message that has some probability

of causing the Voter to increase its olig-salience, which is greater

the higher the tax rate (Rubin 1975;

Aidt 2000). When Voters

do not receive the message that they are being taxed, their

olig-salience levels decrease exponentially along a forgetting curve,

similar to the exponential forgetting model proposed by Ebbinghaus (1913) and used recently in

a political economics model by Aidt (2000).

- 3.20

- Muis (2010)

created a model where a Party's apparent distance from a Voter is

reduced when the Party spends more on campaigning, up to a minimum

fraction of the true distance. Our model combines all these approaches

to account for the effects on Voter preferences of campaign spending

and Voter salience along each policy dimension.

- 3.21

- To simplify our model, we assume that Voters do not make

campaign donations (Baron 1994).

This reflects voters' status as a "large, latent group" (Olson 1965). Olson (1965) used this phrase to

indicate that voters are so numerous and diverse in their interests

that they have little incentive individually to invest in political

influence. We further assume that Voters do not change their policy

positions over time (Muis 2010;

Laver 2005); that all

Voters have the same gross-income (Becker

1983); and that Voters vote in every election (Dixit & Londregan 1996).

- 3.22

- We model Oligarchs, Voters, and Parties as myopic agents

that seek to recover from a misstep that was punished in the previous

cycle, or to repeat a reward that was earned in the previous cycle. The

"win-stay-lose-shift" adaptive heuristic the agents follow is

traditional in agent-based modeling and has been used in many other

agent-based models of political behavior (Kollman,

Miller, & Page 1992; Laver

2005). Even traditional non-agent-based models of political

behavior assume that parties seek to maximize only present votes, not

discounted future votes (Downs 1957).

Laver (2005) describes his

agents as "adaptive agents" that "look backward and learn from the

past" using heuristics, not "hyperrational agents" that "look forward

strategically." This convention in political economics models is

justified by the realities of political systems, where political

parties are not perfectly rational or informed. Gilens and Page (2014) note that parties lack

the information and reasoning ability necessary to optimize their

policies and maximize votes. Instead, parties must adapt to poll data

using simple rules. Thus, it is reasonable for the OLIGO model to treat

Party, Voter, and Oligarch behavior as myopic and adaptive rather than

optimizing.

Design concepts: Emergence

- 3.23

- The OLIGO model captures the emergent behavior of

Party-Voter models such as Laver (2005)

and Muis (2010). Parties in

these models tend to stay near the median Voter's position along the

ideo policy axis, even though there is no rule specifying that they

must do so.

- 3.24

- The OLIGO model introduces a new layer of complexity by

adding Oligarch agents to the system. Party positions along the olig

axis do not tend to align with the median Voter's, but seem to be

pulled toward the Oligarchs' position by campaign donations from the

Oligarchs. Parties do not follow any rule that tells them to adjust

their policy positions to seek donations. Parties seek only to increase

votes, yet campaign donations indirectly lead Parties to promote

Oligarchs' interests. Moreover, Oligarchs' donation levels emerge from

the interaction among Oligarchs, Voters, and Parties, such that a

change in the conditions of any agent type can alter the average level

of Oligarch donations over time.

Design concepts: Adaptation

- 3.25

- Voters in the OLIGO model adapt over time to prevent

Parties from imposing too high a redistributive tax, while also

preventing Parties from drifting too far from the center along the ideo

policy axis. Voters adjust the relative importance of the olig and ideo

policy dimensions by increasing their olig-salience value with a

certain probability, which is greater when the tax rate is high, and

otherwise allowing the olig-salience value to decay exponentially along

a forgetting curve.

- 3.26

- Parties adapt to changing olig-salience values among

Voters, the changing position of their opposing Party, and changing

donation tendencies among Oligarchs, by updating their positions in

policy space. Parties follow a Hunter rule to decide how to update

their policies in pursuit of votes.

- 3.27

- Oligarchs adapt to changing Party positions, Party chances

of winning election, Voter olig-salience values, and other Oligarchs'

donation sizes by updating their donation size. Oligarchs follow a

Hunter strategy in pursuit of profit.

Design concepts: Objectives

- 3.28

- Voters vote for the Party that seems to be closest to their

position along the olig and ideo axes, adjusting for the relative

importance of the two dimensions. Voters assign a relative salience

value to the issue dimensions based on how strongly the voter has been

affected by each issue recently. Each Oligarch aims to increase net

profit, which is its gross-income plus the amount it collects from a

government subsidy, minus the amount it spends on lobbying. Each Party

seeks to increase the votes it will receive in the next election.

Design concepts: Learning

- 3.29

- During a model run, all three entity types learn effective

strategies for their environments. Voters learn a level of

olig-salience that will protect them from high taxes while also making

it likely that the incumbent Party will be near them along the ideo

axis. Parties learn a policy position that will win many votes against

most other positions. And Oligarchs learn a donation level that tends

to increase their profit.

Design concepts: Prediction

- 3.30

- Agents in the OLIGO model do not attempt to predict future

outcomes. They merely repeat actions that have been beneficial in the

past and avoid actions that have been harmful.

Design concepts: Sensing

- 3.31

- Voters in the OLIGO model can detect the location of each

Party in policy space, but with a distortion effect that makes a Party

appear closer to the Voter, the more campaign donations it received.

Voters remember how much tax they paid in the previous run step.

- 3.32

- Parties remember how many votes they received in the

previous run step, but they do not know the other Party's position, the

positions of Voters, the donation policies of Oligarchs, or even their

own positions. The Parties' Hunter strategy allows them to adapt to

changing conditions even with limited knowledge of model state.

- 3.33

- Oligarchs can detect which Party proposes a higher subsidy

and the difference in the proposed subsidy between the two Parties.

Oligarchs remember whether they increased or decreased their donation

level in the previous run cycle, and whether their profit increased or

decreased.

Design concepts: Interaction

- 3.34

- Voters in the model give votes to Parties, which influences

the Parties' behavior, because the Parties attempt to increase their

votes. Voters decide which Party will become the incumbent through

their voting. The incumbent Party sets the tax policy, which takes

money from Voters and redistributes it to Oligarchs. Oligarchs donate

money to the Party that proposes a higher tax, which influences Voters'

vote choices and indirectly affects the policy positions of Parties.

Design concepts: Stochasticity

- 3.35

- Many elements of the OLIGO model are randomized, or

stochastic. In the initialization of a model run, Party positions are

picked from a random normal distribution along the ideo and olig axes,

and Voter ideo positions are picked from a random normal distribution,

as in Laver (2005).

Oligarch gross-incomes are drawn from a random lognormal distribution,

a common model of income distribution (Salem

& Mount 1974).

- 3.36

- During a run cycle, Parties and Oligarchs act as Hunter

agents, which means that if their previous action did not improve their

outcome, they will choose a different action at random. Voters act as

probabilistic reflex agents when they update their olig-salience

values, as they will not always "notice" a high tax rate and update

their olig-salience in response, although they likelihood a Voter will

increase its olig-salience strictly increases with the tax rate. In the

case of a tie in an election or a voter equidistant from both Parties,

the winning Party or vote recipient is decided by a fair random draw,

as in Bendor, Diermeier, and Ting (2003).

Design concepts: Observation

- 3.37

- For each cycle of each model run, we recorded the Parties'

mean position along each policy axis, the difference between the

Parties' positions along each policy axis, the tax rate, the Voters'

mean olig-salience value, the Oligarchs' mean donation size, whether

the incumbent Party was closer to the center of the ideo axis than its

opponent, and whether the incumbent Party had a higher olig value that

its opponent.

Initialization

- 3.38

- Before a run begins, 2 Parties, 100 Voters, and 5 Oligarchs

are created. We tested the model with 50 Voters and 5 Oligarchs, as

well as with 100 Voters and 10 or 50 Oligarchs, while total Voter

income and total Oligarch income were held constant. These variations

did not produce meaningful differences in outcomes, so the model

appears robust to changes in the ratio of Voter count to Oligarch

count.

- 3.39

- As noted above, Parties are initialized with ideo and olig

positions drawn from a normal distribution with mean 0 and standard

deviation 1/3 the radius of each policy axis, as in Laver (2005). Voter ideo positions are

drawn in the same manner. A redraw is taken for any value outside the

range from MIN-POS (-100) to MAX-POS (100). Voters' olig-salience is

initialized to 0.

- 3.40

- We also tested a version of the model where Voter ideo

positions were drawn from a bimodal distribution, but the results were

not significantly different from results with the unimodal

distribution. We chose a bimodal distribution as an alternative because

it can represent a polarized population of voters, as suggested by

Downs (1957). We

constructed the distribution using a mixture of Gaussians to represent

polarized voter positions as in (Di

Maggio, Evans & Bryson 1996). In our bimodal

distribution of Voter ideo positions, we constructed an equal mixture

of two Gaussian distributions to have the same overall standard

deviation as our unimodal distribution (33.3), where each of the two

Gaussians had a standard deviation of half that amount (16.7). We

arrived at a Gaussian mixture with norms 28.9 and -28.9, standard

deviations of 16.7, and mixing parameter 0.5.

- 3.41

- Oligarchs are initialized such that their gross-income

values are drawn from a lognormal distribution, which is commonly used

to model the distribution of incomes (Salem

& Mount 1974). A lognormal distribution is

appropriate for modeling income distributions because unlike a normal

distribution, it assigns probability zero to negative values and near

zero probability to very small positive values; and it has been shown

empirically to represent actual income distributions accurately.

Although only 5 Oligarchs are present in the model whose results are

shown, we tested the model with 10 Oligarchs and 50 Oligarchs to ensure

robustness with the small number of samples from a lognormal

distribution. There was no meaningful difference in results with

greater numbers of Oligarchs, while the total Oligarch income was held

constant. Oligarch counts in the range of 5 to 50 appear reasonable as

a model of real privileged groups, as Olson (1965)

notes that most trade associations have 25–50 members, with 1/3 having

fewer than 20, and most contributions to a trade association come from

a small subset of the members.

Input data

- 3.42

- The model does not use data from external sources.

Model Variant: Party-Ideo-Motivated Model

- 3.43

- We present here the Party-Ideo-Motivated Model (PIMM), the

first of two variants on the base OLIGO model that was presented above.

The PIMM was developed to remove a couple of simplifying assumptions of

the Ideo-Indifferent Model (IIM) and to improve the model's fit for

real world data of changes in party support over time.

- 3.44

- The PIMM introduces an ideological motivation for each

Party, in addition to the Parties' vote seeking motives. The two

Parties are distinguished as the blue, liberal Party and the red,

conservative Party. The blue Party has a bliss point along the ideo

axis of -33, the red Party at +33. Moreover, the Parties are unwilling

to adopt ideo policy positions on the "other side" of the opposing

Party's position. For example, the red Party will not adopt an ideo

position less than or equal to the blue Party's.

- 3.45

- The PIMM makes some Voters "loyalists", instead of having

all Voters be "swing" Voters as in the IIM. Loyalist Voters are not

influenced by campaign spending or the olig position of Parties, but

vote based entirely on the positions of the Parties along the ideo

axis. Theorists including Downs (1957)

note that many voters act as loyalists, in that they habitually vote

for the same party or the party that matches their ideology best.

- 3.46

- In the PIMM, a SWING-VOTER-FRACTION parameter of 0.33

indicates that 2/3 of Voters will be loyalists, and only 1/3 of Voters

will alter their votes based on campaign donations or Party olig

position. We chose these parameter settings based on a Pew Research

study that shows approximately 33% of registered voters in the United

States were swing voters, as of 2008. Since 2008, the fraction of

voters classified as swing voters has become smaller, so this parameter

setting is conservative (Pew Research

2012)

- 3.47

- Initial positions of the two Parties along the ideo axis in

the PIMM are at the Parties' bliss points of -33 and +33, rather than

being drawn from a 0-mean Gaussian distribution.

- 3.48

- In the PIMM, if a Party's position update function directs

it to adopt an ideo position that is on the "wrong side" of its

opposing Party's current policy, the Party will instead keep its ideo

position unchanged in that cycle. If a Party's ideo position is on the

"wrong side" of its bliss point (lower than +33 or higher than -33),

the Party adds a bias term to its updated ideo position, which depends

on the distance from its bliss point. The bias term is 0 at the bliss

point and approaches PARTY-EPSILON at the edge of policy space, so that

in the worst case this bias completely cancels a move in the "wrong

direction." For the red Party, the bias term is calculated as

PARTY-EPSILON / (1 + e ^ ((50 - (33 - ideo)) / 8)). The blue Party

function is similar.

Model Variant: All-Ideo-Motivated Model

- 3.49

- Our last model variant is the All-Ideo-Motivated Model

(AIMM), which is derived from the Party-Ideo-Motivated Model (PIMM),

but assigns an ideo preference in favor of "conservative" policies to

the Oligarchs. It is reasonable to assign Oligarchs a preference for

conservative policies because there is real world evidence that

business interest groups typically hold moderately conservative views

on "unifying" issues (Smith 2000).

Smith shows that business interest groups usually adopt conservative

stances on policies that have broad implications for all market

sectors. But Smith notes that a business-oriented interest group may

oppose a conservative, free market policy if the policy could hurt its

profits. For example, an industry lobbying group might support

increased government spending, subsidies, or regulatory barriers to

entry for the group's own industry, even though such policies tend to

increase taxes and government and spending.

- 3.50

- Note that in the AIMM, Oligarchs update their

donation-level values just as in the other models, based on changes in

profits. Oligarchs in the AIMM do not account for the ideo axis

position of the incumbent Party when deciding how to adjust donation

levels, only in deciding which Party to donate to. Oligarchs in the

AIMM can be thought of as industry leaders who seek to maximize

profits, but believe that one way to do so is by supporting the Party

with a certain ideology, regardless of the Party's current policy on

industry-related issues. Thus, the Oligarchs are more likely to donate

to the Party with a preferred ideo axis position, but if campaign

donations do not lead to increased profits, the donation level will be

reduced.

- 3.51

- In our implementation of the AIMM, Oligarchs have a preferred ideo position of OLIGARCH-IDEO = 33, which is moderately conservative. Oligarchs are assigned an OLIGARCH-IDEO-OLIG-RATIO = 0.5, which controls the relative importance of olig and ideo position for Oligarchs considering which Party to support. Because the two axes are weighted equally in our parameterization, Oligarchs donate to the Party whose distance from [olig=100, ideo=33] is least by Manhattan distance. The amount of the donation is based on a function of the Parties' distance from the Oligarchs' bliss point as in IIM and PIMM, but in the AIMM a Party's position along both axes is considered together, leading to a more complex calculation. In brief, the PARTY-OLIG-DIFFERENCE is replaced by PARTY-OVERALL-DIFFERENCE. PARTY-OVERALL-DIFFERENCE is also in the range [0, 1], but it incorporates both policy axes by taking the absolute value of the mean of red's distance minus blue's distance, over each the two axes. To ensure the result is in [0, 1], the difference in distances between red and blue along each axis is divided by the maximum possible difference along that axis before the mean is taken.

Simulation

experiments

Simulation

experiments

- 4.1

- In this section we present: (1) the outcome variables used

to describe the results of model runs, (2) an example run of the model

that should help readers to understand how the model works, (3) the

verification tests we performed to ensure that the model is properly

calibrated, and (4) the results of hypothesis tests where we attempted

to confirm that the model conforms to prior theory on the emergence of

Oligarch and Voter behavior.

- 4.2

- All statistical analyses were performed using the R

statistics program. Experiments were carried out in NetLogo using the

BehaviorSpace extension.

Outcome variables

- 4.3

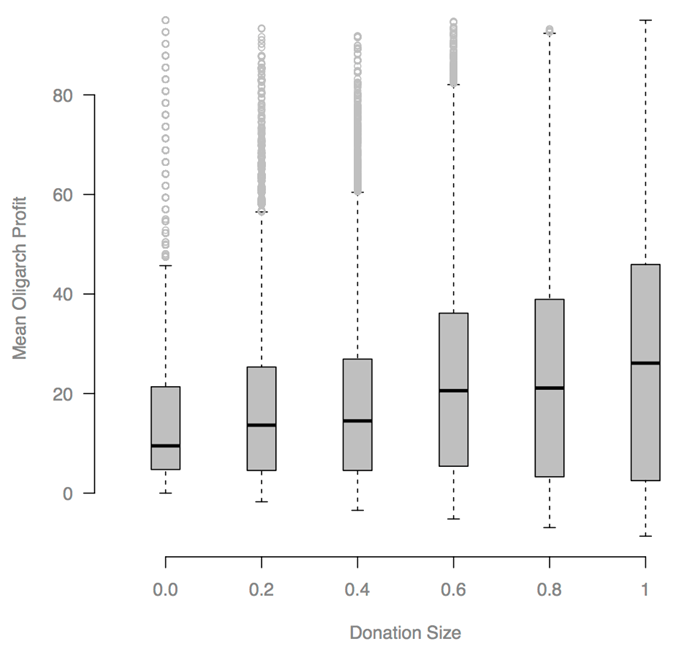

- We used three statistics to measure Oligarchs' success in

capturing a subsidy from the government: the mean voter-tax-rate, the

mean olig position of the Parties, and the fraction of run cycles in

which the winning Party had both the greater olig value and the less

central ideo value (in other words, the greater ideo position absolute

value). The greater any of these statistics, the more successful

Oligarchs were at influencing election outcomes.

- 4.4

- To measure the efficiency of Oligarchs at capturing a

subsidy, we used the mean profit earned by Oligarchs, which is

calculated as the total tax collected, minus the total campaign

donations by Oligarchs, all divided by the number of Oligarchs.

- 4.5

- To measure the campaign donations of Oligarchs, we used the

mean fraction of gross-income donated by Oligarchs, which is the mean

of the Oligarchs' donation-size parameter, times the

PARTY-OLIG-DIFFERENCE-SCALED factor.

- 4.6

- To measure how successful Voters were at keeping Parties

near the center of policy space in the ideo dimension, we used the

absolute value of the mean of the Parties' ideo values.

Typical run description

- 4.7

- We present results from a typical run of the OLIGO model,

to help readers understand basic model behavior. In the example run,

the model was run once for 1300 cycles. In Figures 5,

6, and 9,

we present time series data on the positions of the two Parties, the

mean fraction of gross-income donated to campaigns by the Oligarchs,

and the Oligarchs' mean profit.

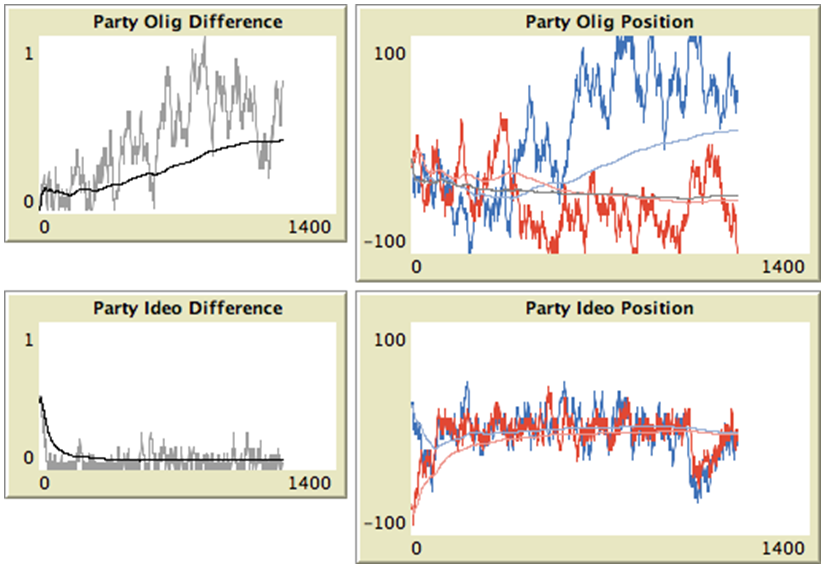

Figure 5. Party position versus time in a typical model run. Left: Gray lines show current difference in olig (top) or ideo (bottom) position between Parties. Black lines show all-time averages. Right: Dark red and blue lines show Parties' current positions in olig (top) or ideo (bottom) dimension. Light red and blue lines show all-time averages for each Party. Gray lines show all-time averages for the incumbent Party. - 4.8

- Note that in a typical model run, Party ideo values tend to

remain near the central value of zero, and they tend to remain close

together. This makes sense, because by the median voter theorem, Voters

evenly distributed about zero on a policy axis will tend to vote for

the Party whose position is closest to zero. A Party that is much

further than its opponent from the center will tend to be punished by

Voters, many of which will find the other Party closer in policy space

and vote for that Party. If a Party is far from the center along the

ideo axis, it will be relatively easy for its opponent to win more

votes, because most positions in policy space will be preferred by the

median Voter to that Party's position.

- 4.9

- Parties' olig values tend to be farther apart than their

ideo values. This is because Voters typically have low olig-salience

values, so they will not punish a Party as heavily for being farther

away along the olig axis as for being farther away along the ideo axis.

This means that a Party could receive more marginal benefit from the

greater donations it receives from Oligarchs by taking a higher ideo

position, than the marginal cost of taking that less popular position

with Voters. As a result, Parties are able to adopt olig values greater

than the minimal value, even though Voters prefer Parties that adopt

the minimum.

- 4.10

- Often during an OLIGO model run, one Party occupies a

significantly higher olig axis position than the other. Although both

Parties' mean olig axis positions have a 95% confidence interval that

includes 0, there is a mean difference between the two Parties' olig

positions in a particular step of 56.4, with 95% confidence interval

[52.5, 60.4]. Recall that the full range of olig space is [-100, 100].

Thus, the two Parties tend to propose significantly different tax rates

(determined by olig axis position) in a given time step, although the

Parties may later switch orientations along this axis so that neither

promotes higher taxes than the other on average. Individual model runs,

as shown in Figure 6, tend to

show occasional spikes in tax rate where a Party with extremely high

olig value is elected, followed by a spike in Voter olig-salience, and

a reduction in tax rates as the elected Party moves to a lower olig

value or is voted out again.

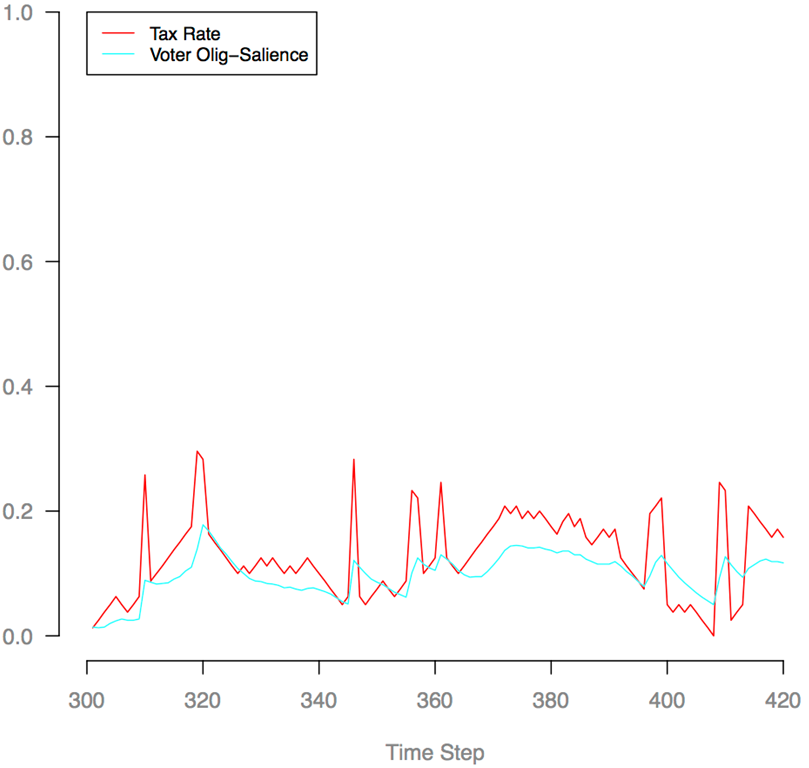

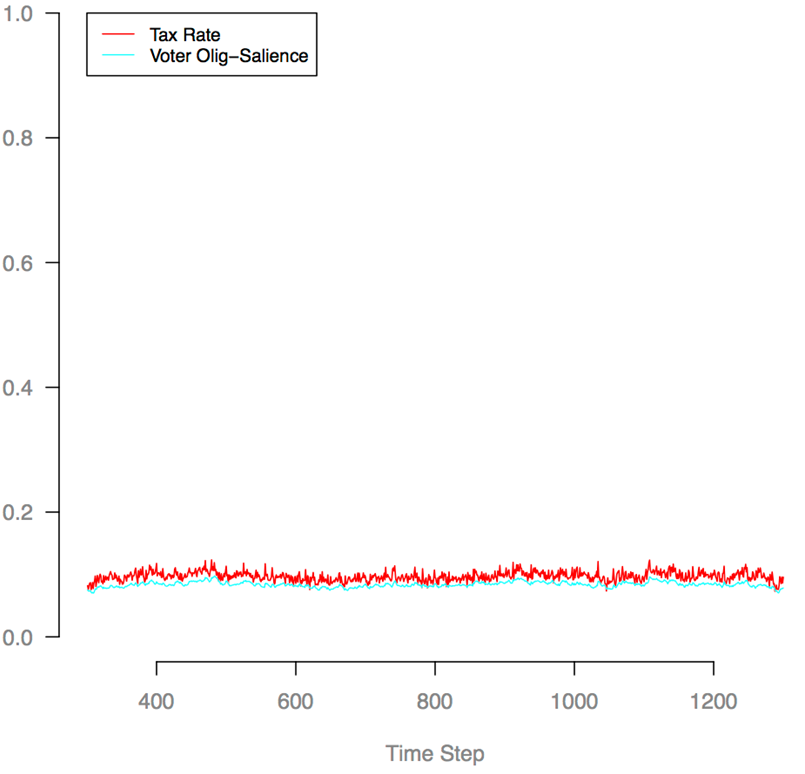

Figure 6. Mean Voter olig-salience and tax rate, versus time step, over a single run of 120 steps after the 300-step warm-up period. - 4.11

- One Party typically breaks away from the other along the

olig axis, adopting a much greater olig value than its opponent, likely

because only one Party can receive donations from the Oligarchs at a

time, so there is more marginal benefit to this Party in seeking

greater donations for itself, than to its opponent in increasing its

olig position to reduce the Oligarch donation amount. In contrast,

Parties frequently trade places being closer to the center along the

ideo dimension. For a snapshot of a typical model run, see Figure 7. A snapshot of the

Party-Ideo-Motivated model appears for comparison, as Figure 8.

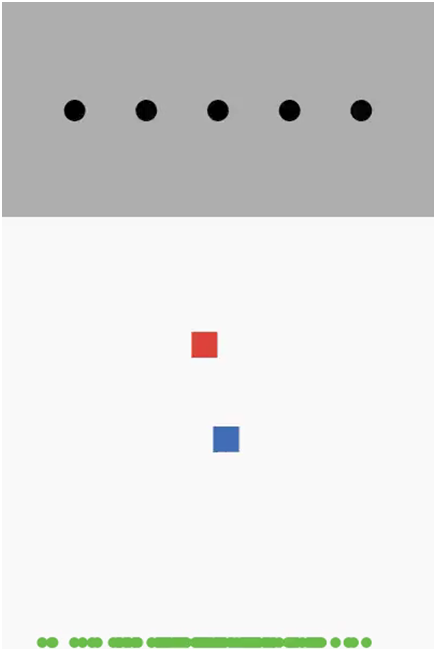

Figure 7. Snapshot of a base model (IIM) run of 500 steps. The five top circles are Oligarchs. Oligarch color shows which Party was recently supported, radius is proportional to amount donated, and label shows donation-size. The two squares are Parties. Party width is proportional to votes received, label indicates if votes increased or decreased, and outline shows the incumbent. The 100 bottom circles are Voters. Voter color shows which Party was voted for. The ideo axis is vertical and the olig axis is horizontal. Each Party and Voter's location corresponds to its position in policy space.

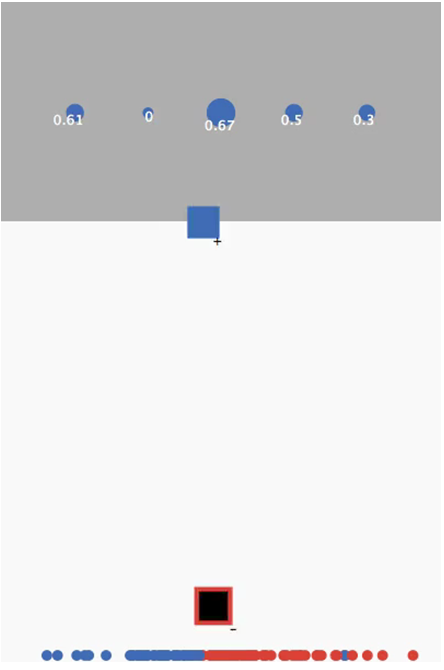

Figure 8. Snapshot of a Party-Ideo-Motivated Model run, beginning after the 300-step warm-up period. - 4.12

- Time series plots averaged over 100 runs of the OLIGO model

suggest that a 300 cycle warm-up period was sufficient for most model

statistics to become stable, in the sense that the means of most model

statistics across runs were not dependent on the time step. In

particular, the mean olig and ideo positions of the Parties, the tax

rate, and the mean olig-salience of Voters had nearly the same means

across runs, regardless of the time step after warm-up (Figure 9). For mean Oligarch profit,

however, there was change over time; this variable did not seem to

attain a stable value over time steps, even in the mean across runs

(Figure 10), although its

drift appeared to stop after 300 steps.

Figure 9. Mean Voter olig-salience and tax rate, versus time step, averaged over 100 runs.

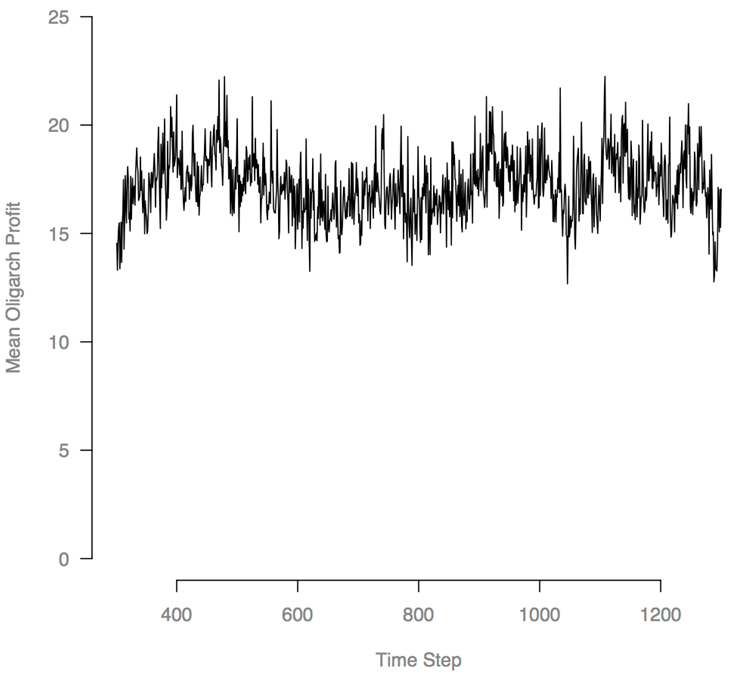

Figure 10. Mean Oligarch profit versus time step, averaged over 100 runs. Experimental methods

- 4.13

- We performed six computational experiments with the IIM

version of the OLIGO model (Figure 11).

- We ran the base model 100 times to obtain summary statistics.

- To explore how Oligarchs and Voters would act if their donations or olig-salience had no effect on Party olig positions, we modified our model to set Party olig positions at fixed values that could not change during a run; we ran this model 100 times.

- To study the effect of fixing Oligarch donation-size at various levels, we ran a parameter sweep for the initial Oligarch donation-size, and we fixed Oligarch donation-size in place so that Oligarchs could not change their donation-size from the assigned value. We ran the model 20 times at each value.

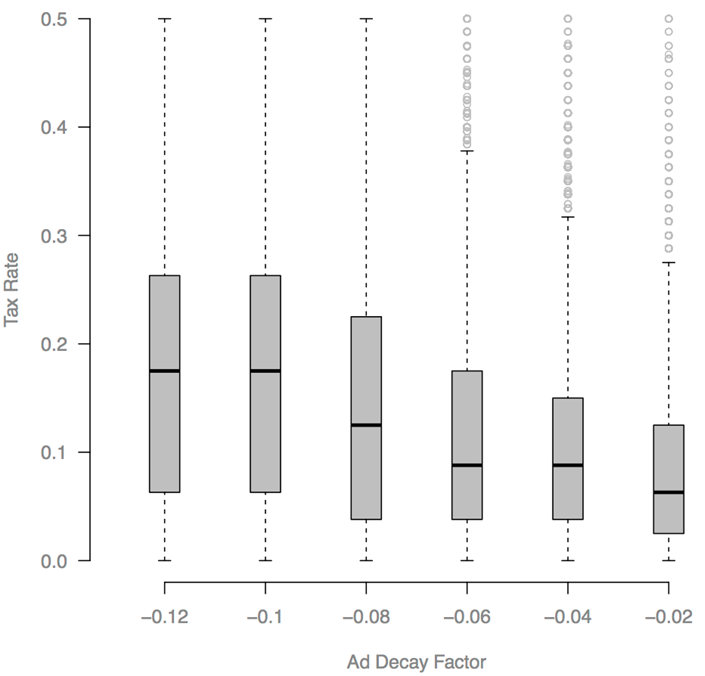

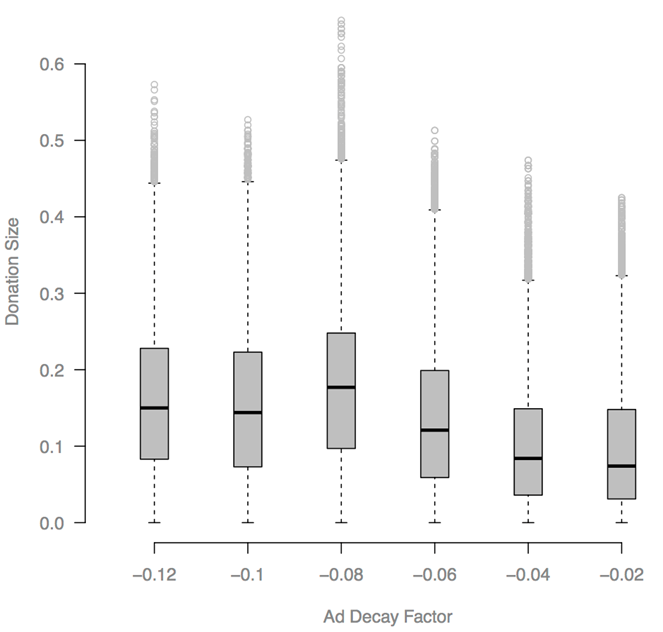

- We ran a parameter sweep for VOTER-AD-DECAY-FACTOR, which affects how strongly Voters react to campaign donations. We ran the model 20 times at each value.

- We ran a parameter sweep over the initial olig-salience of Voters, in a model variation where Voters could not change their olig-salience from its original value. We ran the model 20 times at each value.

- We ran a parameter sweep over the VOTER-MEMORY-STRENGTH, which affects how long Voters maintain a high olig-salience after increasing their olig-salience due to high taxes. We ran the model 20 times at each value.

Figure 11. Experimental conditions. - 4.14

- We also analyzed two variants of the IIM, which we call the

Party-Ideo-Motivated Model (PIMM) and All-Ideo-Motivated Model (AIMM).

Recall that in the Party-Ideo-Motivated Model, unlike in the IIM, each

Party has a preferred ideo axis position, and some Voters are loyalists

instead of swing voters. In the All-Ideo-Motivated Model, changes from

the PIMM are retained, and additionally, Oligarchs have a preferred

ideo position that favors the red, conservative Party. Oligarchs in the

AIMM will donate to the red Party even if the blue Party's olig

position is greater, as long as this difference in olig position is

outweighed by the difference in ideo position.

- 4.15

- To evaluate the results of our experiments, we used

hypothesis tests that make minimal assumptions about the distribution

of results. We used Welch two-sample t-tests to test for different

means between samples, where it seemed likely that the samples had

different variances, so a conventional two-sample t-test would not work

properly. We used cross-correlation, with lags of -5 to 5 run steps, to

look for effects of one variable on another in our default model run.

We chose a lagged approach so that we could detect relationships

between variables that require multiple run steps to emerge. To

evaluate the effect of the sweep parameter on other variables in our

parameter sweeps, we used Spearman correlation to look for a monotonic

relationship between the variables that might be nonlinear.

Model verification

- 4.16

- We performed a series of verification tests to ensure that

the OLIGO model behaved in accordance with prior results from political

economics as well as with common sense.

- 4.17

- According to the median voter theorem, Voters with normally

distributed preferences will tend to elect a Party whose position in

policy space is aligned with the preferences of the median Voter.

Because the OLIGO model initializes Voters with ideo values drawn from

a random normal distribution centered on zero, the mean ideo value of

Parties should be zero when averaged over many runs, because Parties

seek to increase the votes they receive. A two-tailed Welch's t-test on

the 100 default runs could not reject the hypothesis that the mean

Party ideo position was equal to zero, p = 0.84, 95% confidence

interval (-1.042, 0.842) in a possible range of ideo values from -100

to 100.

- 4.18

- If the base model is properly calibrated and scaled,

Oligarch donations should not dominate the effect of Voter preferences.

In other words, Oligarchs should not be able to capture severe

redistributive taxes. Specifically, we expected the mean Party olig to

be below zero (i.e., closer to Voters' preferred value than to

Oligarchs') and the mean Party olig to be below the mean Party ideo

value. A one-tailed Welch's t-test confirmed that the mean Party olig

was indeed less than zero, p < 2.2e-16, M = -45.3.

- 4.19

- For our model to perform reliably, it needs to be

non-degenerate – that is, all agents must take some action at

equilibrium that has an effect on model outcomes. To verify the

non-degeneracy of the base model, we used one-tailed Welch's t-tests to

verify all of the following conditions, p < 2.2e-16:

- mean olig position of Parties > MIN-POS

- mean olig-salience of Voters > 0

- mean tax rate < MAX-TAX

- mean Oligarch donation-size > 0

Results: Base model experiment

- 4.20

- Cross-correlations revealed that in runs of the base OLIGO

model, called the Ideo-Indifferent Model or IIM for clarity, both tax

rate and mean Oligarch profit were positively correlated with mean

olig-salience of Voters at small lags (Figure 12).

A two-sided 95% confidence interval for the cross-correlation at each

lag was computed by treating the cross-correlations at that lag from

different runs as IID samples from a random variable and computing the

t confidence interval, based on 100 runs. The correlation had a maximum

over lags at 0.695 in [0.677, 0.713] for tax rate to olig-salience, and

at 0.678 in [0.659, 0.698] for profit to olig-salience; both of these

correlation sizes are "strong". Tax rate led changes in olig-salience,

with much larger correlations at small negative lags than at positive

lags. Profit also led changes in olig-salience. These results make

sense, because the model is specified such that Voters are more likely

to "notice" the redistributive tax and increase their olig-salience

when the tax rate is high. When tax rates are high, profits tend to be

high also, because profits are computed by subtracting donations from

taxes collected.

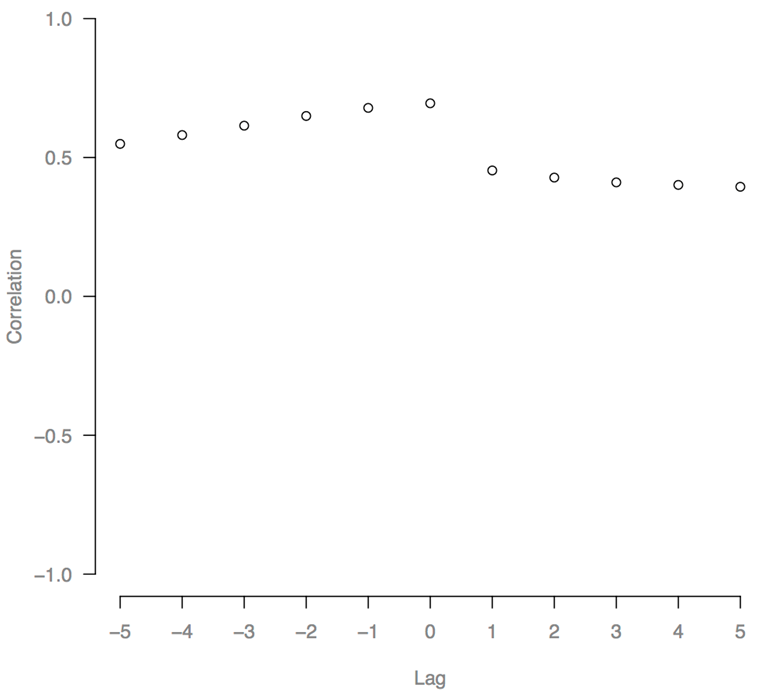

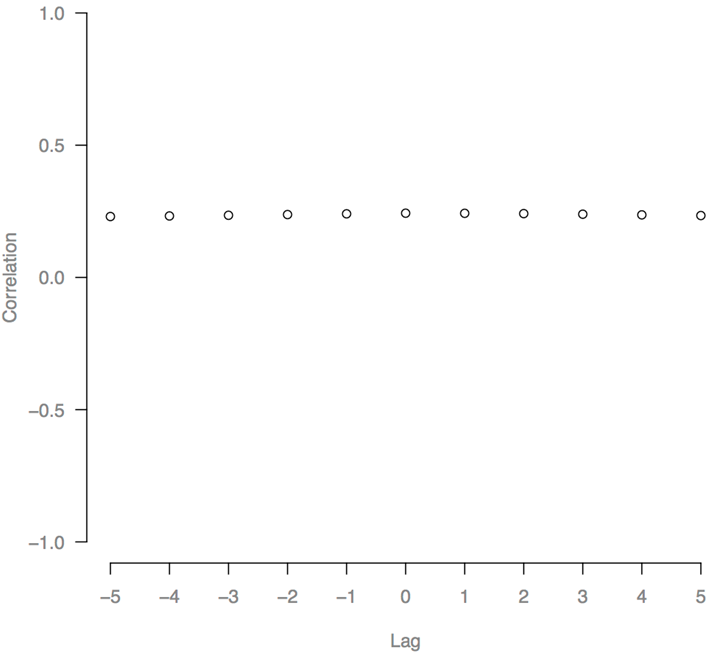

Figure 12. Cross-correlation of tax rate to mean Voter olig-salience, in the base model. Cross-correlations were taken for each run and averaged over 100 runs. - 4.21

- The mean donation-size of Oligarchs was positively

correlated with mean Voter olig-salience, but the maximum correlation

over lags was only 0.243 in [0.201, 0.285], which is "weak" (Figure 13). Neither variable of

donation-size and olig-salience appeared to lead the other, as the

cross-correlations were nearly constant over small lags. This indicates

that although Voter olig-salience tended to be high when Oligarch

donations were high, there was little immediate effect of change in one

variable on the other, for the small changes that typically occurred in

our base model. Indeed, our model does not include rules that directly

link these two variables, so it is understandable that they did not

produce a strongly peaked cross-correlation plot.

Figure 13. Cross-correlation of mean Voter olig-salience to mean Oligarch donation-size, in the base model. Cross-correlations were taken for each run and averaged over 100 runs. - 4.22

- To evaluate the robustness of the results from IIM over

changes to input parameters, we performed the same statistical analyses

for several variations of IIM. We modified IIM in one of several ways:

(1) IIM with 10 Oligarchs instead of 5; (2) IIM with 50 Oligarchs

instead of 5; (3) IIM with 50 Voters instead of 100; (4) IIM with a

bimodal distribution of Voter ideo positions (mixture of 2 Gaussians)

instead of a normal distribution; and (5) IIM where Oligarchs are free

to keep their donation level the same from one step to the next instead

of increasing or decreasing it. In all of these variations, output

parameter results were not significantly different from in the base

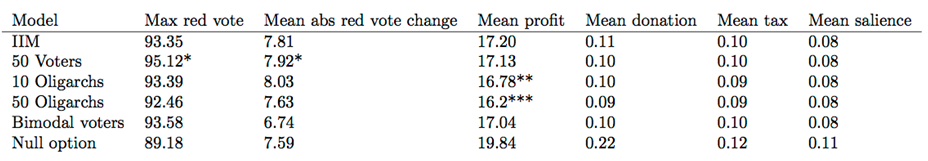

IIM. See Table 1. It does appear that introducing the null action for

Oligarchs leads to slightly increased Oligarch profits and taxes, with

increased donation rates. But other outcome measures are very similar

between the null option model and the base IIM, so these differences do

not appear to alter our key findings. Note that when Oligarch and Voter

counts were changed, the total income of each group was kept the same.

Table 1: Comparison of Ideo-Indifferent Model, and variations with 50 Voters, 10 Oligarchs, 50 Oligarchs, bimodal distribution of Voter ideo position, and null donation change option for Oligarchs.

* 50-Voter max and mean votes were multiplied by 100/50 for comparison.

** 10-Oligarch mean profits were multiplied by 10/5 for comparison.

*** 50-Oligarch mean profits were multiplied by 50/5 for comparison.

- 4.23

- Our model does appear sensitive to a change in the fraction

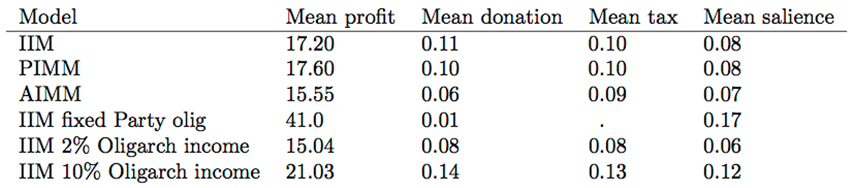

of total income assigned to the Oligarchs (Table 2).

We performed a sensitivity analysis in which the IIM was analyzed with

Oligarchs receiving 2% or 10% of total income, instead of 5% as in the

base version of IIM. We expected that increasing Oligarch income would

allow Oligarchs to donate more money to Party campaigns, leading to

greater advertising effects, higher mean Party olig values, and greater

Oligarch profits. This hypothesis appears to be supported by the

results, based on a comparison of outcomes at 2%, 5%, and 10% Oligarch

income fractions. Increased Oligarch income increased mean taxes by

0.018 from 2% to 5% (Cohen's d = 1.05) and by 0.037 from 5% to 10% (d =

1.36). Mean Party olig positions increased by 10.8 from 2% to 5% (d =

0.793), and by 11.1 from 5% to 10% (d = 0.77). Mean Oligarch profit

increased by 2.17 from 2% to 5% (d = 0.672), and by 3.82 from 5% to 10%

(d = 0.836). All of these Cohen's d values are "large".

Table 2: Comparison of Ideo-Indifferent Model, Party-Ideo-Motivated Model, All-Ideo-Motivated Model, IIM with fixed Party olig position, IIM with 2% of income to Oligarchs, and IIM with 10% of income to Oligarchs. Mean donation is the mean donation level parameter over all Oligarchs. Mean tax was not recorded for the fixed Party olig experiment.

Results: Fixed Party olig experiment

- 4.24

- In the fixed Party olig experiment, Parties were

initialized with randomly drawn olig and ideo positions as usual, but

their olig values were permanently fixed to their initial values. As a

result, Voters could not induce Parties to reduce their olig values by

voting against the Party with greater olig, although Voters might have

been able to prevent the Party with greater olig from winning elections

and setting the tax rate by its olig position. Similarly, Oligarchs

were not able to alter the mean olig value by donating to the campaign

of the Party with greater olig, although Oligarchs might have been able

to increase their favored Party's chance of winning elections and

setting the tax rate.

- 4.25

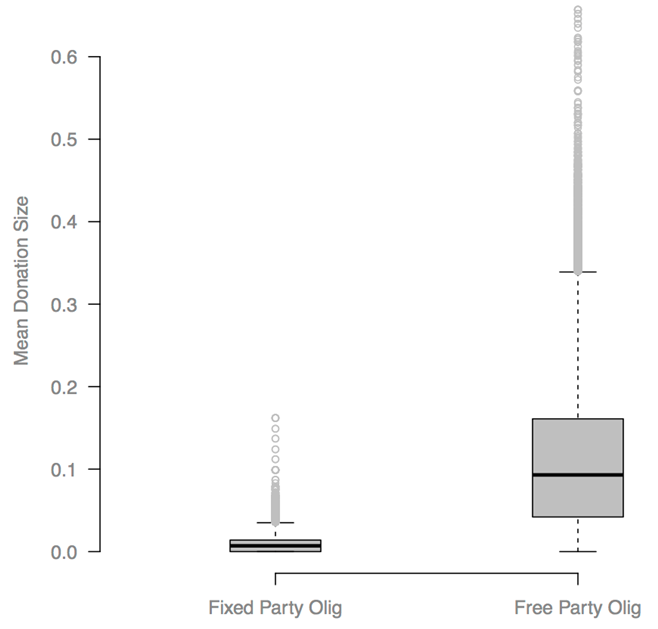

- A one-tailed Welch's two-sample t-test confirmed our

expectation that Oligarchs would donate less money on average when

Party olig values were fixed compared to in the default model, p

< 2.2e-16. The mean fraction of Oligarch gross-income donated in

the base model was 0.112, and in the fixed Party olig model it was only

0.092, or less than one tenth as much (Figure 14). Due to a high

variance in donation level, however, Cohen's d for the difference in

donation levels between the two models is only a small 0.26. Note that

Figure 14 and all other box

plots in this work are Tukey box plots, where the middle line is the

median, the lower and upper box ends are the lower and upper quartiles,

the lower staple marks the lowest datum within 1.5 times the box height

of the lower quartile, and the upper staple marks the highest datum

within 1.5 times the box height of the upper quartile.

- 4.26

- Another one-tailed Welch's two-sample t-test showed that

Oligarchs earned higher profits in the fixed Party olig model than in

the base model, p < 2.2e-16. Oligarchs in the fixed Party olig

model earned approximately 2.38 times the profits of Oligarchs in the

base model on average, for a very large Cohen's d of 7.04. Oligarchs'

profits were higher because they were spending much less on campaign

donations, and the expected Party olig value of zero at initialization

was greater than the mean Party olig value of -45.3 from the default

model, so taxes tended to be higher in the fixed Party olig model.

Figure 14. Mean fraction of gross-income Oligarchs donated. Each time step of each run produced one data point. Results: Voter olig-salience parameter sweep

- 4.27

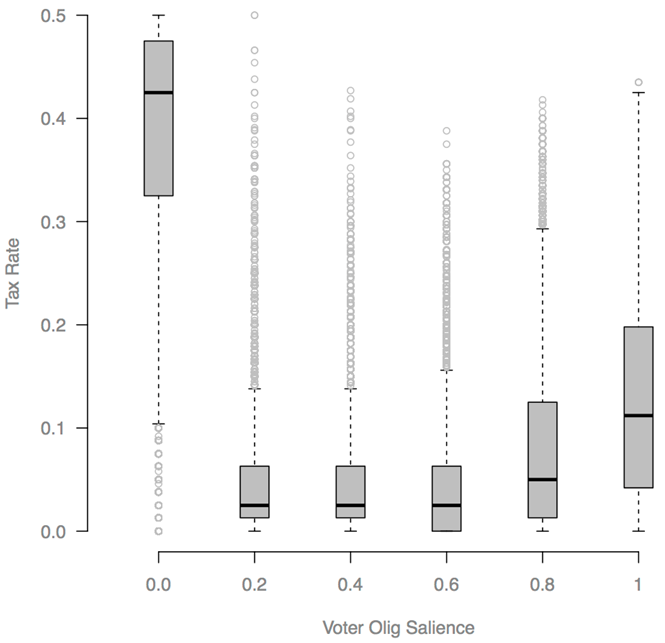

- In the Voter olig-salience parameter sweep, Voters were

initialized to all have the same olig-salience value, ranging from 0 to

1.0 in intervals of 0.2 over the sweep. Voters were not allowed to

change their olig-salience values during a model run. This meant that

they did not adapt to different tax rates by changing their preferences

over Party positions.

- 4.28

- We hypothesized that when olig-salience is higher,

Oligarchs would have less success in influencing policy. This would be

evident in the form of the following outcomes: lower tax rates, lower

mean Party olig value, lower Oligarch profits, and a lower frequency of

the Party with greater olig value defeating an opponent with a more

centrist ideo value. Because Oligarch campaign donations would be less

likely to increase tax rates with a high Voter olig-salience, Oligarch

donations would be lower when olig-salience is fixed at higher values.

The downside for Voters of a high Voter olig-salience, we hypothesized,

was that it would allow the mean Party ideo position to be farther from

zero, the expected preference of the median Voter.

- 4.29

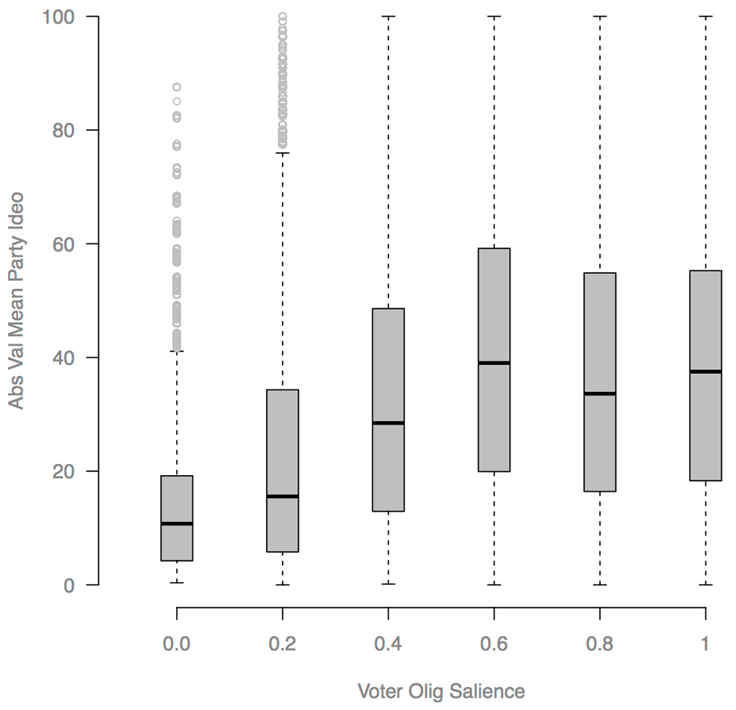

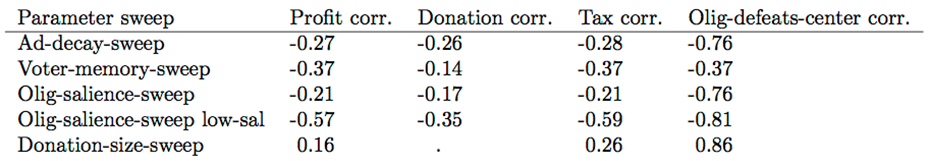

- Our hypotheses were supported by the results (Table 3). There was a strong negative

Spearman correlation (-0.76) between olig-salience and the frequency of

the Party with greater olig defeating a more centrist Party, and there

was a moderate positive correlation (0.32) of olig-salience with the

absolute value of the mean Party's ideo value (Figure 15).

Figure 15. Absolute value of the mean Party ideo position, from the Voter olig-salience parameter sweep. Each time step of each run produced one data point. Spearman correlation = 0.32. - 4.30

- For the other outcome variables, however, correlations were

weak until the two highest olig-salience parameter settings (0.8 and

1.0) were dropped. This is because when the olig-salience value is

fixed at a very high value, the OLIGO model degenerates into a

one-dimensional policy space model, where Voters all share a common

position at one extreme of the sole policy axis. In this degenerate

case, the Hunter strategy that the Parties follow does not work well,

because if the Parties are not within a step length of each other along

the one meaningful policy axis, the losing Party cannot improve its

vote count no matter which direction it moves, because it will still be

farther from all Voters. Therefore, both Parties will wander aimlessly,

until the losing Party happens to cross paths with the winning Party.

As a result, when olig-salience values are greater than about 0.6,

Oligarch power is likely to increase. This degenerate phenomenon is not

usually a problem for the OLIGO model, because such high mean Voter

olig-salience values almost never occur, except in the parameter sweep.

Table 3: Correlations of sweep parameter with mean Oligarch profit, mean Oligarch donation parameter, mean tax rate, and fraction of runs where Party of higher olig position defeats Party of more centrist ideo position. Olig-salience-sweep low-sal gives results for the olig-salience sweep, omitting the conditions with olig-salience equal to 0.8 or 1.0. Donation level correlation is not reported for the donation-size-sweep because donation level is the sweeping parameter.

- 4.31

- When the 0.8 and 1.0 olig-salience parameter conditions

were dropped, leaving only the conditions (0, 0.2, 0.4, 0.6),

meaningful trends emerged. There was a moderate to strong negative

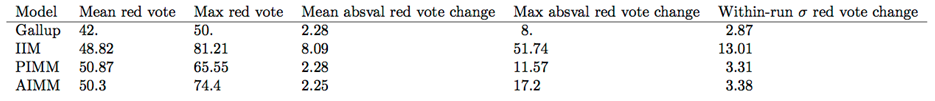

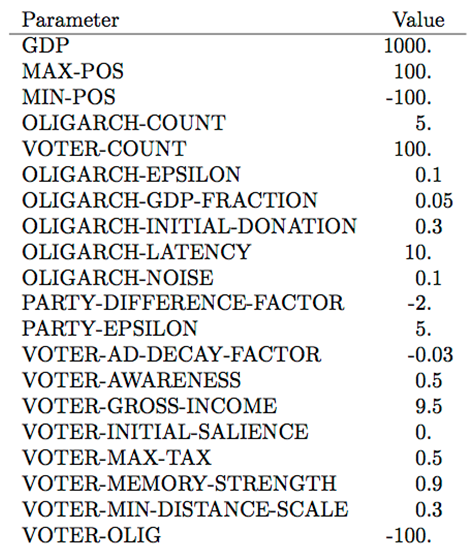

correlation between olig-salience and tax rate (-0.59) mean Oligarch