Effects of a Trust Mechanism on Complex Adaptive Supply Networks: An Agent-Based Social Simulation Study

Journal of Artificial Societies and Social Simulation

12 (3) 4

<https://www.jasss.org/12/3/4.html>

For information about citing this article, click here

Received: 31-Jan-2009 Accepted: 16-May-2009 Published: 30-Jun-2009

Abstract

Abstract| Trust kj, tm = MAX[Trust kj, t m-1, ρ Orderkj, tm-s-o + (1- ρ) Trust kj, t m-1] | (3.1) |

Negative experience: Shipmentjk, tm-s < Orderkj, tm-s-o

| Trust kj, tm = MIN[Trust kj, t m-1, ρ Shipmentjk, tm-s + (1- ρ) Trust kj, t m-1] | (3.2) |

where MAX and MIN functions are used for the self-reinforcing mechanism which induces positive feedbacks. That is, in the case of positive experience, the trust value never goes down, and in the case of negative experience, the trust value never goes up. Moreover, this self-reinforcing mechanism corresponds to an argument by Ring and Van de Ven (1994) that the more frequently the parties have successfully transacted, the more likely they will bring higher levels of trust to subsequent transactions.

| Trust ki, tm = MAX[Trust ki, t m-1, ρ Shipmentki, tm-s-o + (1- ρ) Trust ki, t m-1] | (3.3) |

Negative experience: Orderik, tm-o < Shipmentki, tm-s-o

| Trust ki, tm = MIN[Trust ki, t m-1, ρ Orderik, tm-o + (1- ρ) Trust ki, t m-1] | (3.4) |

The equations of (3.1), (3.2), (3.3) and (3.4) show that within each pair of agents, trust levels may differ, implying the possibility of asymmetrical trust relationships

| Shipment ki,tm = Total_Shipment k,tm * [ Backorder ki,tm / ∑ i Backorder ki,tm ] | (3.5) |

Order Allocation Rule:

| Order kj ,tm = Total_Order k,tm * [ (1/Backorder jk,tm) / ∑ j (1/Backorder jk,tm) ] | (3.6) |

| Shipment ki,tm = Total_Shipment k,tm * [ Trust ki,tm / ∑ i Trust ki,tm] | (3.7) |

Order Allocation Rule:

| Order kj,tm = Total_Order k,tm * [ Trust kj,tm / ∑ j Trust kj,tm ] | (3.8) |

| Shipment ki,tm = Total_Shipment k,tm * [(1-γ)Backorder ki,tm+γTrust ki,tm] / [(1-γ)∑ i Backorder ki,tm+γ∑ i Trust ki,tm] | (3.9) |

Order Allocation Rule:

| Order kj,tm = Total_Order k,tm * [(1-γ)(1/Backorder jk,tm)+γTrust kj,tm] / [(1-γ)∑ j (1/Backorder jk,tm)+γ∑ j Trust kj,tm] | (3.10) |

where γ has a value in (0,1) and represents the relative weight on the trust level compared to the backorder level in the above allocation decisions.

|

|

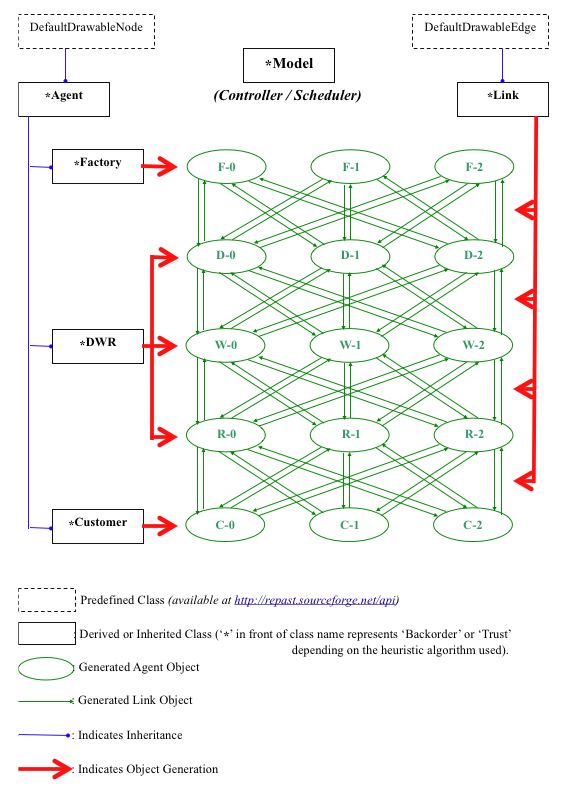

| Figure 1. A supply network with L=5 and N=3 |

| Total_Order k,tm | = ∑iExpected_Demand ik,tm + Stock_Adjustment k,tm + Pipeline_Adjustment k,tm |

| = θ ∑ i Order ik,t m-1 + (1- θ) ∑ i Expected_Demand ik,t m-1 + aS (Desired_Inventoryk - Inventory k,tm) + aPL (Desired_Pipelinek - Pipeline k,tm) | |

| = θ ∑ i Order ik,t m-1 + (1- θ) ∑ i Expected_Demand ik,t m-1 + aS (Qk - Inventory k,tm -βPipeline k,tm) | (4.1) |

where θ : adaptation parameter controlling the rate at which demand expectations are updated aS : stock adjustment parameter (fraction of the discrepancy between the desired and the actual inventory) (=α) aPL: pipeline adjustment parameter (fraction of the discrepancy between the desired and the actual pipeline) β= aPL/aS & Qk = Desired_Inventoryk + β Desired_Pipelinek

|

| Figure 2. The simulation model structure with a case of L=5 and N=3 |

|

|

| Figure 3. A simulation output with the backorder-based heuristic algorithms |

|

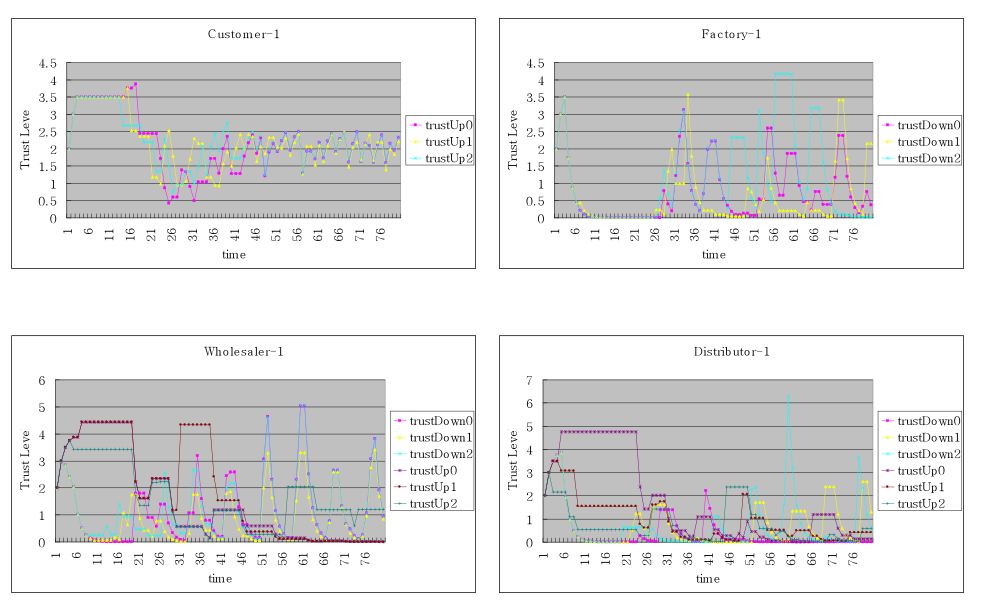

| Figure 4. Trust levels of 4 sample agents with the backorder-based heuristic algorithms |

|

|

| Figure 5. A simulation output with the trust-based heuristic algorithms |

|

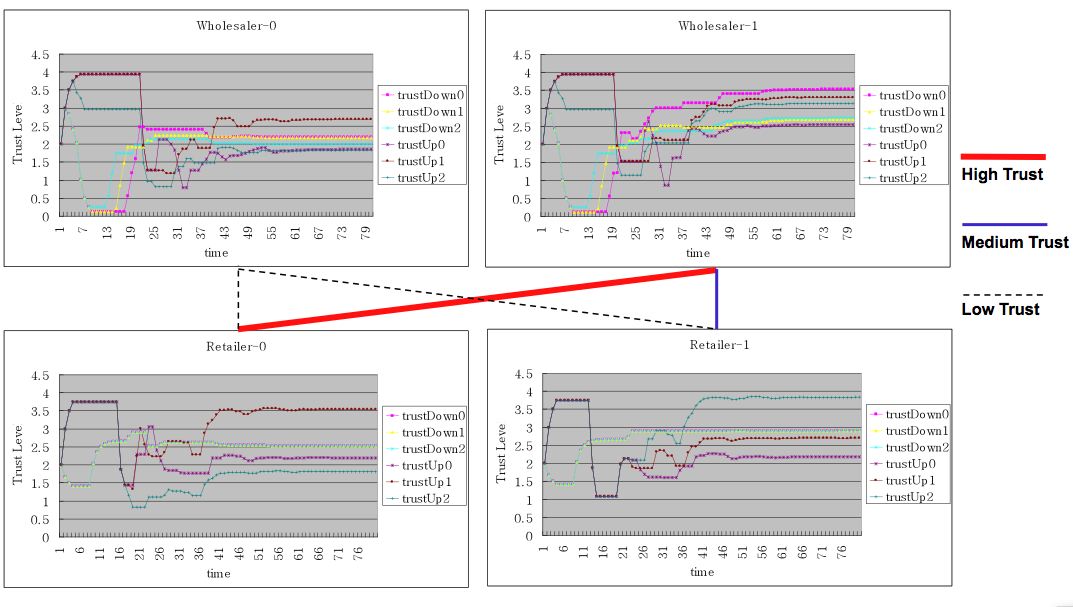

| Figure 6. Trust levels of 4 neighboring agents and their trust relationships with the trust-based heuristic algorithms |

|

|

| Figure 7. The emergent structure of collaboration patterns with the trust-based heuristic algorithms |

|

|

| Figure 8. Inventory levels of all agents with the combined algorithms and γ = 0.2 |

|

|

| Figure 9. Inventory levels of all agents with the combined algorithms and γ = 0.5 |

|

|

| Figure 10. Inventory levels of all agents with the combined algorithms and γ = 0.8 |

|

|

| Figure 11. Inventory levels of Distributors with the combined algorithms and γ = 0.2 |

|

|

| Figure 12. Inventory levels of Distributors with the combined algorithms and γ = 0.5 |

|

|

| Figure 13. Inventory levels of Distributors with the combined algorithms and γ = 0.8 |

For tm = t1 to tT, // T is total simulation time steps.

For i=0 to L-1,

For j=0 to N-1,

Call agent [i][j]. step(tm); // Execute each agent's step()method.

2 Multi-Agent Simulation (MAS) is a simulation method similar to ABSS. MAS is a well-established research and applied branch of Artificial Intelligence (AI). Since MAS is more related with AI, logic-based and cognitive science, it can be defined as the study of societies of autonomous “artificial agents.” In contrast, ABSS can be defined as the study of “artificial societies” of autonomous agents (Conte et al. 1998).

3 The pipeline consists of orders placed but not received.

4 The sequence of supply chain stages from factory to final customer is termed “downstream,” and the sequence of supply chain stages from final customer to factory is termed “upstream.”

5 Backorders, also called backlog of orders, refer to previously unmet demands.

6 The shipment can exceed the order due to the previously unmet demand which is called backorder.

7 The homogeneous agents in the simulation model will produce symmetric simulation results, from which some valuable insights may not be gained.

8 The steep ramp-up is comparable to that used in the simulation experiments of Akkermans (2001) in which business cycles are introduced and a supply network model is tested under severe stress.

9 Eclipse is an open source community whose projects are focused on building an open development platform comprised of extensible frameworks, tools and runtimes for building, deploying and managing software across the lifecycle ( source: http://www.eclipse.org). It provides a Java IDE (Integrated Development Environment) including convenient user interface and other useful tools.

10 The simulations were run for 500 time periods ( t1 ~ t500), but the graph shows the simulation results only up to 80 time periods ( t80). Even after that time, the inventory levels repeat the same pattern, so I chose to show the results only up to that time.

11 The simulation results of symmetrical trust levels coincide with the argument by Anderson and Weitz (1992) that the trust levels in the mutual relationship become symmetrical in the long run, through repeated cyclical interactions between two firms.

12 The argument assumes that preference in their models corresponds to trust in my model.

AKKERMANS, H (2001), Emergent Supply Networks: Simulation of Adaptive Supply Agents. Proceedings of the 34th Hawaii International Conference on System Sciences, January 3-6, Maui, HI, 11 pp.

ANDERSON, J C and Narus, J A (1990), A Model of Distribution Firm and Manufacturing Firm Working Partnership. Journal of Marketing, 54(1), pp. 42-58.

ANDERSON, E and Weitz, B (1989), Determinants of continuity in conventional industrial channel dyads. Marketing Science, 8(4), pp. 310-323.

ANDERSON, E and Weitz, B (1992), The use of pledges to build and sustain commitment in distribution channels. Journal of Marketing Research, 29, February 1992, pp. 18-34.

ANGULO, A, Nachtmann, H and Waller, M A (2004), Supply Chain Information Sharing in a Vendor Managed Inventory Partnership. Journal of Business Logistics, 25(1), pp. 101-120.

AXELROD, R (1984). The Evolution of Cooperation. Basic Books, New York (NY).

CHOI, T, Dooley, K and Rungtusanatham, M (2001). Supply Networks and Complex Adaptive Systems: Control versus Emergence. Journal of Operation Management 19, pp. 351-366.

CONTE, R, Gilbert, N and Sichman, J (1998), MAS and Social Simulation: A Suitable Commitment. Lecture Notes in Computer Science, 1534, pp. 1-9.

DAVIDSSON, P (2002), Agent Based Social Simulation: A Computer Science View. Journal of Artificial Societies and Social Simulation 5(1) 7 https://www.jasss.org/5/1/7.html.

DONEY, P M and Cannon, J P (1997), An examination of the nature of trust in buyer-seller relationships. Journal of Marketing, 61, April 1997, pp. 35-51.

DWYER, R, Schurr, P and Oh, S (1987), Developing buyer-seller relationships. Journal of Marketing, 51, April 1987, pp. 11-27.

FORRESTER, J W (1961), Industrial Dynamics. MIT Press, Cambridge, MA.

GOULDNER, A (1959), Reciprocity and autonomy in functional theory. Symposium on Sociological Theory, Harper and Row, New York, pp. 241-280.

HART, P and Saunders, C (1997), Power and trust: Critical factors in the adoption and use of electronic data interchange. Organization Science, 8(1)), pp. 23-42.

HOLLAND, J H (1995), Hidden Order. Addison-Wesley, Reading, MA.

IACOBUCCI, D and Hibbard, J D (1999), Toward an encompassing theory of business marketing relationships and interpersonal commercial relationships. Journal of Interactive Marketing, 13, Summer, pp. 13-33.

ISHAYA, T and Macaulay, L (1999), The role of trust in virtual teams. Electronic Journal of Organizational Virtualness, 11(1), pp. 140-157.

JARVENPAA, S L, Knoll, K and Leidner, D (1998), Is anybody out there? The antecedents of trust in global virtual teams. Journal of Management Information Systems, 14(4), pp. 29-64.

JONKER, C M and Treur, J (1999), Formal analysis of models for the dynamics of trust based on experiences, Proceedings of MAAMAW'99, LNAI 1647, pp. 221-232.

KIMBROUGH, S O, Wu, D J and Fang, Z (2002), Computers play the beer game: can artificial agents manage supply chains?. Decision Support Systems, 33(3), pp.323-333.

LIN, F, Sung, Y and Lo, Y (2005), Effects of trust mechanisms on supply-chain performance, International Journal of Electronic Commerce, 9(4), pp. 91-112.

LIN, H M (2006), Interorganizational Collaboration, Social Embeddedness, and Value Creation: A Theoretical Analysis. International Journal of Management, 23(3), pp. 548-558.

MACAL, C M (2004), Emergent structures from trust relationships in supply chains, Proceedings of Agent 2004 Conference, October 7-9, Chicago, IL, pp. 743-760.

MADLBERGER, M (2008), International collaboration in supply chain management. Proceedings of the 41st Hawaii International Conference on System Sciences, January 7-10, Walkoloa, HI, 11 pp.

MAYER, R C, Davis, J H and Schoorman, F D (1995), An integrative model of organizational trust. Academy of Management Review, 20(3), pp. 709-734.

MORGAN, R M and Hunt, S D (1994), The Commitment-Trust Theory of Relationship Marketing. Journal of Marketing, 58, July 1994, pp. 20-38.

NORTH, M J and Macal, C M (2007), Managing Business Complexity: Discovering Strategic Solutions with Agent-Based Modeling and Simulation, Oxford University Press, New York.

PARUNAK, H V D, Savit, R and Riolo, R L (1998), Agent-Based Modeling vs. Equation-Based Modeling: A Case Study and Users' Guide. Multi-Agent Systems and Agent-Based Simulation, Springer Verlag.

PATHAK, S, Day, J, Nair, A, Sawaya, W and Kristal, M (2007), Complexity and Adaptivity in Supply Networks: Building Supply Network Theory Using a Complex Adaptive Systems Perspective. Decision Science, 38(4), pp. 547-580.

RING, P S and Van de Ven, A (1992), Structuring cooperative relationships between organization. Strategic Management Journal, 13, pp. 483-498.

RING, P S and Van de Ven, A (1994), Developmental processes of cooperative interorganizational relationships. Academy of Management Review, 19(1), pp. 90-118.

SALLACH, D and Macal, C M (2001), The simulation of social agents: an introduction. Special Issue of Social Science Computer Review, 19(3), pp. 245-248.

SAMUELSON, D A and Macal, C M (2006), Agent-Based Simulation Comes of Age: Software opens up many new areas of application, OR/MS Today, 33(4), August.

SCHIERITZ, N and Größler, A (2003), Emergent Structures in Supply Chains: A Study Integrating Agent-Based and System Dynamics Modeling. Proceedings of the 36th Hawaii International Conference on System Sciences, January 6-9, Big Island, HI, 9 pp.

SMITH, R G and Davis, R (1988), Frameworks for Cooperation in Distributed Problem Solving. Distributed Artificial Intelligence, Morgan Kaufmann Publishers, San Mateo, CA.

STERMAN, J (1989), Modeling managerial behavior: misperceptions of feedback in a dynamic decision making experiment. Management Science, 35(3), pp. 321-339.

STERMAN, J, Mosekilde, E and Larsen, R (1991), Coping with complexity: Deterministic chaos in human decision making behavior. Beyond Belief: Randomness, Prediction, and Explanation in Science, CRC Press, Boston, pp. 199-229.

STERMAN, J (1992), Teaching takes off: flight simulators for management education -The Beer Game. ORMS Today, 20(5), pp. 40-44.

STRADER, T J, Lin, F and Shaw, M J (1998), Simulation of Order Fulfillment in Divergent Assembly Supply Chains. Journal of Artificial Societies and Social Simulation 1(2) 5 https://www.jasss.org/1/2/5.html.

SWAMINATHAN, J M, Smith, S F and Sadeh, N M (1994), Modeling the Dynamics of Supply Chains. The Robotics Institute, Carnegie Mellon University.

TYKHONOV, D, Jonker, C, Meijer, S and Verwaart, T (2008), Agent-Based Simulation of the Trust and Tracing Game for Supply Chains and Networks. Journal of Artificial Societies and Social Simulation 11(3) 1 https://www.jasss.org/11/3/1.html.

UZZI, B (1997), Social Structure and Competition in Interfirm Networks: The Paradox of Embeddedness. Administrative Science Quarterly, 42(1), pp. 35-67.

VLACHOS, P I and Bourlakis, M (2006), Supply chain collaboration between retailers and manufacturers: Do they trust each other?. Supply Chain Forum: An International Journal, 7(1), pp. 70-80.

Return to Contents of this issue

© Copyright Journal of Artificial Societies and Social Simulation, [2009]