Abstract

Abstract

- An agent-based model of firms and their stakeholders' economic actions was used to test the theoretical feasibility of sustainable corporate social responsibility activities. Corporate social responsibility has become important to many firms, but CSR activities tend to get less attention during busts than during boom times. The hypothesis tested is that the CSR activities of a firm are more economically rational if the economic actions of its stakeholders reflect the firm's level of CSR. Our model focuses on three types of stakeholders: workers, consumers, and shareholders. First, we construct a uniform framework based on a microeconomic foundation that includes these stakeholders and the corresponding firms. Then, we formulate parameters for CSR in this framework. Our aim is to identify the conditions under which every type of stakeholder derives benefits from a firm's CSR activities. We simulated our model with heterogeneous agents by computer using several scenarios. For each one, the simulation was run 100 times with different random seeds. We first simulated the homogeneous version discussed above to verify the concept of our model. Next, we simulated the case in which workers had heterogeneous abilities, the firms had cost for CSR activities, and the workers, consumers, and shareholders had zero CSR awareness. We tested the robustness of our simulation results by using sensitivity analysis. Specifically, we investigated the conditions for the pecuniary advantage of CSR activities and effects offsetting benefits of CSR activities. Finally, we developed a new model installed bounded rational and simulated. The results show that the economic actions of stakeholders during boom periods greatly affect the sustainability of CSR activities during slow periods. This insight should lead to a feasible and effective prescription for sustainable CSR activities.

- Keywords:

- Corporate Social Responsibility, Agent-Based Simulation, Sustainability, Multiple Sector Model, Micro Economy

Introduction

Introduction

- 1.1

- Corporate social responsibility (CSR) has become a primary concern in business. Many companies have undertaken CSR activities and make regular reports on them to their various stakeholders: employees, consumers, localities, and shareholders. However, CSR activities generally get less attention during recessions than during boom periods, meaning that they are difficult to sustain.

- 1.2

- Friedman (1970) argued that a firm's activities related to CSR are economically inefficient. However, if this is true, why is there emergence of CSR awareness? The key to the emergence is support by stakeholders. For example, consumers may choose to purchase products produced by a firm with a high level of CSR activity even though they are more expensive, investors may preferentially purchase shares in such firms, and workers may choose to work at such firms although they receive lower wages. In short, the altruistic behaviours of stakeholders promote sustainable CSR activities.

- 1.3

- However, from evolutionary and economic perspectives, CSR promotion by stakeholders is temporary—it cannot be sustained. Generally, goods produced by firms with a higher level of CSR activity are more expensive than those produced by firms with a lower level. While stakeholders who value such activities more highly may support firms that have a higher level of such activities, they are less likely to do so when the economic situation worsens. For CSR activities to be sustainable, there must be an economic benefit for stakeholders. That is, CSR activities that are economically advantageous are needed to respond to Friedman's critique.

Definitions and previous work

- 1.4

- CSR activities are now common in various fields. They include donations, educational support, enlightenment activities, ecological activities, employee welfare programs, contributions to local communities, and investments promoting CSR. Toyo Keizai Inc. (2011) reported the total expenditures on CSR activities by companies headquartered in some large companies in Japan were shown in Table 1. Perrini et al. (2010) categorized the types of CSR activities by using three dimensions: environmental ("how much a company is considered sensitive to ecological issues"), consumer ("how much a company tries to satisfy the needs of consumers and tries to protects their rights and interests"), and employee ("how much a company guarantees equality of economic treatment, avoids discrimination, practices good health and safety policies etc"). Carroll and Shabana (2010) showed that the prevalence of CSR practices affects both its ethical and philanthropic responsibilities. Ethical responsibilities encompass environmental issues such as clean air requirements, social issues such as workforce diversity and gender discrimination, governance issues such as shareholder meetings and voting, and controversial business issues such as the role of nuclear power. On the other hand, philanthropic responsibilities encompass "actions that are in response to society's expectation that business be a good corporate citizen". For example, thousands of businesses around the world donate billions of dollars in total each year to CSR projects such as education, arts and culture, human services, community improvement, medicine, science, and environmental protection (Seifert et al. 2004). Kurucz et al. (2008) categorized the rationale for the business case for CSR activities into four arguments: (1) reducing cost and risk, (2) strengthening legitimacy and reputation, (3) building competitive advantage, and (4) creating win-win situations through synergistic value creation.

Table 1: The total expenditures on CSR activities in 2009 (Data:Toyo Keizai 2011) Company CSR expenditure (billion yen/year) Ratio of it to its pretax profits Toyota 12.1 1.7% JT 3.7 1.2% Sony 3.6 3.4% Panasonic 3.2 41% Toshiba 2.7 631% - 1.5

- Before describing our study, we explore the meaning of CSR. The concept of CSR is ambiguous and thus very confusing (Morsing 2006). It can be regarded as philanthropy, i.e. as cause-related marketing, employee volunteerism, or as another innovative program.

- 1.6

- CSR activity is narrowly defined here as certain social action programs, such as philanthropic programs, that do not directly benefit the firm. If a model can show that CSR activities under our narrow definition can be sustained, then CSR activities under a wider definition will be more readily sustainable.

- 1.7

- There have been a number of studies on CSR activities. Empirical studies have found evidence that CSR activities produce non-economic benefits in the form of consumer donations (Lichtenstein et al. 2004); however, the variables used for measuring the benefits were difficult to control. Other empirical studies have focused on the economic benefits. Baron (2004) developed a model of a firm's CSR activities and the risks related to activist campaigns such as boycotts. Testing using this model revealed the importance of strategic CSR activities; however, the societal effects of CSR activities were not analysed.

- 1.8

- Does the economic climate affect CSR activities? In a special issue of the Journal of Productivity Analysis on CSR and economic performance, Paul and Siegel (2006) pointed out that the vast majority of studies on CSR and its effect on financial measures had been done from an economic perspective. They suggested that a more fundamental issue is the relationship between economic performance and CSR behaviour, where economic performance entails technological and economic interactions between output production and input demand, with respect to the opportunity costs of inputs and capital formation. They concluded that the costs of CSR activities must be balanced by the benefits motivating firms to carry them out. Selvi et al. (2010) studied Turkey's financial crisis in 2007 and mentioned that proponents of CSR claim that it has many benefits for the company such as enhancing its reputation and that opponents claim that it cannot protect a firm from financial harm in times of crisis.

- 1.9

- Reinhardt et al. (2008) addressed the question of how one should think of the notion of firms sacrificing profit in the interest of society. They considered cases of "voluntary" CSR, "reluctant" CSR, and "unsustainable" CSR. As an example of reluctant CSR, they pointed out that investors might "be forced to accept profit-sacrificing activities that are the result of external constraints" like having to use equipment designed for higher than required pollution limits. If CSR activities are unsustainable, firms might have to "raise prices, reduce wages, accept smaller profits, or pay smaller dividends". In the short-term, this could lead to a loss of market share, an increase in insurance costs, an increase in borrowing costs, and a loss of reputation. Possible long-term consequences include shareholder litigation, corporate takeover, and closure. So why would a firm chose to continue CSR activities that are unsustainable? One explanation they present is the principal/agent problem: managers (the "agents") may make decisions that commit the firm to short-term CSR activities that are not to the benefit of the owners (the "principals"), meaning that those activities should not be continued in the long run (SeeBaron 2006, for example).

- 1.10

- We can survey some theoretical approach for describing CSR. Fehr (1999; 2002) introduced psychological insights into a theoretical economic model in the form of a function for the pecuniary payoff to both oneself and others; i.e. he assumed a kind of altruism. Since awareness of CSR includes altruistic motivation, he used a more general framework; however, it is difficult to apply his model to CSR activities.

- 1.11

- Brekke (2004) developed a microeconomic model in which social welfare is added to the pecuniary payoff function. Testing with this model showed that "green firms", i.e. firms with a high level of CSR activity, may be better able to survive in the long run and that the CSR profile of a firm may affect both wages and worker productivity. The key point of his mechanism for survival is that morally motivated workers work harder when they are employed by a green firm. That is, firms with a higher level of CSR activity can potentially survive longer without public intervention. However, his model has an unrealistic assumption: each worker calculates his or her social welfare utility in a society in which all workers act like the worker. Moreover, the other stakeholders are not included.

- 1.12

- Shinohara et al. (2009) modelled CSR activity by using an agent-based approach. In their model, dissemination of CSR activities requires that consumers socially learn to value such activities and that firms identify economic incentives for embracing them. The model, however, is not based on microeconomic principles; for example, it lacks a function for maximising an agent's benefit. Moreover, the model has a fixed interaction topology and no interaction among multiple stakeholders. Therefore, it is insufficient for addressing Friedman's critique. A model with a stronger economic framework is needed.

Aim and overview

- 1.13

- To understand CSR activities from the economic viewpoint, a model is needed that takes into account the various types of stakeholders. Moreover, it should reflect the observation that a firm's cost for CSR activities and its stakeholders' CSR awareness are different. So, we analyse how a firm with a certain level of CSR activities behaves economically in a society of stakeholders with differences in CSR awareness. This means that a static approach to solving the equilibrium condition is insufficient. To overcome this insufficiency, we developed an agent-based model. In accordance with Axtell's classification (2000), our approach corresponds to "third use, models ostensibly intractable or provably insoluble: agent computing as a substitute for analysis".

- 1.14

- Our model focuses on three types of stakeholders: workers, consumers, and shareholders. First, we construct a uniform framework based on a microeconomic foundation that includes these stakeholders and the corresponding firms. Then, we formulate parameters for CSR in this framework. Our aim is to identify the conditions under which every type of stakeholder derives benefits from a firm's CSR activities.

- 1.15

- After describing our model in Section 2, we describe our computer simulation using it and present key results in Section 3. The results are discussed in Section 4. We conclude with a brief summary and a mention of future work in Section 5.

Model

Model

- 2.1

- We first explain the uniform framework in which economic agents operate and describe the concepts for modelling it. Then we describe the agents' awareness and the firm's CSR activities. The notation and structure equations are then defined. Finally, we formulate an agent-based model for simulation.

Framework

- 2.2

- Our model has four types of economic agents: firms, workers, consumers, and shareholders.

- 2.3

- Products made by a firm depends on its capital stock and the sum total of the workers' efforts (Eq. 1). We use the constant elasticity of substitution production function (Arrow 1961). Product quantity affects both the economic attractiveness of the firm's products (Eq. 6) and worker wages (Eq. 4). Here we assume that the higher the quantity of a product, the higher its price, and that the higher its economic attractiveness, the higher the worker wages. For simplicity, all workers at a firm are assumed to earn the same wage (Eq. 4). The assumption for capital stock is simple: it depreciates at a constant rate and new stock is added each month (simulation period) (Eq. 2). Investors invest one unit in any firm of their choice each month.

- 2.4

- A worker hired by a firm consumes production goods as a consumer, so the number of workers equals the number of consumers. This assumption is important because the effect of a firm's CSR activities redounds through a mechanism for changing consumption quantities as wages change. It may be easy to understand if you would regard that a pair of a worker and a consumer makes a family budget. Firm size is based on the calculated aggregate demand. The demand quantity of firm F is the total wages of consumers who choose the firm F. Shareholder behaviour is modelled on investment behaviour, and shareholders tend to focus on firm size. The size is based on the aggregate demand (Eq. 7). Shareholder investment in a company contributes to advances in product quantity (Eq. 1).

- 2.5

- In every simulation period, which is described below, a firm is chosen by workers (Eq. 5), consumers (Eq. 6), and shareholders (Eq. 7) through their job hunting activities, consumption behaviours, and investment destination selections, respectively. The economic actors in each group use a function to calculate the value to them of each firm. Each actor defines a probability vector consisting of all the firm's values and selects one firm. Therefore, all stakeholders have the ability to communicate with all firms. Figure 1 shows a conceptual diagram of this framework.

Figure 1. Conceptual diagram between parameters of the framework Concept

- 2.6

- The greater the level of a firm's CSR activities, the more the firm degrades product quantity (Eq. 1). This is because CSR activity is defined here as cost. The three types of stakeholders have biased evaluations of the firms by their observations of firms' CSR activities (Eqs. 3, 5, 6, 7).

- 2.7

- An essential point of modelling a job market is including a firm's need to find a small number of candidate workers with both high task ability and high CSR awareness. Due to asymmetric information, firms cannot distinguish such workers ex ante. In contrast, workers can distinguish firms with a high level of CSR activity. When a firm with a high level of CSR activity hires workers who have both high task ability and high CSR awareness, it is likely to earn higher profits (Eq. 1) because such workers implicitly approve of their new employer's support of CSR activities and thus exert greater efforts in their work.

- 2.8

- Workers generally favour firms that pay higher wages; moreover, those who highly value CSR pay more attention to the CSR activities of firms. In our model, every worker calculates the value of every firm and decides where to accept employment on the basis of these valuations (Eq. 5). Since we assume that there is a shortage of workers, each worker can work at whichever firm he or she prefers (Burdett 1998). Workers decide their levels of effort on the basis of their own abilities. The higher the wage they receive, the greater their effort, and the higher the firm have cost for CSR, the greater the effort of the workers who highly value CSR (Eq. 3).

- 2.9

- A small number of consumers with high environmental awareness are a key factor in our model. Firms with higher support of CSR set higher prices for their products, while consumers with high environmental awareness favour those products. Consumers also choose firms and buy their goods on the basis of their incomes (Eq. 6). Which firms do consumers choose? Each consumer calculates the value of each firm on the basis of its economic attractiveness and level of CSR activity. Strictly speaking, consumers base their buying decisions on each firm's level of CSR in our model. That is, we assume that a firm's level of CSR affects its activities directly.

- 2.10

- Shareholders (investors) who highly value CSR bias their investments toward firms with more CSR activities. They have a function for calculating the value of firms and use it to decide their investment allocations (Eq. 7). For simplicity, we consider neither dividends nor shareholder consumption behaviours.

- 2.11

- A conceptual diagram of the parameters related to CSR is shown in Figure 2.

Figure 2. Conceptual diagram of CSR Notation and structure equations

- 2.12

- Before formulating our conceptual model, we present in Table 2 the notation used. We use X instead of X(t) because almost all the parameters change over time; that is, X(t) means the value of X at time t.

Table 2: Notation Parameter Definition Qi Product quantity of firm i Xi Demand for firm i's product Aj Ability of worker j Eji Effort level of worker j at firm i CFi Level of cost for CSR activities t firm i CWj Level of CSR awareness of worker j CCj Level of CSR awareness of consumer j CHj Level of CSR awareness of shareholder j Ni Set of workers hired by firm i Ki Capital stock of firm i Ii Investment in firm i Wi Firm i's wage for every worker VWji Value to firm i of worker j VCji Value to firm i of consumer j VHji Value to firm i of shareholder j - 2.13

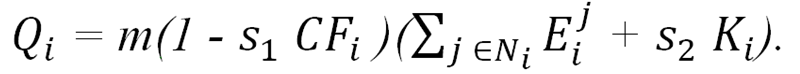

- Next, we formulate the structure equations of our model:

where wi, qi, and x1 are defined relative to Wi, Qi, and Xi, respectively, and where #W, #F, and #H are the number of workers, firms, and shareholders, respectively. For example, wi, the relative wage level for workers at firm i is defined by

Parameter si is defined as shown in Table 3.

Table 3: Parameters s1 Upper limit of social tolerance ratio by firm's performance to CSR activities s2 Ratio of investment to workers' productivity on production function s3 Depreciation rate s4 Constant degree of worker's effort s5 Term for tuning of value functions for firms - 2.14

- If all the economic entities (firms, workers, consumers, shareholders) have the same level of CSR awareness and activities (=C), and all workers have the same ability (=A), and each agent is both a worker and a consumer, the model has a robust equilibrium state,

- 2.15

- We call this model a homogeneous model as it is based on the assumption of homogeneous economic agents. Moreover, as mentioned in Section 1.2, the model should reflect the observation that a firm's CSR activities and its stakeholders' CSR awareness are different. Therefore, parameter values should differ between agents and be dynamic. If we allow entity heterogeneity, it is difficult to analyse the model. This is because Qi cannot be calculated analytically because the choice functions (VW, VC, and VH) use probability vectors and a firm's level of CSR activities CFi. is heterogeneous. Therefore, we need agent-based simulation.

Agent-based model

- 2.16

- On the basis of the notation and structure described above, we constructed an agent-based model of firms, workers, consumers, and shareholders to investigate the effect of CSR activities.

- 2.17

- The agents do not have adaptive processes, so the level of CSR awareness and activities does not change throughout the simulation except as otherwise noted. While Shinohara (2009) used agents with adaptive processes, the processes were modelled without a function for maximising the agent's benefit, and the model cannot be used to analyse variations in CSR awareness in society after the dissemination of CSR awareness.

- 2.18

- The parameters for the simulation were set as shown in Table 4. The pseudocode for the model is shown in Appendix A, and source code in the C language is here. Some parameters were calibrated. Equation 8 (Table 4) shows that s2 and s3 must be close to each other to balance the labour factor with the capital stock factor in the production function (Eq. 1). If they are not balanced a change in either has little effect on product quantity. Our aim is to observe the effect of both factors on cost for CSR activities, so we set s2 = s3, which is a limitation of our study. It is common in economics for the depreciation rate, s3, to be set to 0.1 (Alti 2003). Parameters s1 and s5 and the range of A affect model stability, so they are set for easily observing the behaviour of the simulation model.

Table 4: Parameter Setting Name Value or Range #F 10 #W 1000 #H 1000 No. of simulation periods 100 s1 0.1 (, 0.2, 0.3 used only in Figure 4) s2 0.1 s3 0.1 s4 0.0 s5 1.0 Aj [0.9, 1.1] CFi [0, 1] CWj [0, 1] CCj [0, 1] CHj [0, 1]

Simulation

Simulation

- 3.1

- We simulated our model with heterogeneous agents by computer using several scenarios. For each one, the simulation was run 100 times with different random seeds. The metric was the average quantity of capital stock for over the 100 runs. Since capital stock reflects firm size, it is an appropriate metric for firm survivability.

Verification

- 3.2

- We first simulated the homogeneous version discussed above to verify the concept of our model. We tested whether the model reached an equilibrium state regardless of the initial parameter settings. Changes in Q, W, X, I, and K over time for (a) Q(0), W(0), X(0), I(0), and K(0) equal 1.0, (b) Q(0), W(0), X(0), I(0), and K(0) equal 1000.0, (c) Q(0), W(0), and X(0) equal 1.0, and I(0) and K(0) equal 1000.0, and (d) Q(0), W(0), and X(0) equal 1000.0 and I(0) and K(0) equal 1.0, where (A,C) in all cases was (1.0,1.0). Therefore, a change in the values of the observed parameters can be attributed to CSR.

- 3.3

- Next, we simulated the case in which workers had heterogeneous abilities, the firms had cost for CSR activities, and the workers, consumers, and shareholders had zero CSR awareness. Figure 3 shows the average quantity of capital stock (K), wage (W), and demand (X). It shows that the greater the degree of cost for CSR a firm has, the worse its performance. This supports the well-known insight that CSR activities are not economically advantageous to firms.

Figure 3. Values of W, X, and K for different degrees of firm cost for CSR activities when other entities had zero CSR awareness. Note that this figure shows 100 times W instead of W and K divided by 10 instead of K. As formulated in Appendix A, each firm has a different CFi, so the firms line up on the horizontal axis. Results

- 3.4

- To determine the effect of a firm's CSR activities on its survival, we tested various cases in our agent-based simulation. First, we investigated which type of stakeholder is most effective for sustaining CSR. Figure 4 shows that the CSR effect strongly depends on the social tolerance ratio by firm's performance to CSR activities. If the ratio is low (s1= 0.1), all three types of stakeholders substantially affect the firm's CSR activities. If the ratio is much higher (s1= 0.3), firms with much CSR activity have trouble surviving. Moreover, as shown in Figure 4, any type of stakeholder has the effect on that a firm's cost for CSR activities makes the firm large.

Figure 4. Effect of degree of CSR activity on firm size (=K) for s1 = 0.1, 0.2, and 0.3: (a) only workers have CSR awareness: (b) only consumers have awareness. The graph for shareholders is omitted because it is almost the same as that for consumers. - 3.5

- Next, to test the stability and robustness of the CSR effect, we assumed that the CSR awareness of stakeholders suddenly disappears. Parameters (I, K, X, W, Q) were initialised as (#H/#F, I/s3, Q, Q #F/#W, (1-s1CFi){(s4+ A #W / #F + s2K} where A is the average of Ai. Figure 5 shows the trend in the quantity of investment for two firms with the largest and smallest degrees of cost for CSR activities. The CSR awareness levels for all stakeholders (workers, consumers, and shareholders) were set randomly in the initial period; they were switched to zero when the number of simulation periods reached ten.

Figure 5. Trend in quantity of investment for firms with maximum and minimum expense for CSR activities, where CSR awareness of all stakeholders disappears when simulation period reaches ten. - 3.6

- Although, the advantage of CSR activities for a firm subsequently declined, it did have inertia.

- 3.7

- We then extended this case by assuming that stakeholders of one type retained their CSR awareness while those of the other types lost it. Figure 6 shows the trend in the quantity of investment for the same two firms. The advantage of CSR activities was retained despite all but one stakeholder type losing its CSR awareness.

Figure 6. Trend in quantity of investment for same two firms in Figure 5 but (a) workers retain CSR awareness after simulation period ten, (b) consumers retain it. The graph for shareholders is omitted because it is almost the same as that for consumers. - 3.8

- Finally, we tested the effect of activities on the depreciation of capital stock. Figure 7 shows the results for various values of depreciation rate s3. The greater the inertia of stock depreciation (= lower s3), the greater the advantage of CSR activities.

Figure 7. Effect of CSR activities on degree of depreciation rate for s3 = 0.001, 0.1, and 1.0. Note that s2 was set equal to s3 to enable equilibrium to be maintained by using Eq. 8, and the values of K are normalized. Sensitivity analysis

- 3.9

- We tested the robustness of our simulation results by using sensitivity analysis. Specifically, we investigated the conditions for the pecuniary advantage of CSR activities and effects offsetting benefits of CSR activities.

- 3.10

- First, we analyzed whether there is a threshold for CSR awareness. As shown in Figure 6, CSR awareness by only one stakeholder is sufficient to maintain advantage of CSR-aware companies. This phenomenon is implicit in the model, so we investigated it in detail by conducting additional experiments. As shown in Figure 8, surprisingly, one stakeholder with CSR awareness is sufficient to maintain the overall advantage of CSR activities even if the remaining stakeholders have no CSR awareness initially.

Figure 8. Difference in quantity of capital stock with maximum and minimum expense for CSR activities under the same conditions as for Figure 6, except that the simulation period the CSR awareness of two kinds of stakeholders disappears at is changed as a variable. The curve for shareholders is omitted because it is almost the same as that for consumers. - 3.11

- How does the strength of CSR awareness weaken? Figure 9 shows that the stregnth of CSR awareness weakens when the simulation period reaches ten. We investigated whether the degree of the advantage of CSR-awareness increases the number of stakeholders with CSR awareness. We found that the advantage of CSR activities is retained if at least 30% of one stakeholder retains their awareness.

Figure 9. Difference in quantity of capital stock with maximum and minimum expense for CSR activities under the same conditions as for Figure 6, except even the remaining stakeholder with CSR awareness showed a x% drop in awareness when the simulation period reached ten. The curve for shareholders is omitted because it is almost the same as that for consumers. - 3.12

- Next, we tested two effects offsetting the benefits of CSR activities. The first effect is increased marginal cost of production. We represent this by the addition of multiplier m to the production function (eq. (1)):

(1') - 3.13

- Figure 10 shows the change in capital stock with an increase in m. The change in the marginal cost of production clearly had no effect on the benefits of CSR activities although there were some slight differences.

Figure 10. Difference in quantity of capital stock with maximum and minimum expense for CSR activities under the same conditions as for Figure 3 for various values of multiplier m (horizontal axis). - 3.14

- The second effect is a change in the distribution of workers' ability. We set the range of their abilities, r, to 0.1 (i.e. the range of their abilities was 0.9 to 1.1) in the basic model. The simulation results for various values of r are shown in Figure 11. As in the case of a multiplier added to the production function, a change in the distribution of workers' ability had no effect on the benefits of CSR activities.

Figure 11. Difference in quantity of capital stock with maximum and minimum expense for CSR activities under the same conditions as for Figure 3 for various values of worker ability range r (horizontal axis). Installing bounded rationality

- 3.15

- Some might feel that our model is too restrictive with regard to several points. Generally speaking, agents cannot have perfect information or rationality. We thus revised our model to incorporate this imperfection. The new bounded rational model differs from the model described above in four ways.

- Separation between workers and consumers. Shareholders as well as workers consume, so a family budget does not always need a pair of one worker and one consumer. The new model allows the number of those stakeholders to be freely adjusted. In this model, #S represents the number of consumers. The consumption unit is defined as Q / #S because the total income for the economy equals the total production, and consumers are assumed to have equal consumption power.

- Cognitive limitation. Since a stakeholder usually does not know all of the firms, the new model has restricted stakeholder memory capacity. Initially, an agent knows a list of M firms selected randomly. It calculates certain values, such as the average wage, for the firms in its memory list. For simplicity, the new model does not need the value function, VW, VC, VH in this phase. A stakeholder chooses a firm in memory list randomly; that is, the firms in a list have the same probability of being selected.

- Informative limitation. Since a stakeholder also usually does not know the actual evaluated values of firms, the new model incorporates cognitive probability, p, as a value function. Actually, each stakeholder knows the correct value of the value function (VW, VC, or VH) with probability p, so the new model uses a random value that follows a uniform distribution instead of the correct distribution. This function is calculated in a revision phase newly added at the end of each simulation period. In this phase, the half of the firms with lower values are replaced.

- New values for some parameters. The extensions described above resulted in the use of new values for the parameters listed in Table 5. The other parameters had the values shown in Table 4.

Table 5: New Parameter Settings #F 100 #W 10000 10000 10000 10 - 3.16

- Feasible source code for the bounded rational model in C language is here. Figure 12 shows the effect of stakeholder's cognitive error (p) on the advantage of CSR activities in the case where every stakeholder has CSR awareness randomly. As was shown as Figure 4, CSR-aware firms have an advantage if all stakeholders have CSR awareness. Moreover, the CSR effect strongly depends on the level of the stakeholders' cognitive error. If they have perfect information on the level of firms' CSR activities (p = 1.0), they can choose firms they prefer correctly. Therefore, firms are divided into groups of winners and losers definitely which depends on the size of stakeholder's memory, M. On the other hand, if they have less than perfect information (p = 0.0), the performance looks like it is random due to cognitive error. The results for p = 0.1 suggest that CSR activities can keep their advantages in spite of slight information for their activities.

Figure 12. Values of K for different degrees of a firm's expense for CSR activities: (a) p = 0.0, 0.1, and 0.5, and (b) p = 1.0. - 3.17

- We tested the robustness of the CSR effect á la Figures 5 and 6. The results are shown in Figures 13 and 14, respectively. As shown in Figure 13, if stakeholders have little information on the level of firms' CSR activities (p = 0.1), the inertia of the advantage of CSR activities quickly loses its power. Even if p = 0.5, the advantage cannot be maintained. In contrast to the heterogeneity model (Figure 5), however, when the level of information known by stakeholders exceeds a certain level (p = 0.7), the inertia maintains its power. This is because the degree of the advantage is sufficient for stakeholders to keep choosing the same firm due to their cognitive limitation. The case in which one stakeholder can retain its CSR awareness keeps advantage even if p = 0.1, as shown in Figure 14. This means that there is strong inertia for maintaining the advantage of CSR activities in spite of a large cognitive error.

Figure 13. Trend in capital stock for firms with maximum and minimum expense for CSR activities, where CSR awareness of all stakeholders disappears when simulation period reaches ten in the bounded rational model with p = (a) 0.1, (b) 0.5, and (c) 0.7. Figure 14. Trend in capital stock for firms in Figure 13 with p = 0.1 only, but (a) workers retain CSR awareness after simulation period ten, and (b) consumers retain it. The graph for shareholders is omitted because it is almost the same as that for consumers.

Discussion

Discussion

- 4.1

- As mentioned in the introduction, it is generally believed that CSR activities are economically inefficient. However, our testing showed that, if a firm's various stakeholders make decisions that take into consideration a firm's CSR activities, its CSR activities have a pecuniary payoff. The stakeholders considered here are workers, consumers, and shareholders. Moreover, simulation using our model showed that the pecuniary advantage of CSR activities has inertia. That is, CSR-aware firms continue to have a pecuniary advantage for a while after the CSR awareness of its stakeholders disappears.

- 4.2

- Why does the pecuniary advantage of CSR have inertia? It has inertia because a firm with high cost for CSR activities tends to establish a high-profit structure. Product quantity is not affected positively by CSR awareness directly but by the cumulative investment in capital stock and by the high wages paid to labour for quality work.

- 4.3

- As illustrated in Fig. 7, investment in depreciable capital stock results in the inertia of CSR activities. The fact that almost all capital stock is depreciable ensures the sustainability of CSR activities. This benefit, however, is not derived when a uniform framework consisting of various stakeholders is not developed.

- 4.4

- The most important finding here is that, even if only one type of stakeholder retains CSR awareness, the firms have a pecuniary advantage. The realization by stakeholders of the importance of CSR apparently has an irreversible effect. Once enhanced awareness of CSR, driven by a few stakeholders who highly value CSR, has been attained, its effect may continue even if this awareness diminishes over time. CSR activities thereby become irreversible, and firms with a higher level of CSR activity can better survive. Therefore, a promising approach is to formulate a policy in which at least one type of stakeholder retains its awareness of CSR even in recessions.

- 4.5

- The workers in particular greatly affect a firm's CSR activities (Figures 4 and 6). This is because only workers affect CSR-aware firms in two ways: choice of firm and level of effort. In contrast, consumers have only one effect (product choice) and shareholders have only one effect (investment choice). Although shareholders could affect the decisions a company makes about CSR activities by, for example, speaking up at the shareholders' meeting, the effects among shareholders would not be equal. In any case, in our model, the case in which a small group of workers has high CSR awareness has the largest possible effect among all possible cases.

- 4.6

- These insights provide a clue for how to sustain CSR activity when the economy weakens. Typically during a recession, firms cut their expenses by reducing or eliminating CSR activities. However, if CSR-aware firms could keep the pecuniary advantage they enjoy during boom periods, they would be less inclined to reduce or eliminate their CSR activities. Our findings show that the economic actions of stakeholders during boom periods greatly affect the sustainability of CSR activities during slow periods. These insights should lead to a feasible and effective prescription for attaining sustainable CSR activities.

Summary and Future Work

Summary and Future Work

- 5.1

- We simulated an agent-based model of firms and stakeholder economic behaviours in order to test the theoretical feasibility of attaining sustainable corporate social responsible activity. The results provide significant insights into the pecuniary advantage of CSR activity and the inertia of its effect. The key insights are that investment in capital stock brings inertia to CSR activities and that even if only one type of stakeholder retains its CSR awareness during a recession, the firm will be less likely to reduce or eliminate its CSR activities. These insights should lead to a feasible and effective prescription for attaining sustainable CSR activities.

- 5.2

- Various other possible approaches to attaining sustainable CSR activities remain for future work. One idea is to use more specific case studies. However, our aim was to construct a theoretical and operational model. Rather, we need to extend the model itself. For example, the economic entities should be able to learn so that they can imitate the entity achieving the highest performance. Moreover, our model does not directly connect the consumption quantity to a firm's performance, so there is no feedback related to consumption. This means that consumer behaviour, such as boycotting a firm's products, is not considered.

- 5.3

- There are other limitations as well. For example, there is only a one-dimensional perspective on CSR activity, so it is hard to distinguish between eco-friendly production and improvement in the work environment. In the current model, the CSR awareness of an employer is independent of that of its employees. The model should be extended to allow dependence between them. Moreover, it should be extended to incorporate a learning process. Although we simplified the model, we can still make it multidimensional without changing the framework once the base model is constructed and verified. Finally, our model does not consider firm loyalty, a major factor in economic sustainability.

Appendix A: Pseudocode for main routine

Appendix A: Pseudocode for main routine

-

Function main: Start: for number_of_randomseed (<=from 1 to 100) initialise(number_of_period): for number_of_period (<= from 1 to 100) invest() job_search() produce() consume() End: Function initialise(seed): Start: Initialise Randomseed(seed) Set Parameters (#F, #W, #H) = (10, 1000, 1000) (s_1, s_2, s_3, s_4, s_5, lower and upper limits of workers ability (A)) for firm_id (<= from 1 to 10) Set Parameters (CF, Q) CF(firm_id) = firm_id / #F Q = (1.0 - s_1* CF) * (#W / #F * (s_4 + ave(A)) + s_3* #H / (s_2 * #F)) Calculate Initial Values of (X,W,I,K) X = Q; W = X * #F / #W; I = #H / #F; K = I / s_3 for worker_id (<= from 1 to 1000) Set Parameters (A, CW, CC) by using randomness for shareholder_id (<= from 1 to 1000) Set Parameter (CH) by using randomness End: Function invest(): Start: for shareholder_id for firm_id Calculate (VH) Select firm (f) = choice(VH) Invest for firm_id Calculate Capital Stock (K) End: Function job_search(): Start: for worker_id for firm_id Calculate (VW) Select firm (f) = choice(VW) Accept Employment Calculate Effort Level (E) End: Function produce(): Start: for firm_id Calculate Product Quantity (Q) Calculate Wage (W) Payt Wage End: Function consume(): Start: for worker_id for firm_id Calculate (VC) Select firm (f) = choice(VC) Consume Production Goods for firm_id Calculate Demand (X) End: Function choice(V): Start: Set r by using randomness choice one of [1,#F] by using r to probability vector V End:

References

References

-

ALTI, A., (2003). How sensitive is investment to cash flow when financing is frictionless?, J. of Finance, 58, 707-722. [doi:10.1111/1540-6261.00542]

ARROW, K.J., Chenery, H.B., Minhas, B.S., and R.M. Solow (1961) Capital-labor substitution and economic efficiency, Review of Economics and Statistics, 43 (3): 225-250. [doi:10.2307/1927286]

AXTELL, R., (2000) Why agents? On the varied motivation for agent computing in the social science, Center on Social and Economic Dynamics Working Paper, 17, The Brookings Institution, 2000.

BARON, D.P. (2004) Private Politics, Corporate Social Responsibility, and Integrated Strategy, J. of Economics & Management Strategy, 10(1), 7-45. [doi:10.1162/105864001300122548]

BARON, D.P. (2006) Business and Its Environment. Fifth Edition. New York: Pearson Prentice-Hall.

BREKKE, K.A. and K. Nyborg. (2004) Moral hazard and moral motivation: Corporate social responsibility as labor market screening, Memorandum of Dept. of Econ., U. of Oslo, 25.

BURDETT, K. and D.T. Mortensen (1998) Wage Differential, Employer Size, and Unemployment, International Economic Review, 39(2), 257-273. [doi:10.2307/2527292]

CARROLL, A.B. and Shabana, K.M. (2010) The Business Case for Corporate Social Responsibility: A Review of Concepts, Research and Practice, International Journal of Management Reviews, 275, 85-106. [doi:10.1111/j.1468-2370.2009.00275.x]

FEHR, E., and K.M. Shumidt (1999) A Theory of Fairness, Competition, and Cooperation, Quarterly J. of Economics, 114, 817-868. [doi:10.1162/003355399556151]

FEHR, E., and A. Falk (2002) Psychological Foundations of Incentives, European Economic Review, 46, 687-724. [doi:10.1016/S0014-2921(01)00208-2]

FRIEDMAN, M. (1970). The Social Responsibility of Business Is to Increase Its Profits, The New York Times Magazine, Sept. 13.

KURUCZ, E., Colbert, B. and Wheeler, D. (2008) The business case for corporate social responsibility. In Crane, A., McWilliams, A., Matten, D., Moon, J. and Siegel, D. (eds), The Oxford Handbook of Corporate Social Responsibility. Oxford: Oxford University Press, 83-112. [doi:10.1093/oxfordhb/9780199211593.003.0004]

LICHTENSTEIN, D.R., M.E. Drumwright, and B.M. Braig. (2004) The Effect of Corporate Social Responsibility on Customer Donations to Corporate-Supported Nonprofits, J. of Marketing, 68 (October), 16-32. [doi:10.1509/jmkg.68.4.16.42726]

MORSING, M., and R. Langer. (2006) CSR-communication in the business press: Advantages of strategic ambiguity, CSR & Business in Society, CBS Working Paper Series, 01-2007.

PAUL, C., and Siegel, D. (eds) (2006) Special issue on corporate social responsibility (CSR) and economic performance, Journal of Productivity Analysis, 26(3), 207-287. [doi:10.1007/s11123-006-0016-4]

PERRINI, F., Castaldo, S., Misani, N. and Tencati, A. (2010) The Impact of Corporate Social Responsibility Associations on Trust in Organic Products Marketed by Mainstream Retailers: a Study of Italian Consumers, Business Strategy and the Environment, 19, 512-526. [doi:10.1002/bse.660]

REINHARDT, F.L., Stavins, R.N., and Vietor, R.H.K. (2008) Corporate social responsibility through an economic lens, Review of Environmental Economics and Policy, 2(2), 219-239. [doi:10.1093/reep/ren008]

SEIFERT, B., Morris, S.A., and Bartkus, B.R. (2004) Having, giving, and getting: slack resources, corporate philanthropy, and firm financial performance. Business and Society, 43, 135-161. [doi:10.1177/0007650304263919]

SELVI, Y., Wagner, E., and Turel A. (2010) Corporate Social Responsibility in the time of Financial Crisis: Evidence from Turkey, Annales Universitatis Apulensis Series Oeconomica, 12(1).

SHINOHARA, N. (2009), K. Hashimoto, and S. Egashira. Modeling of CSR activity as quasi-public goods and analysis of dissemination mechanism, IPSJ-SIG Notes (19),117-120. (in Japanese)

TOYO KEIZAI Inc. (2011). CSR Kigyou Souran 2011, Toyo Keizai, Inc. (in Japanese)